LIC has launched LIC New Tech Term Plan (Table 954). The earlier launched tech term plan by LIC is now closed. LIC’s New Tech-Term is a Non-Linked, Non-participating, Individual, Pure Risk Premium Life Insurance Plan.

LIC New Tech Term plan is an online-only plan you can purchase from LIC’s website. You must be keen to know the difference between the old tech term plan and LIC’s New Tech Term Plan. So, here is a complete post about key features, eligibility, benefits, and a review of LIC’s New Tech Term Plan.

Key Features of LIC New Tech Term Plan

- LIC New Tech Tem is a pure Online Term Life Insurance Plan.

- The minimum Sum assured for this plan is 50 Lakh with no upper limit on Sum assured.

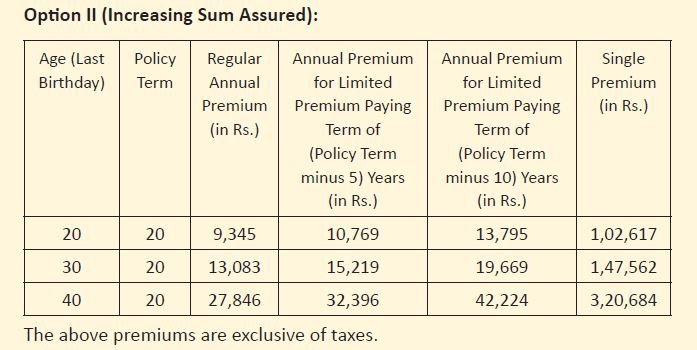

- Flexibility to choose from two benefit options: Level Sum Assured and Increasing Sum Assured.

- Flexibility to choose from Single Premium, Regular Premium, and Limited Premium Payment

- Choose the Policy Term/Premium Paying Term

- Opt for payment of benefits in installments.

- Special rates for women.

- The benefit of an attractive High Sum Assured Rebate.

- Two categories of premium rates namely (1) Non-Smoker rates and (2) Smoker rates.

- Option to enhance coverage by opting for Accident Benefit Rider on payment of additional premium for the rider benefit.

Benefits payable under an in-force policy shall be as under

#1 Death Benefit

The death benefit payable on the death of the life assured during the policy term after the date of commencement of risk but before the date of maturity provided the policy is in force and the claim is admissible shall be “Sum Assured on Death”.

For Regular premium and Limited premium payment policies, “Sum Assured on Death” is defined as the highest of:

- 7 times of Annualised Premium; or

- 105% of “Total Premiums Paid” up to the date of death; or

- Absolute amount assured to be paid on death. For a Single premium policy, “Sum Assured on Death” is defined as the higher of:

- 125% of Single Premium.

- Absolute amount assured to be paid on death.

Where,

i. “Annualized Premium” shall be the premium payable in a year chosen by the policyholder, excluding the taxes, rider premiums, underwriting extra premiums, and loadings for modal premiums, if any, and

ii. “Total Premiums Paid” means the total of all the premiums received, excluding any extra premium, any rider premium, and taxes.

iii. Absolute amount assured to be paid on death shall depend on the Death Benefit Option chosen at the time of taking this policy and is as under:

Option I: Level Sum Assured

The absolute amount assured to be paid on death shall be an amount equal to Basic Sum Assured, which shall remain the same throughout the policy term.

Option II: Increasing Sum Assured

The absolute amount assured to be paid on death shall remain equal to the Basic Sum Assured till the completion of the fifth policy year. Thereafter, it increases by 10% of the Basic Sum Assured each year from the sixth policy year till the fifteenth policy year till it becomes twice the Basic Sum Assured. This increase will continue under an in-force policy till the end of the policy term; or till the Date of Death; or till the fifteenth policy year, whichever is earlier. From the sixteenth policy year and onwards, the Absolute amount assured to be paid on death remains constant i.e. twice the Basic Sum Assured till the policy term ends. For example, the Absolute amount assured to be paid on death under a policy with a Basic Sum Assured of Rs. X will be Rs. X till the end of the fifth policy year, Rs. 1.1X during the sixth policy year, 1.2X during the seventh policy year, increasing so on by 10% of the Basic Sum Assured each year till it becomes 2X in the fifteenth policy year. From the sixteenth policy year and onwards, the Absolute amount assured to be paid on death will be 2X.

