Sukanya interest rate is slashed by the government recently. New Sukanya interest rate is 8.6%. This rate cut is applicable from April, 2016 for the first quarter of FY 2016. Apart from Sukanya, interest rate of other small saving scheme like PPF, KVP, NSC is also reduced by the government. The main reason behind the rate cut of small saving scheme is to align them with current market rates.

This is a third big surprise from the government this year. Prior to this government has already given two big surprise first is not allowing Full EPF withdrawal and second is imposing five additional taxes. Please note that this is one of the biggest rate cuts in the small saving scheme in a long time. Let’s take a look at a new interest rate applicable to small saving schemes after April 2016.

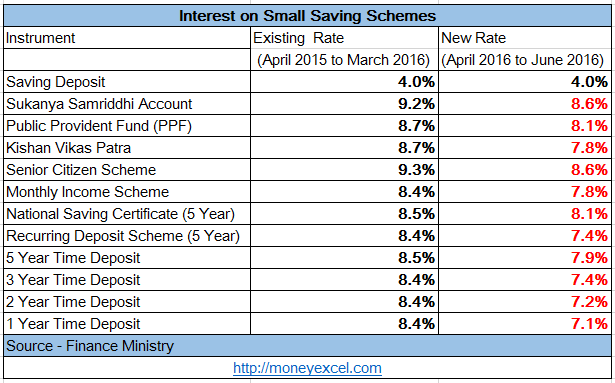

Small Saving Scheme Interest rate from April 2016 to June 2016

- Sukanya interest rate slashed from 9.2% to 8.6%

- PPF interest rate is reduced from 8.7% to 8.1%

- Kishan Vikas Patra interest rate reduced from 8.7% to 7.8%

- Senior Citizen Scheme interest rate slashed from 9.3% to 8.6%

- Monthly Income Scheme interest rate is cut from 8.4% to 7.8%

- 5 Year NSC interest rate is reduced from 8.5% to 8.1%

- 5 Year Recurring deposit scheme interest rate is reduced from 8.4% to 7.4%

- 5 Year Time deposit rate has been cut from 8.5% to 7.9%

- 3 Year Time deposit rate has been cut from 8.4% to 7.4%

- 2 Year Time deposit rate has been cut from 8.4% to 7.2%

- 1 Year Time deposit rate has been cut from 8.4% to 7.1%

Source – Finance Ministry

How Sukanya Interest rate cut will impact investors?

Sukanya Samriddhi Scheme is one of the most lucrative small saving schemes after PPF. Big slash in Sukanya interest rate is difficult to digest by many investors. This rate change will reduce maturity corpus of SSA investor. Let’s calculate how much money you will be losing by this rate change.

Also Read – Sukanya Samriddhi Account – Calculator Download

Calculation

If you are investing maximum amount 1.5 Lac in SSA at the beginning of the year.

As per current 9.2% interest rate, Interest amount in your account at the end of year – Rs 13800.

As per new Sukanya Interest rate 8.6%, Interest amount in your account at the end of year – Rs 12900.

Change = Rs 900 yearly

Assumption – New interest rate 8.6% will remain constant throughout the year.

How PPF Interest rate cut will impact investors?

PPF is one of the best investment schemes for the small investors. PPF interest rate reduction from 8.7% to 8.1% will reduce PPF corpus at maturity. Let’s see the calculation.

Calculation

If you are investing maximum amount 1.5 Lac in PPF at the beginning of the year.

As per current 8.7% interest rate, Interest amount in your account at the end of year – Rs 13050.

As per new PPF interest rate 8.1%, Interest amount in your account at the end of year – Rs 12150.

Change = Rs 900 yearly

Assumption – New interest rate 8.1% will remain constant throughout the year.

Overall Impacts of this rate cut

- This rate cut will badly impact small investors as their corpus will reduce.

- A new investor may not participate and open Sukanya Samriddhi and PPF Account.

- As an adverse effect, we may see a reduction in fixed deposit rates by the bank.

- Now Investing money in these small saving schemes means only beating Inflation rate.

- An investor may start investing in the stock market instead of small saving schemes.

Social Media Reaction on Interest rate change –

Over to You –

What is your reaction to the change in Sukanya Interest rate?

For me, this rate cut matters a lot as my hard earned money is going to earn less interest now onwards.

Initially, the government has shown lollipop of 9.2% interest rate on Sukany Samriddhi Scheme for the investment. As a majority of investor has invested their money in SSA now they are reducing the interest rate 🙁

Hope the government will increase interest rate of all small saving scheme in next quarter.

Do share your views in comment section.