Electronic Verification Code for Income Tax Return – Now one can e-verify income tax return using electronic verification code (EVC). Central Board of Direct Taxes has issued notification on 13th July, 2015 for using Electronic Verification Code for e-filing income tax return. If you verify income tax return using EVC, you need not to send paper acknowledgement by post to CPC Bangalore.

What is Electronic Verification Code?

- Electronic Verification Code (EVC) is Code or PIN number used to verify the identity of the person furnishing income tax return.

- The EVC will be 10 digit alpha numeric number/code.

- The EVC can be generated on E-filing website (http://incometaxindiaefiling.gov.in) of Income Tax department.

- Individual filing income tax return ITR1, ITR2, ITR2A, ITR4, ITR4S can use this EVC. Karta of HUF can also use EVC for verification of Income Tax Return.

- EVC generation process varies based on risk-category of the Assessee.

- The Eve would be unique for an Assessee PAN and Will not valid for any other PAN at the time of filing of the Income Tax Return.

- One EVC can be used to validate only one return of the Assessee irrespective of the Assessment Year or return filing type (original or revise) .

- The EVC will be valid for 72 hours.

- The verifier can use multiple mode to generate EVC and can generate EVC multiple times.

How to Generate Electronic Verification Code?

Electronic Verification Code Generation through Net Banking

- Some specified banks authorized with Income Tax Department for generation of EVC may provide direct access to e-filing website. The link will be provided by bank only in the case of verifier PAN card is validated by bank during process of KYC.

- One can use Internet banking user id and password to login to Net banking site. Once user see this link and click on that he/she will be redirected to Income Tax site for the generation of EVC. EVC generated using this process will be send to register mobile number of verifier.

Electronic Verification Code Generation through Aadhar Card

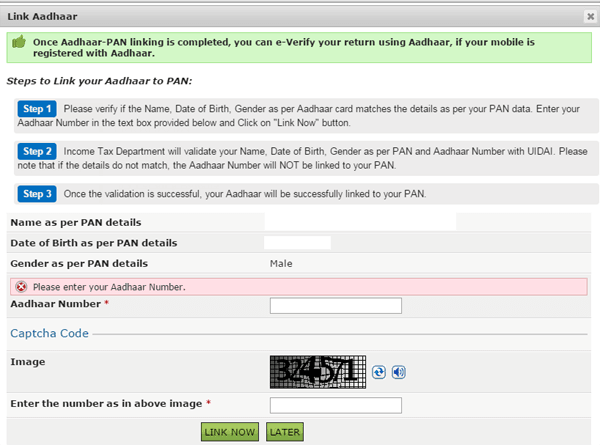

- You can link your Aadhar Card with PAN number on e-filing website. Once Aadhar-PAN linking is complete, you can e-verify your return using Aadhar.

- If your mobile is registered with Aadhar one OTP will be generated by UIDAI and sent to your mobile number. This Aadhaar OTP will be the EVC and can be used to verify your Income Tax return. The Aadhaar OTP as EVC will be valid for 10 minutes (or as specified by UIDAI).

- In order to link your Aadhar card with PAN you need to login to e-filing website. On logging to this site you will see pop up display message for Aadhar-PAN linking.

Electronic Verification Code Generation through ATM

- If your ATM card is linked to PAN card validated bank account and bank is registered with Income Tax department for providing this services can generate EVC using this method.

- Under this method you need to access the ATM of the Bank using ATM PIN at ATM Kiosk. On ATM screen you will find option to generate EVC for Income Tax return filing.

- On clicking this you will get EVC on your register mobile number.

Electronic Verification Code Generation through E-filing website

- If your total income as per the Income Tax Return is Rs. 5 Lakh or below and there is no refund claim you can generate EVC on E-filing website.

- EVC generated using this method will be send to you on register e-mail id and mobile number.

- You can use this EVC to verify your income tax return.

How to e-verify your Income Tax return using EVC?

- Login to e-filing website using your credential.

- Click on Upload Return and submit your Return

- You will see message Return is uploaded (Pending for e-verification)

- Click on e-Verify Return under tab e-file.

- Uploaded returns of last 120 days pending for e-verification will be displayed.

- Click on e-verify.

- You will be prompted for four different option to e-verify return.

Option -1 “I already have an EVC and I would like to Submit EVC”

Step -1 Provide EVC in text box and press submit

Step -2 Download the Acknowledgement (No action is required)

Option-2 “I do not have an EVC and I would like to generate an EVC”

Two options are provided –

Generate EVC using Net Banking

Step -1 Login to your Net Banking account.

Step -2 Click on e-verify Return

Following banks provide facility of filing return using Net Banking.

Allahabad Bank

Andhra Bank

Axis Bank Ltd

Bank of Baroda

Bank of India

Bank of Maharashtra

Canara Bank

Central Bank of India

City Union Bank Ltd

Corporation Bank-Coroorate Banking

Corporation Bank-Retail Banking

DENA BANK

HDFC Bank

ICICI Bank

IDBl Bank

Indian Bank

Indian Overseas Bank

Kotak Mahindra Bank

Oriental Bank of Commerce

Punjab National Bank

State Bank of India

syndicate Bank

UCO Bank

Union Bank of India

United Bank of India

Vijaya Bank

Generate EVC to register e-mail id and Mobile Number.

Step -1 Enter EVC sent to you in your E-mail id and Mobile number and click on submit.

Step -2 Download the Acknowledgement (No action is required)

Option-3 “I would like to generate Aadhaar OTP to e-Verify my return”

Step -1 Enter Aadhar OTP sent to you on your register Mobile number and click on submit.

Step -2 Download the Acknowledgement (No action is required)

Option-4 “I would like to e-Verify later/ I would like to send ITR-V”

Step -1 Download the Acknowledgement ITR- V

Step-2 Send ITR-V to CPC Banglore by Post.

I hope you find detail given in this article useful. If you have any query related to filling of income tax and e-verification using EVC, do post in comment section given below. I will surely answer them.