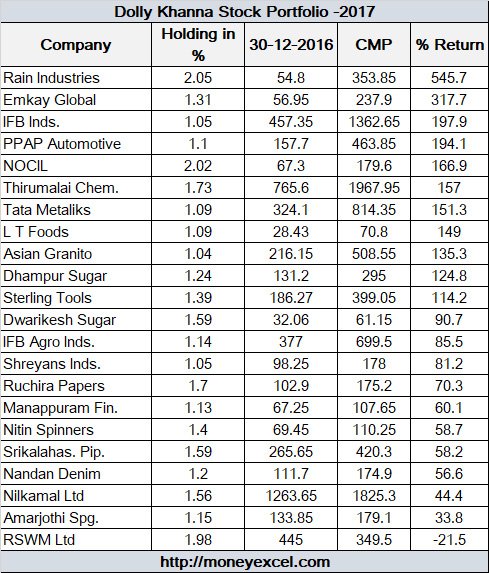

Dolly Khanna Chennai based popular stock market investor and Housewife. She is famous as a lady with Golden Touch. It is believed that whatever stock she buys that becomes multibagger stock. Few example of multibagger stocks identified by Dolly Khanna is Nilkamal, Liberty Shoes, RS Software, Trident, Manappuram Finance, Cera Sanitaryware etc. The portfolio of Dolly Khanna is managed by her husband Rajiv Khanna. In short Rajiv Khanna is the brain behind Dolly Khanna’s holding in the equity market. The estimated worth of Dolly Khanna Portfolio is 200 Cr. The year 2017 was a magnificent year for the Dolly Khanna aka Rajiv Khanna. Nearly half of the stocks from her portfolio has pulled up to 550 % return. 11 stocks have turned out to be multibagger by giving more than 100% returns.

11 Multibagger Dolly Khanna Stocks of 2017

Rain Industries – Rain Industries is turn out to be multibagger stock for Dolly Khanna. Total holding of Dolly Khanna in this stock is 2.05%. This stock gave 545% return to the investor in 2017.

Emkay Global – Emkay Global is next multibagger in her portfolio. Total holding of Dolly Khanna in this stock is 1.31%. The return given by this stock in 2017 is 317%.

IFB Industries – IFB Industries was a fresh investment of her in 2017. In a single year, this stock has given 197% gain to her.

PPAP Automotive – Khanna Couple is holding this stock since past two years. Total holding of this couple in this stock is 1.01%. This stock has given 194% return to the investor in 2017.

NOCIL & Thirumalai Chemical – NOCIL and Thirumalai Chemical both these stocks are from chemical space. Both these stocks have given 166% and 157% return to the investors in 2017.

Top Large Cap, Mid Cap & Small Cap Stocks For Investment in 2018

Tata Metaliks – Tata Metaliks is next stock that gave very good return to Khanna’s. The holding of this couple in this stock is 1.09%. This stock has given 151% return to the investor in 2017.

LT Foods & Dhampur Sugar – The next two stocks are LT Foods and Dhampur Sugar. These stocks have given 149% and 124% return to the investors.

Asian Granito – Asian Granito is another multibagger stock in Khanna’s portfolio. Asian Granito has given 135% return to the investor in 2017.

Sterling Tools – Last multibagger stock in the Khann’s portfolio this year is Sterling Tools. Sterling Tools has given 114% return to the investor in 2017.

Latest Portfolio of Dolly Khanna as on Sept 2017 is given below. As per data of BSE site, she is holding 22 stocks in her portfolio. Details are given below.

Dolly Khanna method of picking Multibagger Stock

Fundamental Analysis –

The method selected by Dolly Khanna and Rajiv Khanna for identifying multibagger stock is very simple. Do fundamental research on the stock. If fundamentals are strong, a stock is more likely to become multibagger. It is also called as a thoughtful investment.

Only Small Cap & Mid-cap Stocks –

Dolly Khanna portfolio clearly says that invest only in small cap or mid cap stocks. Your chance of finding multi-bagger stocks is high when you go for small cap and mid-cap stocks.

Consumption based stocks –

Rajiv Khanna and Dolly Khanna invest in consumption based stocks like cookers, shoes, denim, plastic, paper etc. All these companies deal with a middle-class product where the demand for the product is likely to be very high.

Business Potential & Facts –

Business Potential and Facts are important when you make investment. Never Invest based on insider’s information or speculation. Invest based on public knowledge and information. Study market situation and pick stock accordingly.

Lastly, I would like to share valuable advice given by Rajeev Khanna – “When you buy stock – You have to ask if you would like to buy the entire company. If the answer is yes, then invest in it. Look for companies which have low market cap to sales ratios, low P/E ratios and companies that have a greater potential to grow.”

Do you think multibagger stocks of Dolly Khanna and Rajiv Khanna will give better return in future also?

Do you think investment style of Dolly Khanna & Rajiv Khanna is useful?

Do share your views and queries in the comment section.