The Death Benefit Option once chosen cannot be changed later.

#2 Maturity Benefit:

On survival of the life assured to the end of the policy term, no maturity benefit is payable.

Eligibility

a) Minimum Age at entry: 18 years (Last Birthday)

b) Maximum Age at entry: 65 years (Last Birthday)

c) Maximum Age at Maturity: 80 years (Last Birthday)

d) Minimum Basic Sum Assured: Rs. 50,00,000/-

e) Maximum Basic Sum Assured: No Limit*

The Basic Sum Assured shall be in multiples of Rs. 5,00,000/-, if the Basic Sum Assured for the policy is Rs. 50,00,000/- to Rs. 75,00,000/-. Rs. 25,00,000/-, if the Basic Sum Assured for the policy is above Rs. 75,00,000/-.

f) Policy Term: 10 to 40 years

g) Premium Paying Term

Regular Premium – Same as policy term

Limited Premium –

- [Policy Term minus 5] years for Policy Term [10 to 40] years

- [Policy Term minus 10] years for Policy Term [15 to 40] years

Single Premium – NA

LIC New Tech Term Plan – LIC Term Plan Review

LIC New Tech Term Plan is a pure term plan where the minimum sum assured value is 50 Lakh. It is a very good product by LIC. As it is an online term plan it can be purchased with a click of a button without intervention from LIC Agent.

This new policy is a direct copy of the LIC Tech Term Plan (Table 854). The only change is in the premium amount.

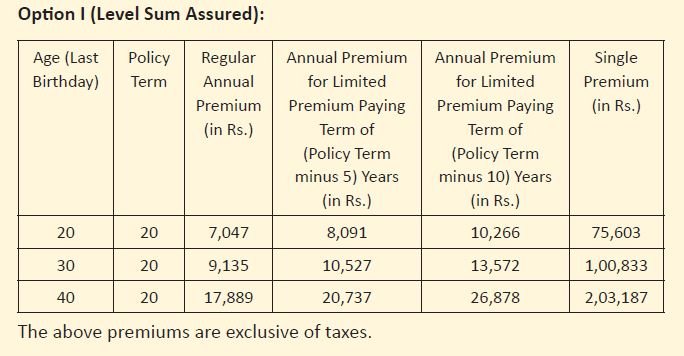

Examples of premium change in Level Sum assured for 1 Cr Plan – Nonsmoker Male are given below.

| Age | Policy Term | Regular Annual Premium (Old Policy) | Regular Annual Premium (LIC New Tech Term Plan) |

| 20 | 20 | INR 5368 | INR 7047 |

| 30 | 20 | INR 7216 | INR 9135 |

| 40 | 20 | INR 13770 | INR 17889 |

This means that compared to the last plan (old tech term policy) premium of the new plan is increased. The increase is nearly 25%. This means for the new plan you need to pay a 25% extra premium amount (yearly regular plan).

LIC New Tech Term Plan Premium

This premium is at par with other available term plans like ICICI Pru Term Plan. This plan provides coverage for up to 80 years. The accidental rider option and discounted rate premium for non-smokers and women are additional advantages.

You have the flexibility to select the sum assured and type of plan. You can select level sum assured as well as increasing sum assured. The increasing sum assured is a unique feature of this policy. The risk level is increasing with age & one should increase the sum assured with age. This concept is perfectly covered in this plan. One can avoid purchasing multiple insurance policies if he/she opts for an increasing the sum assured.

If you have not purchased any term plan you can go for LIC New Tech Term Plan.

For more information, you can visit LIC Website – LIC New Tech Term Plan.