LIC of India is back with new Insurance plan Jeevan Rakshak (Plan No 827). Official Launch date of this plan is 19th Aug, 2014. This is regular premium paying Non-linked, With Profits, Endowment Assurance plan. This plan shall be available to standard life only under non medical limit and the total Sum Assured under this plan shall not exceed Rs.2 Lac. Let us look at LIC Jeevan Rakshak in detail.

LIC Jeevan Rakshak Key Features –

- Sum Assured: Minimum Rs 75,000 – Maximum Rs 2,00,000

- Tenure: Minimum 10 Years – Maximum 20 Years

- Age Entry – Minimum 8 Years – Maximum 55 Years

- Maximum Maturity Age – 75 Years

- Double Accident Benefit – Allowed with Additional Premium

- Death Benefit – Basic Sum Assured or 10 Times of Annualized premium or 105% of all premium paid on date of death

- Maturity Benefit – Basic Sum Assured with Loyalty addition if any

- Mode of Premium – Monthly, Yearly, Half Yearly, Quarterly or ECS

- Loan – Allowed after payment of premiums for at least 3 years.

- NO Medical Check up Required

- Suicide Clause – If life insurance policy holder commits suicide at any time within 12 months from date of commencement of risk LIC will not entertain any claim under this policy.

- Free Look Period – If policy holder is not satisfied with “Terms and Condition” of policy he/she may return policy to LIC stating reason within 15 days from date of receipt of policy.

- Premium rebate of 2% for yearly premium and 1% for half yearly premium.

- High sum assured rebate of 1.5% if you opted for more than Rs.1,50,000 Sum assured.

- Offers guaranteed surrender and special surrender.

- In case of surrender then no loyalty addition.

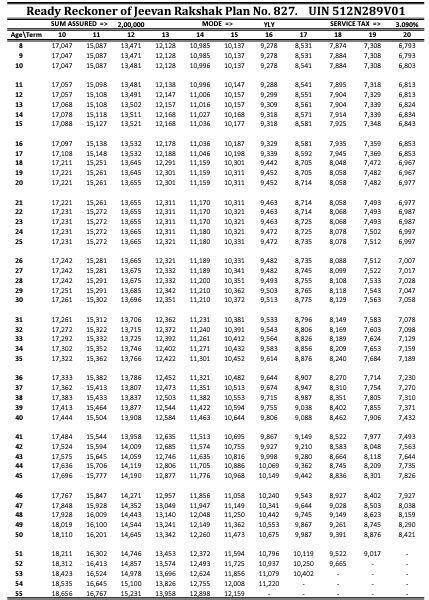

LIC Jeevan Rakshak Premium Detail

You can find Premium Ready Reckoner here.

Jeevan Rakshak Premium Details

Is it really Jeevan Rakshak?

LIC Jeevan Rakshak at first instance might look attractive but in general endowment plans like this will end up giving return in range of 5-6%. If we look at higher commission rate of agent and other expense of this policy is expected to give same type of return.

Sum assured of this policy is biggest constrain as per me. In today’s world 2 Lac is having no value and at the time of maturity after 15-20 years this amount will be peanut. In 2 Lac I don’t know how many years any depended can survive. Today people find 1 Cr risk cover is less.

With this Sum Assurance I don’t think so this policy is really Jeevan Rakshak!

Overall it seems to be another Bad policy by LIC.

How do you rate this policy? Do share your views.

For More Information Visit LIC site.

Also Read –