Among all traders and investors, George Soros is probably the most recognizable. In this article, you will find all the information about the greatest traders. There is always something we can learn from successful experienced traders to use in our trading.

Understanding their secrets could also tremendously affect our growth and profits. Great traders have great strategies when approaching trading. You can check these strategies, to know more about trading strategies secrets. Let’s find out what we can learn from Soros and other famous traders and investors of all time.

Famous Traders Of All Time

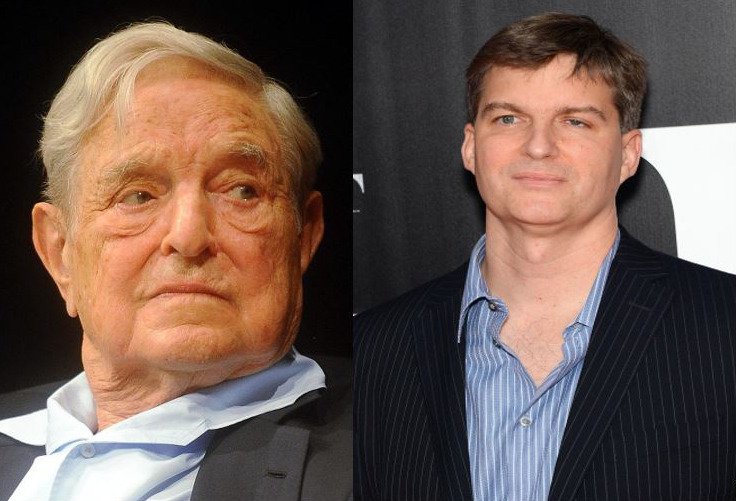

Many other famous traders wrote their names in history forever. Another big name in the recent history of trading and investing is Michael burry who shorted the 2008 crisis and made lots of money in doing so. Christian Bale is portraying him in the famous movie “ The Big Short”(2015). This movie is a must-watch for any trader together with “Margin call”(2011) and “The Wolf of wall street”(2013). There are many important trading lessons in these movies. We won’t be taking any lessons from the latter movie though, except that never scam or fraud anyone.

There is always a way to make money by providing value to others. Warren Buffet is also a very powerful investor and billionaire. But we are going to focus more on traders in this article. Speaking about traders, did you know there is a company founded by a Nobel prize mathematician Jim Simons? His medallion fund is generating constant yearly profits for decades using advanced automated trading algorithms which he has developed with other partners.

Another must-know trader is highly successful Chicago-based commodities trader Richard Dennis who made $200 million dollars in 10 years. with his partner William Eckhardt he developed the mythical Turtle Trading experiment. The book “The way of the turtle” should be on any trader’s table. All traders mentioned here have one thing in common, they are knowledgeable people, they know what they are doing, they analyze markets thoroughly, and they understand the underlying workings of the financial markets. They studied and developed their strategies for years and not in a get-rich-quick style.

To make an example Michael Burry can pick a company in Spain and know every detail about it in financial terms. He then makes trade and that trade usually is successful. He is currently active on Twitter. Recently he stated that he wouldn’t delete his tweets anymore. So, follow him right now if you have not done it already.

What all great traders have in common is patience, discipline, and vast knowledge of financial markets and the world economy. All of them use advanced and well-developed trading strategies. George Soros is a trader in every sense of the word. He became famous for a single-day profit of $1 billion dollars when he shorted the pound. It happened in 1996 Sept. and shook the world. He has been world-famous since then.

There are also investors who bet on long-term price movements. The difference between trading and investing is simple, traders speculate on short market movements while investors buy and save assets for future price movements. If you want to know more superstar traders here is a great source. We all know someone who has owned some stocks for decades, they can be considered investors while traders bet leveraged money in the short term attempt to make profits.

Final Thoughts And Summary

Now, what can we learn from George Soros? From his quotes about trading, we can clearly see that he loves betting on short-term trends. Analyze the market with fundamental and then technical analysis and only then make a decision. Be disciplined and execute your trading strategy flawlessly. It is not easy for novice traders to make money trading Forex currency pair markets. It takes dedication and hard work.

With a good trading strategy, it becomes easier to learn and test trading skills. Buying the fears and selling the news is another famous mantra among big traders. When everyone panics and thinks that markets are gonna fall then it is probably a good time to buy, and when everybody starts to buy stock or pair then it is a good time to sell and take profits.

To conclude, discipline, dedication, and hard work are traits of the most successful traders. They buy when others are afraid and they sell when others are buying the tops. They analyze markets thoroughly and have a profound understanding of financial markets and the economy. Study more and be patient if you too want to repeat their success.