Sensex has crossed the level of 50000 in 2021. Expert are of opinion that market is expected to reach a new height and stay on a higher level in the year 2021 despite Covid-19.

Large Cap Mutual Funds are fund one of the best category mutual funds when it comes to investing in equity. Large-cap mutual funds are a safe bet and generally withstand every market situation compared to mid-cap and small-cap mutual funds. Large-cap funds invest in big companies with large market capitalization. The large-cap companies are blue-chip companies with sustainable growth and a proven track record. Key features, benefits, and detail about best performing large-cap mutual funds of 2021-22 are given below.

Features & Benefits of Large Cap Mutual Funds

Large-cap funds are a fund that invests minimum 80% of its assets in equity and equity-related instruments of large-cap companies.

Stability in the portfolio

Large-cap companies are companies with long business tenure. Large-cap companies are likely to generate profit regularly. This means large-cap companies and large-cap funds provide stability to your portfolio. You should keep large-cap funds in your portfolio.

Diversification in the Portfolio

The large-cap fund invests in companies from multiple sectors with different capitalization. This means investing in a large-cap fund provides the advantage of diversification in the portfolio. Additionally, investors need not to invest in every sector or monitor their performance.

Withstand over Economic Downturn

The large-cap companies where these funds have invested money can withstand over economic downturn and likely to provide positive returns. This is due to a strong business model and future business prospects. History shows that large-cap fund has given better return during economic downturn also.

Higher Liquidity

Large-cap mutual funds offer higher liquidity to investors compared to mid-cap and small-cap funds. An investor with a low-risk appetite and long-term goal can opt to invest in large-cap mutual funds. This fund is suitable for first-time investors.

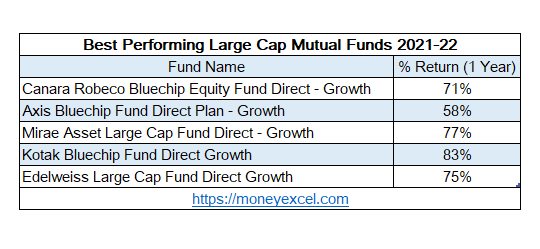

Best Performing Large Cap Mutual Funds 2021-22

#1 Canara Robeco Bluechip Equity Fund Direct – Growth

Canara Robeco Bluechip equity fund is one of the popular large cap fund. This fund invest more than 70% of fund in large cap stocks. Three years annualized return of this fund is 17.23%. Last 1 Year Annualized return as on 1st April 2021 is 70.95%. Investor with 3-5 years’ horizon can plan to invest in Canara Robeco Bluechip equity fund.

#2 Axis Bluechip Fund Direct Plan – Growth

Axis Bluechip Fund Direct Plan – Growth is five star rated fund. This fund has invested more than 82% fund in the large cap stocks. The expense ratio of this fund is very low. Three years annualized return of Axis Bluechip fund is 18%. Last one year Annualized return of this fund as on 1st April 2021 is 58%.

#3 Mirae Asset Large Cap Fund Direct – Growth

Mirae Asset Large Cap Fund is one of the top mutual funds in India. This fund has constantly performed well compared to other funds. It is three star rated fund. This fund has given 15% annualized return in last three years. In last one year this fund has generated 77% annualized returns for the investors.

#4 Kotak Bluechip Fund Direct Growth

Kotak Bluechip Fund is three star rated fund. It is good diversified fund where more than 65% of investment is in large cap fund. This fund has generated very good returns for the investors. Last three years annualized return of this fund is 13.83%. This fund has generated 82.85% annualized returns for the investor in in last one year.

#5 Edelweiss Large Cap Fund Direct Growth

Edelweiss Large Cap Fund is next in the list of best performing mutual funds. It is four star rated fund with good performance history. This fund has invested more than 60% fund in large cap stocks. This fund has generated 13% annualized return for the investor in last 3 years. Last year performance of this fund was also good. This fund generated 75% annualized return for the investor in last one year.