If you are a new stock market investor and willing to invest in stock market, you need good trading demat account for buying and selling stocks. A Large number of trading demat account options are available in the market and you must be wondering where to open trading demat account? In this post, I will discuss Best Online Trading Demat account options in India. I will also compare cost associated with each account option.

Best Online Trading Demat Account

ICICI Demat Account – ICICI Direct 3-in-1 Account

ICICI Direct offers 3-in-1 online account for saving, trading and demat requirement. ICICI Direct demat account also provide facility to invest in 20 different financial products including equity, derivative, mutual funds, ETF, fixed deposit and NPS.

Key Features –

- 3-in-1 Online Trading platform

- Offers wide range of products margin based and future option for trading

- Portfolio Tracker and SMS alert facility

- Flat and variable brokerage plans

- Buy and Sell Limit based trading

- Trading is available in both BSE and NSE

- Low-bandwidth website for slow internet connection

ICICI Direct Account Charges –

- One Time Account Opening Charges -Rs. 975

- Demat Annual Maintenance Charges – Rs. 500

SBI Demat Account – SBI eZ – Trade

SBI offers online demat account facility for both Indian Residents and NRI’s. This account is known as eZ -Trade account. You can invest in equity, mutual funds and derivatives using this online account.

Key Features –

- Live Market Streaming Facility

- Reports facility – Demat holding, order and trade book & SMS Alert

- After Market order facility

- Low bandwidth option and anywhere access

- Secure and Encrypted Transaction

- Centralized helpdesk and telephonic assistance

- Real time advice and recommendation

SBI Demat Account Charges –

- One Time Account Opening Charges -Rs. 500

- Demat Annual Maintenance Charges – Rs. 400

HDFC Online Trading

HDFC Online Trading account is offered by HDFC Securities. This account provides options for trading on both NSE and BSE. You can do delivery based, intraday and future option trading using this account.

Key Features –

- Online and Mobile trading facility

- Email confirmation on execution of trade

- High level of security using 128 bit encryption

- Dedicated customer care

HDFC Online Trading Account Charges –

- One Time Account Opening Charges -Rs. 999

- Demat Annual Maintenance Charges – Rs. 750

Axis Direct

Axis Direct offers 3-in-1 online investment account. You can invest in equity, mutual funds, IPO, NCD, ETF, Company FDs using this account.

Key Features –

- Internet trading & Mobile trading facility

- Research Advice

- Fixed and Variable Brokerage Plan

- Real time quote and multiple watch list

- Portfolio Tracker

Axis Direct Trading Account Charges –

- One Time Account Opening Charges -Rs. 999

- Demat Annual Maintenance Charges – Rs. 650

Kotak Gateway Demat Account

Kotak Securities is one of the largest brokerage in India. Kotak Securities offers 3-in-1 trading account. This trading account offers online trading facility in equity, derivatives, IPO, ETF and bonds.

Key Features –

- Light-weight trading website for low speed internet connection

- High-speed trading tool – Keat Pro X and FastLane

- Mobile trading app – Kotak Stock Trader

- Free Research Reports

Kotak Trading Account Charges –

- One Time Account Opening Charges -Rs. 750

- Demat Annual Maintenance Charges – Rs. 600

Evaluation of Best Online Trading Demat Account

Best online trading demat account given above are selected based on extensive research and data available over the internet. Evaluation criteria for the selection of best online trading demat account is given below.

Fees –

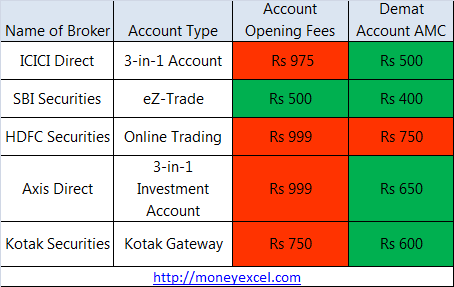

You should consider account opening fees and AMC charges while opening demat account. Account opening fees and Demat account AMC for all brokerage houses varies from Rs. 500 to Rs.999. Look at fee comparison table given below.

Brokerage –

Another important factor you should consider before opening demat trading account is brokerage charges. Brokerage charge comparison of Best online trading demat account is given below.

Usability –

Third factor for the evaluation is usability. Trading Demat account should be user-friendly and easy to operate.

Customer Services –

Customer service is most important factor in evaluating demat account. Customer support should be excellent and accessible all time.

You should carry out an independent research before opening online trading demat account.

If you like reading this article do share it on facebook and twitter, it will be a special gift from you to our blog.