Personal loans can seem like an attractive option when you’re facing financial challenges or considering a major purchase. In today’s world income is limited but desires are endless. This desire often inspires us to take additional debt using credit cards or personal loans. personal loans can often lead to financial strain and should be approached with caution.

I advise you not to take any personal loan unless it is an extreme situation. Keep a personal loan as your last option to avail your immediate cash requirement.

Personal loans can be used for any purpose including medical expenses, marriage expenses, home improvement, purchasing household items or to pay your credit card debt. The best part is that you need not inform the bank about the purpose of taking a personal loan. In this way, personal loans are all-purpose loans.

In a home loan, car loan, or education loan you have to prove that you will be using this amount for said purpose only. A personal loan has one additional advantage the processing time of this loan is faster compared to any other loan. Most banks do not ask for any guarantor or any security deposit for this type of loan.

Due to this you might be thinking that this is the best loan option but believe me this is the worst loan option. Let’s discuss in detail why you should think of a personal loan as the last option.

Why You Should Avoid Personal Loans

High-Interest Rates

The interest rate charged by banks under personal loans is 14-18%.

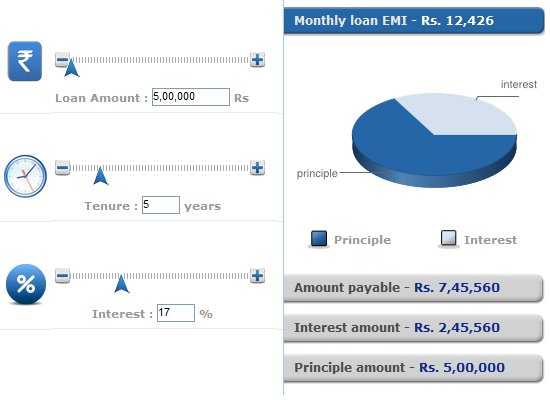

Let’s understand the facts by taking an example. Mr.X has an urgent need and he is taking a personal loan of 5,00,000 Rs/- an interest rate of 17% for 5 years. The effective EMI for this loan will be 12,426 Rs/-.

This loan will cost around 50% additional money as interest – 2, 45,560 Rs/-

Personal Loan Example

This can result in significant interest charges over the life of the loan, making it more expensive in the long run.

Prepayment Penalty

Most lenders don’t allow part payment of loans. This means you end up paying the loan for the entire tenure of the loan. It can work out quite expensive since your initial installments go towards interest payments. Some banks allow prepayment but they keep very high penalties for the prepayment of the loan.

Hidden Charges

Many banks keep certain hidden charges which make this loan more costly. Most of the borrowers forget to read the offer document/terms and conditions and may end up paying more.

Credit Score Impact

Obtaining a personal loan can harm your credit score, particularly if you already have a high debt-to-income ratio or a track record of tardy payments. Failing to make payments on time or defaulting on the loan can worsen your credit score.

Possibility of Entering a Cycle of Debt

Individuals who use personal loans to pay for their expenses could become stuck in a pattern of debt, continuously borrowing to fulfill their financial responsibilities. This could result in a negative cycle of mounting debt and financial strain.

It is usually advisable to stay away from debt but if you have a pressing need for cash & you can afford to repay it in a short period of time it is advisable to take a loan against assets like gold or property compared to a personal loan.

Lastly, decide if you can stay away from any loan. While this loan may be useful in certain instances like medical emergencies, it doesn’t make sense if you are using it on your vacations or any other fun-making expense.

FAQs

- Are personal loans ever a good idea?

Personal loans can be a viable option in certain situations, such as consolidating high-interest debt or funding a necessary expense. However, it’s essential to carefully consider the terms and potential impact on your financial health.

- How can I qualify for a personal loan with favorable terms?

To qualify for a personal loan with favorable terms, you’ll typically need a strong credit history, stable income, and a low debt-to-income ratio. Shopping around and comparing offers from multiple lenders can also help you secure the best possible terms.

- What should I do if I can’t afford to repay my personal loan?

If you’re struggling to repay a personal loan, contact your lender immediately to discuss your options. They may be willing to work with you to modify your repayment plan or offer alternative solutions.

- What are the alternatives to personal loans for financing major purchases?

Depending on your financial situation, alternatives to personal loans may include using savings, taking advantage of low-interest credit options, or exploring financing options offered by the seller, such as installment plans or store credit cards.

- How can I avoid falling into a cycle of debt with personal loans?

To avoid falling into a cycle of debt, it’s essential to borrow responsibly and only take out loans for necessary expenses or investments. Additionally, focusing on building an emergency fund and improving your financial literacy can help you avoid relying on loans in the future.