Technical Analysis and Fundamental Analysis are two widely used terminology in the stock market. Technical Analysis is generally used by the trader whereas fundamental analysis is used by the investor. Technical Analysis helps you in deciding entry, exit and risk perspective associated with specific stocks.

The intent of a person plays a crucial role in deciding the type of analysis used for buying a stock or product. For example, when you are planning to purchase property for long term for your own living you will look at multiple factors such as location, type, area, reputation of builder, quality of construction, etc. It is as good as fundamental analysis. However, if you are buying property for short term for the investment you will look at supply, demand, and price benefit analysis for the short term. This is as good as technical analysis. When you buy shares with eToro or trade stocks with a broker, it would be wise to apply technical analysis to recognize patterns or investment opportunities.

If you are a beginner in the stock market and want to understand more about technical analysis, continue reading. In this post, you will get basic information about Technical analysis along with examples and charts.

Also Read – Technical Analysis for Buying and Selling Stock

What is Technical Analysis?

Technical analysis (TA) is a method of predicting the stock price based on the historic market data, supply, and demand. The market data includes share price movement, volume, chart patterns, etc. In layman terms, the best analogy of technical analysis would be weather forecasting. Weather forecasting is a method of forecasting weather condition, whereas technical analysis is a method of predicting stock price condition.

Technical Analysis is done based on price and volume. This analysis is done on the charts. This type of analysis is used for short term trading. TA is somewhat superficial and it depends on stock chart and price movement.

What is Fundamental Analysis?

Fundamental Analysis (FA) is a method to identify the fundamental (intrinsic) value of the stock. Fundamental analysis is done by collecting financial statement and doing research over data such as revenue, expense, growth prospects, etc.

Fundamental analysis is done based on Quantitative and Qualitative factors. The data used for this analysis is financial statements. This type of analysis is used for long term investing. FA is more in-depth as an investment is done for a longer duration.

Also Read – Technical Analysis or Fundamental Analysis – Which is better?

Technical Analysis vs Fundamental Analysis

Points to consider before using Technical Analysis of Stocks

Before making actual use of technical analysis you need to consider following factors.

Short Term Trades – This technique is used for short term trades only. Don’t try to use this method to identify stock for long term.

Return per trade – You cannot gain huge money by means of using TA. It is a method to gain small and consistent profits by frequent trading.

Holding period – Holding period in this case would be from few minutes, few hours or few weeks. It does not stretch beyond this.

Risk – Risk associated with TA is very high. TA works on prediction based on past performance and charts. You may end up making losses if method is not used effectively.

How to do Technical Analysis of Stocks?

First of all, let me clarify that TA is a very vast subject and cannot be covered in a single article. The information given here is for beginner or learner and not for an expert.

The first step for doing TA is the identification of stock. This process is also known as stock screening. The second step is chart scanning and the third is a trade setup. In the stock screening, you need to consider various factors such as volume, price, movement etc. The air of stock screening is quickly shorting out few stock candidates from thousands of stocks. Later stage these few stocks are converted into three or four stocks by scanning the charts. Finally, details chart analysis is done of the stock you are planning to trade. You can use various stock screener in order to perform analysis. So, the steps involved in doing TA are given below.

- Stock Screening – It is a process of identifying a few stocks for trading. You need to choose various technical indicators in order to do a screening. This includes sector, 52 weeks high, 52 weeks low, market cap, moving average, returns, active volume trade etc. You can create a watch list for a few days and take the appropriate decision about shortlisting.

- Chart Scanning – Once you shortlist the stock you need to do charting and understand various patterns. The charting is done using various screener and online websites. You need to select various factors and you can get a chart on your screen. Some website also offers readymade service of providing charting. Most of them are paid.

- Trade Setup – Once you are done with steps given above you need to set up a trade. If you don’t have a trading account you can open a new trading account. Make sure to open an account where a trading fee is low.

Also Read – 5 Technical Screener Websites for Technical Analysis in India

How to use charts for Technical Analysis of Stocks?

There are multiple charts and pattern involved while doing TA of stocks. In this post, I will share information about three widely used charts.

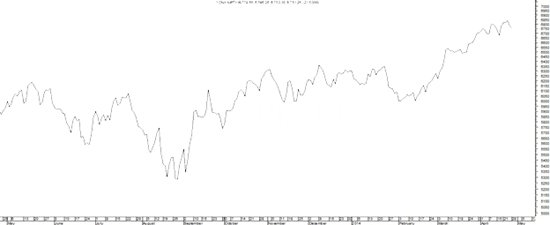

#1. Line Chart

Line chart is plotted by joining closing prices of any stock or index. They can be prepared by checking closing prices on monthly, weekly and even hourly basis. A dot is placed for each closing price and the various dots are then connected by a line. The line chart is used for observing trade. This chart is prepared by considering only closing price and does not take into account open, high and low. Example of a Line chart is given below.

#2. Bar Chart

The bar chart is a slightly improved version of the line chart. This chart considers high, low, open and close. Instead of dots here bars are used for drawing chart. This bar has three components. The central line for indicating high and low. Left tick mark and right tick mark to show open and close. Example of one bar chart is given below. The complexity in this chart is higher.

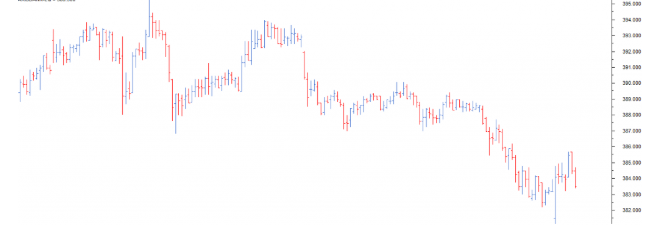

#3 Candlestick Chart

The candlestick chart uses famous Japanese Candlestick Charting Techniques. This technique is famous among many traders. In bar chart, we have seen that open and the close prices are shown by a tick on the left and the right sides of the bar respectively, however, in a candlestick the open and close prices are displayed by a rectangular body – Candle.

In a candlestick chart, candles can be classified as a bullish or bearish candle usually represented by blue/green/white and red/black candles respectively. The colour of the candle can be customized. The candlestick chart shows bullishness, bearishness as well as buying and selling activity. It gives more information compared to the line chart and bar chart. You can visualize between all parameters and take an appropriate decision. The example of a candlestick chart is given below.

Best Sources to Learn Technical Analysis

- Read Good Books

- Read Articles and Blogs

- Follow Good Traders

- Join Course for learning TA

Over to You

I hope you have got some basic understanding of TA after going through the above article. Please note that the information given above is based on my knowledge and collected from various books and course material. The information given above is only for knowledge sharing purpose. Make sure to get expertise before doing trading in the stock market.