We recently received email asking about Best Long term Investment in India (for 15 year+). As we have multiple option of investment it is very difficult to decide which one best.

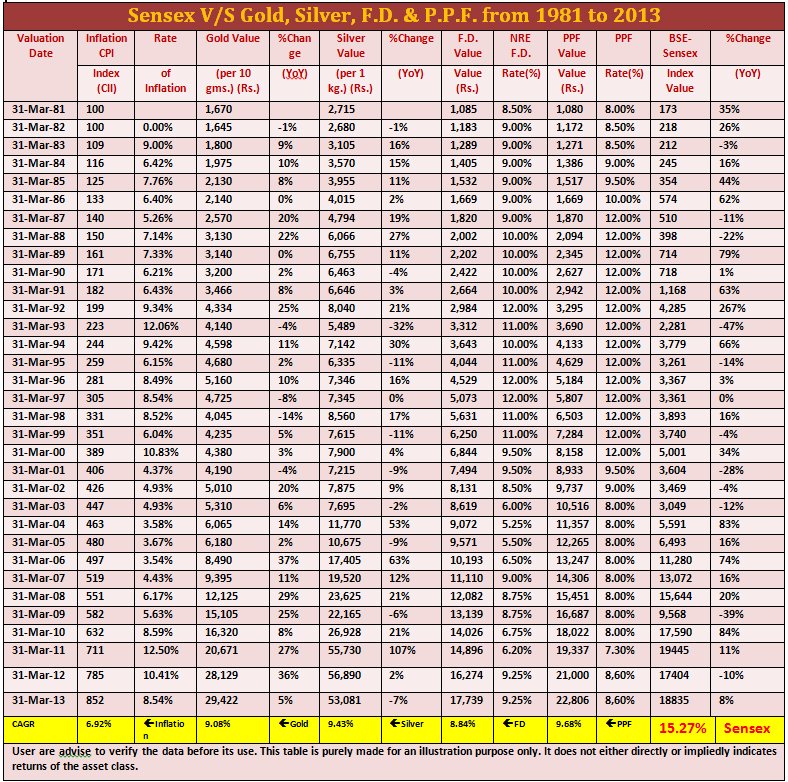

Probably many of us say that real estate is best for long term investment but it is really difficult to calculate return on real estate, since lot of black money is involved in real estate sector. Due to lack of real data we are excluding real estate from this study and here is data of past 32 years showing investment return in Sensex Vs Gold, Silver, FD & PPF from 1981 to 2013.

History reveals that Sensex is providing higher return in terms of CAGR compare to all other investments.

Gold has yielded CAGR of 9.08%

Silver has yielded a CAGR of 8.84%

Fixed Deposit in Banks gave a CAGR of 9.25%

PPF Public provident Fund has yielded a CAGR of 9.68% [Tax Free]

BSE Sensex has given splendid return in double digit 15.27 %

Note:-Sensex return is calculated based on index value and does not contain any stock specific return.

This clearly says that nothing could beat BSE Sensex. History repeats again on 1st Nov, 2013 Sensex has crossed all time high level. Slowly Investors are returning back to stock market.

Although market is touching new heights it is always advisable to spread the investment over various asset classes regularly. Pull towards equity is due to it can beat inflation. We definitely recommend investing in PPF / EPF for various tax benefits as well as liberal returns.