How to pay income tax online? Can I use a credit card or debit card to pay income tax online? What are the steps for e-payment of tax? If you are looking for the answer of these question, here is a complete guide for paying income tax online within 5 minutes.

You need to pay income tax on your own under following conditions.

- You are working independently as a self-employed and earning income more than the tax-free limit you need to pay income tax.

- A tax is not deducted at source.

- After TDS also still some amount is balance for the tax.

If you are falling in above mention criteria, get ready, you need to pay income tax yourself. No one will come and ask you to pay the tax. You need to calculate your tax liability and pay taxes on time. The government will not send any invoice asking for tax payment. But if you forgot to pay taxes on time government official may ask you to pay a penalty (1% interest on every delayed month) on the tax amount.

Also read – 20 Types of Taxes in India

How to Know Tax Payable?

You can calculate your tax liability through income tax calculator. Another alternative is to check your annual tax statement form 26AS. Form 26AS give all information about the tax paid and tax balance. If you have already paid some taxes you need to deduct it from total tax liability.

How to Pay Income Tax?

There are two ways to pay Income Tax to the government.

Pay Income Tax Offline – You can deposit this tax amount to authorize bank. Total 30 banks are authorized to accept income tax. To pay tax through the bank, you need to fill Challan 280. Bank will accept tax on behalf of the government and give you acknowledgement receipt. This receipt contains CIN – Challan Identification Number. You need to quote this CIN number while filing income tax return.

Pay Income Tax Online – Another method to pay income tax is via online NSDL website. You can pay your income tax in 5 minutes using this online facility. So no need to visit the bank. No need to stand in a long queue for the payment of tax. Just relax sit at your home use internet and pay your tax in 5 minutes. You can use this facility if you have bank account with net banking facility.

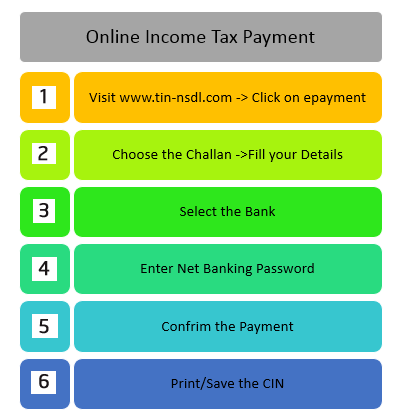

Procedure for e-payment of Tax (Pay Income Tax Online)

Step -1

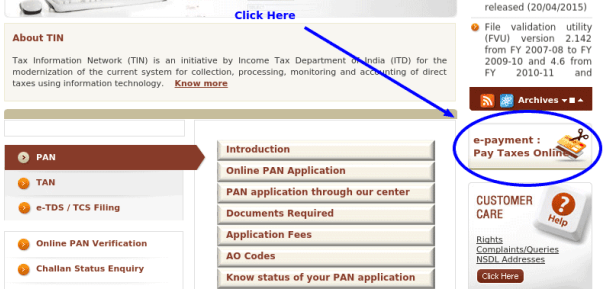

- Log on to NSDL-TIN website.

- Click on the icon “e-payment: pay taxes online” right-hand side.

- Click on ‘Click to pay tax online’

- Select appropriate challan.

Step – 2

Once you select the challan you will be directed to the online challan Form for entering the following data:-

- PAN for non-TDS payments or TAN for TDS payments

- Address of the taxpayer

- Assessment Year or Financial Year

- Major Head Code

- Minor Head Code

- Type of payment (for TDS payments)

- Select the bank name from the drop down provided

Step-3

On submission of data confirmation screen will appear which will redirect you to net banking site of the bank. You need to login using net banking password to pay tax amount.

Step -4

On successful payment of tax acknowledgement slip containing CIN number will be displayed on screen.

Remember online income tax payment is allowed using internet banking only. You cannot use Credit card for income tax payment. Only SBI customer can pay income tax using debit cards.

If you face any difficulty contact TIN Call center at 020-27218080 or write on tininfo@nsdl.co.in

I hope you can pay Income tax online easily using method mentioned above. Do share your experience.