Credit Card Autopay facility – Forgetting credit card bill payment will cost you lot of money. If you have tendency to forget your credit card bills you should set up Autopay facility. Autopay credit card bill facility save you from late payment fees, higher interest rate as penalty. It will also save you from negative effect in credit score.

Let us try to understand this by example. Recently I came across one case where my friend forgot to pay hefty credit card dues. His credit card bill of roughly Rs.40000 was due and he forgot to pay it. After due date was over he again got reminder email. His total due amount after calculating interest and GST charge was Rs.41730. He again missed payment of credit card and next month he received credit card bill of Rs.45700 along with interest rate and penalty. Due to his nature of forgetting bill payment he ended up paying Rs.5700 extra. At later stage, he setup auto pay bill facility for credit card dues.

What is Autopay Facility of Credit Card?

Autopay is auto payment bill facility for credit card. Autopay or automatic payment facility can be setup easily using internet banking. This facility automatically transfer money from your bank account as payment of credit card bill on specified date. It is one-time setup facility. You can cancel this facility anytime. In this facility you can set complete payment facility or minimum amount due facility.

Also Read – Converting Credit Card Bill to EMI – Good or Bad?

What are benefits of Automatic Payment – Credit Card?

Never miss payment

You need not to remember due date for the bill payment automatic payment facility takes care of bill payment every month. So never miss bill payment. As long as you use credit card you can make use of this option.

Fast and Automatic option

You need to waste time for bill payment. Automatic payment facility eliminates manual process and save time required for making payment. It is convenient option for many people as they don’t have time for making payment.

You may save money

When you make use autopay facility, you need not worry about late payment penalty, high-interest charges. You will be able to save yourself from late fee and higher interest charges.

Credit score protection

As you make payment via auto pay regularly your credit score remains protected. Higher credit score give benefit such as low interest rate on loan and better chance of getting credit card and loan approval.

What are Flip slide of Automatic Payment – Credit Card?

Billing Error

The auto pay credit card bill option does not address billing error. If your credit card bill contains error such as duplicate entry or fraudulent transaction you end up paying higher amount. You need to make practice to review your credit card if you setup auto pay facility.

Maintain Cash in the account

You need to maintain sufficient money in your account when the bill date is due. If you don’t have enough funds in your account this option will not work. At the time of due date payment will not take place and it will be as good as not paying bill on time.

How to setup credit card auto pay facility?

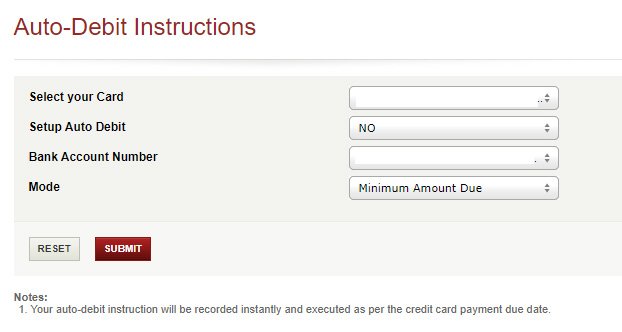

The process of setting up credit card auto pay vary from one card issuer to another. Here are steps to setup auto pay facility for ICICI Credit Card.

- Login to your bank account via internet banking user ID and password.

- Visit credit card section and click on auto debit option given at the left hand side menu.

- You will be taken to new page of auto debit.

- Select the card for which you need to setup auto debit or auto pay facility.

- Next is selection of bank account from where you need to make payment.

- Now select the mode. You have two modes minimum amount due or total amount due.

- Once you are done with the selection of option click on the submit button.

Should you use it?

The answer of this question depends upon your credit card spend pattern and habits of making payment. If you have tendency to forget bill payment you should make use of this facility. Instead of making payment of total amount due you can choose minimum amount due option.

Make sure to understand flip side of this facility such as billing error and maintaining enough balance on the due date.

If you have any query about auto pay or auto debit facility feel free to share it in the comment section.

![Expert Tips to Improve Your Personal Loan Eligibility [2024] expert tips personal loan](https://moneyexcel.com/wp-content/uploads/2024/04/expert-tips-personal-loan-100x70.jpg)