Prepayment of Home Loan – Everyone has a dream of purchasing their own house, where one can live with peace and happiness. Many people can’t afford to purchase it due to the hefty price or may end up purchasing it by taking a Home loan.

Once you take home loan property is yours but you have a home loan as a big financial obligation. Every month you have to pay a considerable amount of money as EMI (Equated monthly installment).

E.g If you take a Home loan of Rs. 10 lakh for 20 years at an interest of 8%, you have to pay nearly Rs.10,500 per month. If you make a calculation you will end up spending a hefty amount of more than Rs.25 lakh this is due to payment interest on the principal.

At any point in time do you feel uncomfortable that you need to wait for a number of years to free your home from loan? Think of closing your home loan before it becomes a lifetime burden. One good way to close your home loan earlier is “prepayment”.

Prepayment of Home Loan – Good Decision

Prepayment refers to the act of repaying a loan, whether partially or in full, before the stipulated loan tenure. In the context of home loans, prepayment involves making additional payments towards the principal amount of the loan.

You need to find out the following information from your bank:-

(1) When you can start prepayment of your loan?

(2) Whether you can make part-prepayment or not?

(3) Any penalty is applicable on prepayment or not?

Once you have the above information you need to calculate the outstanding loan amount and how much repayment is possible for you.

Most banks do not impose any penalty but, if your bank has a limit of partial repayment you need to ensure that part-prepayments do not exceed this limit to avoid a prepayment penalty. If by any chance you need to pay a penalty charge keep in mind that this penalty should be much less than the interest value saved.

You can plan to make prepayment every quarter or half yearly based on your convenience. Every month start preserving some money for this. If possible follow discipline and make SPP – Systematic prepayment plan. This prepayment will bring down your outstanding loan and lead to saving on overall loan payments.

By prepayment like this, you can not only save on net interest but you will get ownership of your home earlier than planned. The longer the tenure more you will pay, hence it is a good decision to make multiple parts- repayments of home loan to shorten the tenure and to reduce interest burden. Provided you can manage the outflow of this prepayment comfortably from your current income.

Another way to reduce the home loan burden is to increase EMI. Banks usually cap a certain maximum limit on EMI based on your monthly income. So, the way out is to make part-prepayment.

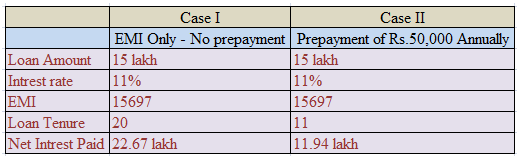

Let’s take a small example of how much interest you can save when you prepay your home loan.

Mr.X has taken a home loan of Rs15 lakh for a loan tenure of 20 years @ 11 % interest rate. The EMI of this loan comes out to be Rs.15,696. If Mr.X does not opt for any prepayment he will end up paying Rs 15 lakh principal and net interest of Rs.22.67 lakh.

If Mr.X is a wise person like you and opts to pay 50,000 Rs/- every year towards repayment (total repayment of 5.5 lakh), the tenure of this loan will be reduced to 11 years and the net interest paid will be Rs 11.94 lakh. So actually Mr. X can save a hefty Rs 10.73 lakh which can help him build a good retirement corpus or may be useful for other needs.

Click Here to download excel sheet which will help you to calculate how much you can save by doing prepayment.

So due to prepayment, Mr.X could close the home loan 9 years earlier. He could save significantly on the interest part. The above table shows that by making a prepayment Mr.X could reduce the interest burden by 50 %.

Advantages of Prepayment

Reduced Interest Burden

One of the primary benefits of prepayment is the reduction in the overall interest burden. By making extra payments towards the principal, borrowers can lower the total interest payable over the loan tenure.

Shorter Loan Tenure

Prepayment allows borrowers to expedite the repayment process, leading to a shorter loan tenure. This not only saves on interest costs but also helps in achieving debt-free homeownership sooner.

Improved Credit Score

Timely prepayments demonstrate financial discipline and responsibility, which can positively impact the borrower’s credit score. A higher credit score can lead to better loan terms in the future.

Equity Buildup

Prepayment accelerates the buildup of equity in the property. As the outstanding loan amount decreases, the homeowner’s equity stake in the property increases, providing a sense of ownership and financial security.

Tax Implication

As per current Income tax law principal repayment of housing loans up to 1 lakh (Under 80 C) is exempted, not only interest payment up to 2 lakh is also exempted. So by making prepayment, you can avail of dual benefits, tax saving, and saving on net interest paid.

If you are thinking of taking tax benefits also, do remember that the value of prepayment and EMI put together do not exceed the 1 lakh 80 C limit. Amounts exceeding 1 lakh will not be beneficial to you in terms of tax savings.

Caution

Another important point on the tax saving part is prepayment amount causes direct reduction in principal and hence reduction in the interest component. If you are in a higher tax bracket and want to take maximum advantage of the exemption limit of interest payment (2 lakh) you can avoid this prepayment it is your decision.

But we see that a small prepayment of a home loan at an earlier stage is a good decision to save money on net interest paid.

So finally if you can afford to make multiple prepayments towards your home loan, possibly due to a salary hike, promotion, bonus or abrupt business profit then making prepayment of the home loan is a good proposal that can save you a lot of money and term of loan.

Prepayment Tips for Different Stages of Loan Tenure

Early Stage

In the early stages of the loan tenure, borrowers can benefit significantly from prepayment due to the higher allocation of interest in EMIs. Making regular prepayments during this stage can yield substantial long-term savings.

Mid-Stage

As the loan tenure progresses, borrowers may have more financial stability and surplus funds available for prepayment. Increasing prepayment amounts during the mid-stage can further accelerate the repayment process.

Final Stage

In the final stage of the loan tenure, borrowers may prioritize complete repayment to achieve debt-free homeownership. Making strategic prepayments in this stage can help clear the remaining balance and secure full ownership of the property.

Conclusion

Prepayment of home loans can be a prudent financial decision for borrowers seeking to reduce debt, save on interest costs, and achieve homeownership goals sooner. By understanding the benefits, risks, and strategies associated with prepayment, borrowers can make informed decisions tailored to their financial circumstances and objectives.

FAQs

Is prepayment of home loans always beneficial?

Prepayment can be advantageous for many borrowers, but its suitability depends on individual financial circumstances, loan terms, and alternative investment opportunities.

What factors should I consider before opting for prepayment?

Factors such as prepayment charges, savings vs. investment opportunities, financial stability, and tax implications should be carefully evaluated before deciding to prepay a home loan.

Are there any tax benefits associated with prepayment?

Prepayment may impact tax deductions on home loan interest, depending on applicable tax laws and individual financial situations. Consulting a tax advisor is advisable for clarity on tax implications.

Can prepayment affect my credit score?

Timely prepayments demonstrate financial responsibility and may positively impact credit scores. However, the extent of the impact may vary based on individual credit histories and other financial factors.

What if I have surplus funds but uncertain about prepayment?

If unsure about prepayment, consider consulting a financial advisor who can assess your financial situation, goals, and the potential impact of prepayment on your overall financial plan.