A Consistent Performer Stocks are best suited for the medium term and long-term investors. These type of stocks may not make you wealthy in the short term, but it will surely give you very good return over the long run. Consistent Performer stocks give better return all time irrespective of market conditions.

However, it is a difficult task is to identify this type of stock for the investment. You need to collect a lot of information and do a research in order to find the best stock of a reputable company with good business potential. You may or may not get success in identifying best stock for the investment. Your stock may come out as a winner or loser. Don’t worry I have something special for you. Today I will be sharing details about 5 stocks that consistently beating the market and generating positive return since past five years.

Also Read – Best Stocks to buy in India for long term Investment

Top 5 Best Consistent Performer Stocks (2012-2017)

Bajaj Finance

The first consistent performer stock is Bajaj Finance. Bajaj Finance is NFBC dealing in consumer finance, SME, Consumer lending and wealth management. In last five years (2012-2017) this stock has given a two-digit YOY consistent performance. Apart from that company has posted consistent growth of 35.2% over last 5 years. Fundamental and future prospects of this stock is very good. One can invest in this stock for long term.

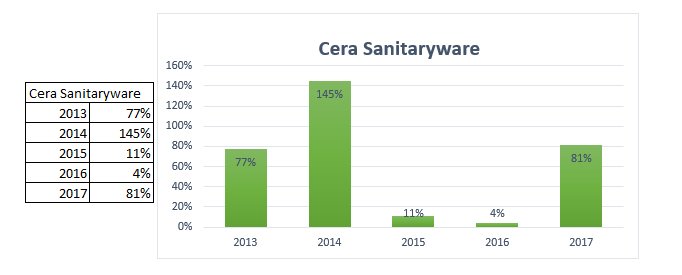

Cera Sanitaryware

The second consistent performer stock is Cera Sanitaryware. Cera Sanitaryware is leading supplier of tiles, water pipe, and other sanitary ware. Cera Sanitaryware is virtually debt free. A company has good consistent growth of 25.73% over 5 years. It is fundamentally sound stock and recommended for investment. The past performance of this stock is given below.

Must Read – 7 Consistent Performer Stocks last 3 Years

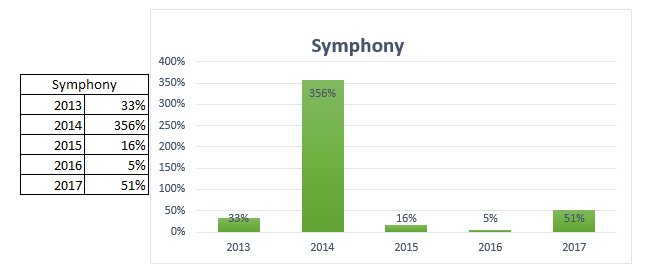

Symphony

Symphony is leading name in Air Cooler segment. Symphony is virtually debt free. A company has a very good track record of ROE. Last 3 years ROE is 41.31%. A stock is slightly overpriced but if you are planning for the long term you can invest in this stock. The past performance history of this stock is given below.

Eicher Motors

Eicher Motors is a well-known name in the auto sector. Eicher Motors stock is a multibagger stock. Eicher motors have maintained good consistent profit growth of 41.96% over last 5 years. In last five years (2012-2017) this stock has given a two-digit YOY consistent performance. ROE Track record and dividend payout history of this stock is good. Overall it is a good choice for the investment for a long-term perspective.

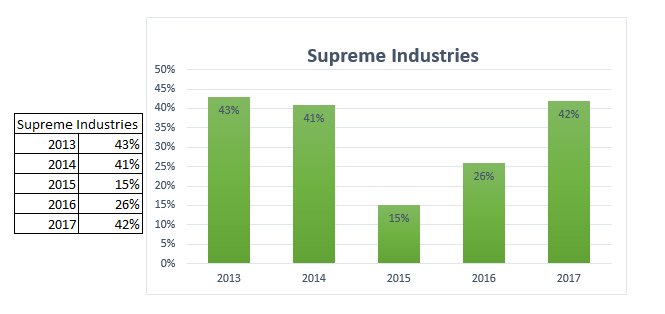

Supreme Industries

The last stock in the list is Supreme Industries. Supreme Industries deal in the manufacturing of plastic chair, furniture, and plastic items. Supreme Industries has given consistent performance in last five years (2012-2017). It is a mid-cap stock with very good future prospects. The performance history of this stock is given below.

Must Read – 5 Multibagger Stocks – Multibagger Returns in 5 Years

Note – The performance detail given in above image is for respective calendar year from 2012 to 2017. (January to December)

Over to You –

These stocks have generated a good return in past that does not mean that they will continue giving better performance in the future. You should do your own research before taking any position in these stocks.

What is your take on these stocks? Do you think these stocks will perform better in future? Do share your views in comment section.

Follow us on Facebook.