Hybrid Mutual Funds – There are three types of mutual fund investors, One, those who are willing to take a risk and invest in equity funds. Second, are those who are risk-averse and select debt funds, and third are balanced investors, who invest in hybrid mutual funds.

What is Hybrid Mutual Fund?

Hybrid mutual funds are funds that invest in both equity and debt instruments depending on the investment objective of the fund. This means hybrid funds provide diversified exposure to both the equity and debt markets. Hybrid funds reduce concentrated portfolio risk. The hybrid fund has the potential to generate slightly higher returns compared to debt mutual funds. These types of funds are ideal for moderate risk-taking investors.

Benefits of Investing in Hybrid Mutual Funds

- Investing in a hybrid fund offers diversification to the investors, as this fund invests in both equity and debt asset class.

- A hybrid fund allows investors to balance risk and return. The equity portion generates higher returns and debt earns steady returns at lower risk.

- Hybrid funds carry lower risk compared to pure equity funds.

- Hybrid funds are best to hedge against inflation as the equity component offers a higher return and the debt component offers regular income.

How to select Hybrid Mutual funds for investment?

You should consider the following factors while selecting hybrid funds for investment.

Fund performance – Hybrid fund offers moderate returns to the investors. You should check the fund performance for the past three years before investing in hybrid mutual funds.

Risk – You should assess a mutual fund portfolio with respect to risk. Check out where the fund manager is investing your money and in what ratio. Based on the fund portfolio you can determine what type of returns are expected from the fund and risk level.

Expense ratio – Check the expense ratio of the fund. The expense ratio is decided by the fund manager based on expenses incurred for managing funds. Ensure that the expense ratio of the fund is lower.

Fund Type – You need to check out the fund type before investing. There are six types of hybrid funds available in the market, balanced, aggressive, dynamic, income generation, etc.

Fund Rating – Fund rating is an important thing to check before investing. You should invest in a fund with a fund rating 4 Stars or above.

Investment Objective – Make sure to check the investment objective of the fund. The investment objective of the fund where you are investing money should meet your investment goal.

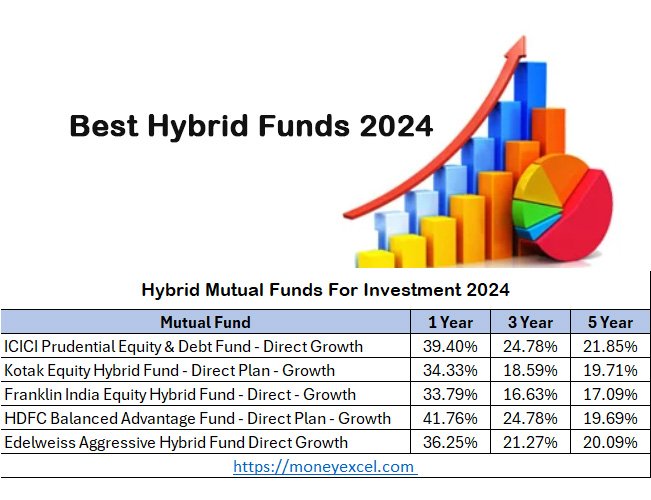

5 Best Hybrid Mutual Funds to Invest in 2024

#1 ICICI Prudential Equity and Debt Fund Direct

ICICI Prudential Equity and Debt Fund Direct is the first aggressive hybrid fund for 2024.

Rationale –

- ICICI Prudential Equity and Debt Fund is the best-performing mutual fund. This fund is beating the benchmark index consistently. This fund has given 39.4% returns (as of June 2024) to investors in the last year.

- The expense ratio of this fund is low (1.02%) which is very good as a fund manager is managing funds with lower expenses.

- The CRISIL rating of this fund is five and this fund invests 72% money in equity and the rest in debt.

#2 Kotak Equity Hybrid Fund – Direct

Kotak Equity Hybrid Fund – Direct is one of the best-performing hybrid funds for 2024.

Rationale –

- Kotak Equity Hybrid fund has generated very good returns for investors in the last three years. This fund is generating good returns with respect to peer funds.

- The CRISIL rating of this fund is four-star.

- The expense ratio of this fund is the lowest 0.48% (as of June 2024).

- It is an aggressive hybrid fund recommended for investment from a long-term perspective.

#3 Franklin India Equity Hybrid Fund – Direct-Growth

Franklin India Equity Hybrid Fund – Direct-Growth is Top most aggressive hybrid fund for 2024.

Rationale –

- Franklin India Equity Hybrid Fund has consistently given double-digit returns to investors. Last year this fund generated 33.79% returns for the investors. (As of June 2024).

- CRISIL has given a four-star rating to this fund.

- The expense ratio of this fund is very low 1.08%.

- It is a good fund for investment in the long run.

#4 HDFC Balanced Advantage Fund – Direct Plan-Growth

HDFC Balanced Advantage Fund – Direct Plan-Growth falls under dynamic asset allocation or balanced advantage category. It is one of the top-performing funds.

Rationale –

- HDFC Balanced Advantage Fund has given 41.76% returns (as of June 2024) to investors in the last year.

- It is managed by an experienced fund manager. The expense ratio of this fund is 0.73% (As of June 2024).

- CRISIL has given a four-star rating to this fund.

#5 Edelweiss Aggressive Hybrid Fund Direct-Growth

Edelweiss Aggressive Hybrid Fund Direct-Growth is an aggressive hybrid fund generating consistent two-digit returns for the investors.

- Edelweiss Aggressive Hybrid Fund has given 36.25% returns (as of June 2024) to investors in the last year.

- This fund has the lowest expense ratio of 0.39%.

- The CRISIL Rating of this fund is Five Star.

- This fund is consistently beating the benchmark index.

Over to You

The hybrid fund has gained very good popularity among investors in the past few years. This fund balances the risk and return and help investors to diversify their portfolio.

If you are moderate risk investors or novice investor you should consider a hybrid fund for investment.

Note – All mutual funds given above are aggressive hybrid funds and fall under the direct category (free from distribution commission).