Gold Price History – Gold a yellow shining material is considered a safe haven for investment. Gold is valuable & reliable metal for investment.

Gold consistently gives better returns to investors. In the year 2020, gold has given 25% returns to the investors. The 1 Lakh invested in gold in the year 2019 has become 1.25 Lakh in 2020. However, gold could not perform well in the year 2021. Gold generated very low returns in the 2021.

Gold is likely to give better returns in the year 2022.

In India buying a gold is tradition. Gold is purchased during festivals and during the wedding season. As per me, you should invest at least 2-20 gm gold every year. In this post we will talk about – Why you should invest in Gold? Gold Price history of 50 years and factors affecting gold price.

Also Read – Gold Loan Options in India – Key Features and Documents required

Why you should invest in gold?

The top reasons to invest in Gold are given below.

#1 Hedge Against Inflation

Gold acts as a hedge against volatile markets and inflation. The inflation rate is growing with time. Almost all currencies get depreciated in value with time. Gold is an appreciating asset. Over the long run, gold has beaten almost every asset class and given very good returns to the investors. The gold price has doubled over the last five years and tripled in a decade.

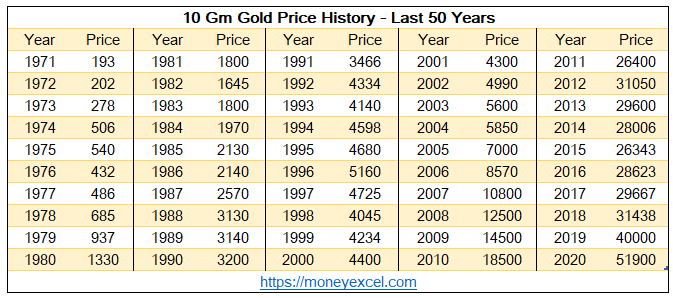

#2 Good returns over long term – Gold Price History – 50 Years

Historically gold has given very good returns to investors. In the year 2020 gold has given 25% return to the investors. In the last five years (2015-2020) gold has generated 14.5% returns to the investors.

If you have invested 1 lakh in gold on January 1, 2010, today (as on 1st January,2021) your investment would have become 2.80 lakh (around tripled). The gold price history for the last 50 years is given below.

#3 Portfolio Diversification

One of the top reasons to invest in gold is portfolio diversification. Gold offers good portfolio diversification. Gold partially protect you from market events. You should design your portfolio in a manner that enables you to achieve your long-term financial goals. You should allocate at least 10% of your portfolio to gold or gold-related securities.

#4 Multiple forms of investment

Gold offers multiple forms of investment. You can invest in physical gold, gold jewelry, gold coins, gold bar, gold ETF as well as a sovereign gold bond issued by the government. You can select an investment form based on your need. As per my opinion, Gold ETF is the best way of investing in gold.

#5 Higher Liquidity

Gold offers a higher level of liquidity. Whatever form of investment you have be it a gold coin, gold jewelry or gold ETF you can sell gold anytime. The process of selling gold is quick and easy. There are multiple buyers of gold in the market. If it is a gold ETF it would take 3 business days for settlement and getting cash in your account.

#6 Gold is Tangible

Gold is a tangible asset. You can touch and feel gold. You can purchase physical gold after checking gold purity. Buying gold is relatively easy compared to other assets such as real estate, equity, and mutual funds. Electronic gold can be stored digitally and prone to hacking and other misuses.

#7 Gold does not require specialized knowledge

Gold does not require any specialized knowledge. You require specialized knowledge when you make an investment in equity, real estate, cryptocurrency, and mutual funds. On the other hand, you can invest in gold without any specialized knowledge. It is easy to check the purity of gold. You just need to check the hallmark symbol.

#8 Gold Loan

In bad times, you can also use gold to avail loan. Most of the banks and financial organization offers a loan against gold. You need to pledge gold to avail a gold loan.

Conclusion

Gold offers multiple benefits to investors. Historically gold has generated very good returns for investors. Investment in gold for the short term is not advisable but over the long run, one should defiantly consider gold for investment.

Happy investing 🙂