HDFC is leading finance company engage in providing loan facility for purchase or construction of house. Recently HDFC has launched HDFC deposit called as HDFC Double Money & Money Multiplier Plan. Let’s checkout features & details of HDFC Double Money & Money Multiplier.

Investments in double money will double your money in 95 month (7 Year 9 months). Suppose you invest 100000 Rs/ – in this scheme you will get 200000 Rs/- on maturity. TDS will deducted on actual one can submit form 15G/15H to avoid tax deduction.

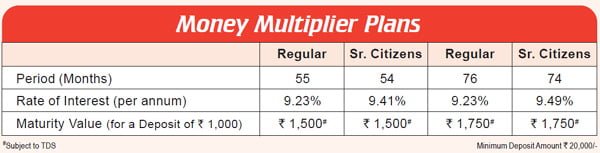

Investment in Money multiplier will multiply your money 1.5 times or 1.75 times. Refer to following table for more information.

HDFC Double Money Plan

HDFC Money Multiplier

Loan

Loan against deposit is available after 3 months from the date of deposit upto 75% of the deposit amount, subject to the other terms and conditions framed by HDFC. Interest on such loans will be 2% above the deposit rate.

Premature Withdrawal

Request for premature withdrawal may be permitted but not allowed before completion of 3 months from the date of deposit. In case of request for premature withdrawal after the expiry of three months up to six month no interest shall be paid. After 6 month withdrawal shall attract 2% less interest.

Conclusion:-

Interest rate offer by HDFC Double money & Money multiplier is more or less same as that of FD available in market.

This plan is projected as double money or Money multiplier but from our prospective it is Fix deposit only. Even if you invest in Fix deposit from SBI it will also double in nearly same time as interest rate offer by SBI is 9%.

It is like “Old wine in New bottle”