Today everyone wants happy and healthy retirement life, but very few people do planning for the same. If you are one of them it’s time to do retirement planning. Please refer to our previous article to know how much money is required for your retirement.

Once you come to know about the requirements of your retirement fund it is time to work towards achieving the same. Here is a systematic way for retirement planning.

Retirement Planning

Retirement planning entails knowing the best investment assets, strategies, and risk-mitigation

techniques. Here are steps to help you go about this process:

Step -1 Determine how much money you can invest for retirement?

The first step in doing retirement planning is to determine how much money you can invest for retirement on a monthly basis. As you know your monthly income and expenditure you can easily figure out this amount. Once you know this amount it is time to select asset class for investment.

Step -2 Select Asset Class for Investment

The second step in doing retirement planning is to select the right asset class for investment. You need to select an asset class based on your risk appetite. Make sure you consider equity and debt both for investment. Consider past performance and other factors like benefits and drawbacks before making a selection of asset class.

Advisable investment for retirement is PPF, Equity & Mutual funds. Avoid taking retirement plans. Diversify your investments & reduce risk.

A Public Provident Fund is a government-backed savings investment scheme that offers a guaranteed return. This is a good option for investors looking for a secure investment. On the other hand, the value of equity investments can increase, so they’re more risky than other investments, such as PPF. But the former has the potential to generate higher returns over the long term. Mutual funds pool money from investors, investing it in various assets like stocks, bonds, and money market instruments.

An individual retirement account (IRA) is a tax-advantaged account that ensures you have enough money when you retire. A traditional IRA allows deducting contributions from taxable income. Your money grows tax-deferred, meaning you won’t pay taxes on any earnings until you withdraw them in retirement.

You can set up a gold IRA. Gold holds or even increases in value during market volatility. A gold IRA company like Goldco can help with retirement in a few ways, helping you diversify your portfolio.

On the other hand, Roth IRAs don’t offer a deduction for your contributions, but your earnings grow tax-free. You can withdraw your contributions without penalty, but you’ll pay taxes on any earnings if you withdraw them before retirement age.

Step-3 Start Systematic Investment

Once you are through with asset class selection, it’s time to do an investment. Rather than doing a lump sum investment at a single go, it is advisable to do a systematic Investment on a monthly basis.

Make sure you are disciplined in doing this investment if not, you can plan to adopt the automatic SIP option.

Step-4 Review and Make Changes

You need to regularly review the performance of the asset class. If asset class is not performing up to make you need to make appropriate changes in investments.

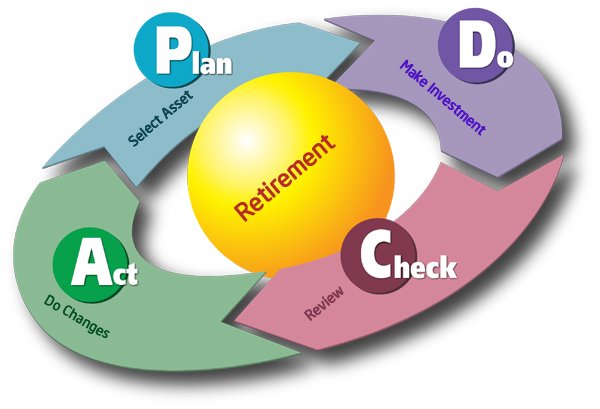

Follow the steps given above and I am sure you can achieve happy retirement life. A simple graphical representation above steps (PDCA) is given below.

Important Factors to Consider for Retirement Planning

Start Early – Sooner is better. You need to start preparing for your retirement at an early age. The simple fact is that if you start saving early, you will likely save more. Another reason for starting early is your investment will have more time to grow (power of compounding).

Inflation – Inflation kills. The inflation rate is a very important factor for retirement planning. Inflation rates keep on changing. A higher inflation rate means more money is required for retirement.

Invest in Health – Health care expense is likely to rise as you grow older. You should start investing in health from a retirement perspective. I suggest going for a health insurance policy along with retirement planning. This will help in reducing unlikely expenses on health during retirement.

Hope the above stuff will help you in retirement planning.

Do share with us your thoughts in the comments below.