PAN (Permanent account Number) is 10 digit alphanumeric ident

Today we will discuss following:-

- HOW TO APPLY FOR NEW PAN CARD ONLINE

- VERIFY PAN CARD DETAILS

- HOW TO GET DUPLICATE PAN

- HOW TO CORRECT PAN CARD DETAILS

HOW TO APPLY FOR NEW PAN CARD ONLINE

New PAN card can be issued by UTI or NSDL. To apply for PAN card one need to fill following form.

FORM 49A: – To be filled by Indian citizens including those who are located outside India.

FORM 49AA: – To be filled by foreign citizens.

- An applicant will fill Form 49A online and submit the form.

Online application for PAN card -NSDL

Online application for PAN card -UTI click here.

- A confirmation screen with all the data filled by the applicant will be displayed.

- On confirmation, an acknowledgement will be displayed. The acknowledgement will contain a unique 15-digit acknowledgement number.

- The applicant is requested to save and print this acknowledgement.

- Individual’ applicants should affix two recent color photographs with white background in the space provided in the acknowledgement.

- Apply Signature / Left Thumb Impression within the box provided in the acknowledgement.

- Fees of processing PAN card application is 105 Rs/- if communication address is within India and 971 Rs/- if communication address is outside India.

- This payment can be done online on successful credit card / debit card / net banking payment acknowledgement will be displayed. Applicant shall save and print the acknowledgement.

- Send application and acknowledgement to NSDL (‘Income Tax PAN Services Unit, NSDL e-Governance Infrastructure Limited, 5th floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411016) or UTI (UTI Limited Plot No. 3, Sector 11, CBD Belapur NAVI MUMBAI – 400614 ) for processing along with proof of Identity and proof of address within 15 days from date of application.

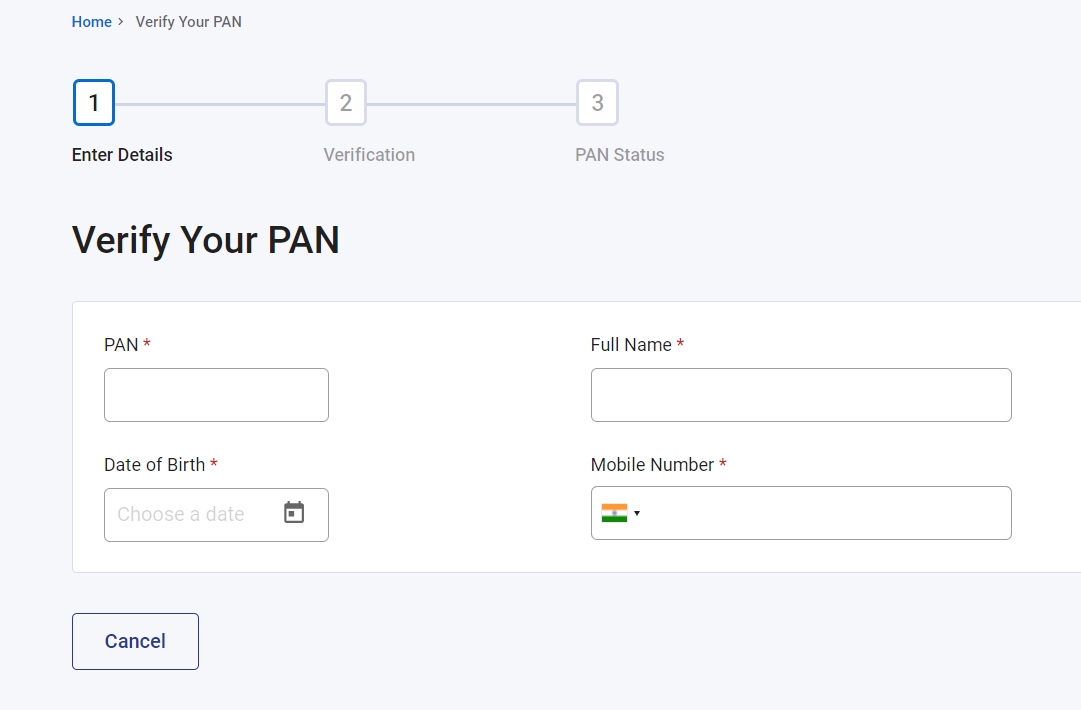

VERIFY PAN CARD DETAILS

You can verify or know about your PAN card details from Incometax, NSDL or UTI site.

Income tax site:-

To Know and verify PAN card details from Income Tax site – click here

- Provide your date of birth, First Name and Surname.

- Enter Captcha code and press submit button.

On submission you will find webpage mentioning your PAN details including jurisdiction – IT ward details and status.

NSDLsite:-

To verify PAN card details from NSDL – Click here

Input 15 digit acknowledgement number or Name and date of birth/incorporation.

On submission you will find webpage mentioning your PAN card details and date of dispatch.

UTI Site:-

You need to register at UTI for PAN verification. Once you are register and login please input your details and you will get information about PAN card.

Although it is easy to verify PAN card but many people find it difficult task. The reason is they put wrong information or does spelling mistake. Remember following to verify PAN details online.

- Input correct information.

- Avoid spelling mistake

- Use case sensitive letters (UPPER CASE)

- Think what you have filled in PAN application and input same information

Also check – How to know about PAN structure

HOW TO GET DUPLICATE PAN or HOW TO CORRECT PAN CARD DETAILS

You can apply online to get duplicate PAN or to correct PAN card details by filling an online form

- For Changes or Correction in PAN data, fill all mandatory fields (marked with *) of the Form and select the corresponding box on left margin of appropriate field where correction is required.

- If the application is for re-issuance of a PAN card without any changes in PAN related data of the applicant, fill all fields in the Form but do not select any box on left margin.

- Follow from step 6 onwards or Applying New PAN card. (Given above)

If you are facing any difficulty to verify PAN card please write back to us.

Also check – How to know about PAN structure

Also Read:- 20 Types of Taxes in India