Stocks that multiply your wealth and give multifold returns is known as Multibagger stocks. Investors are always in search of good multibagger stock for investment. That is the reason, one of the most frequently asked questions by investors is – How to Find Multibagger Stocks for Investment? In this post, I will address your query of identifying good multibagger stock by a simple flowchart. In addition to that I will also recommend future multibagger stocks for investment.

What are Multibagger Stocks?

The term multibagger is used for stocks that have the potential to grow multiple times in short period of time. This term is coined from two words multi and baggers. Multi means too many and bagger means bags. So, the stock that gives a return in multiple bags is known as multibagger stock. Today let’s discuss how to find multibagger stocks for investment.

Also Read – Chartink Screener – Fundamental and Technical Scanner

How to Find Multibagger Stocks for Investment?

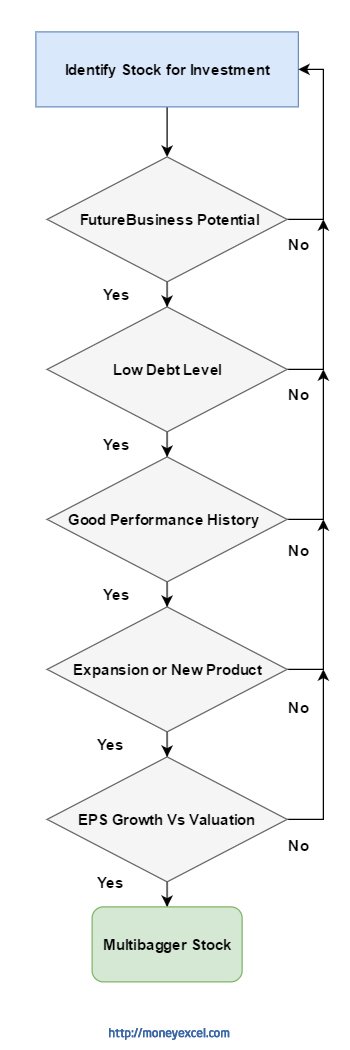

In order to identify the next multi-bagger stock, you need to follow a simple flowchart containing various checks. This checklist will surely help you identify a stock that has the potential to become the next multi-bagger.

Future Business Potential

The first thing you should check is the future business potential of the company. In order to find future business potential, you should look at products and services offered by the company. If a product or service is having future demand company will get future business and make a profit.

If you are looking at the stock of IT companies like Infosys you should look at present demand and potential growth in demand for the IT products or services offered by Infosys.

Low Debt Level

The second check for the multibagger stock is the debt level of the company. Ideally, a company should be debt free. However, you can also look at a company with low-level debt. The logic behind this check is simple if the debt level is high company will be spending more money for the repayment of high-interest debt.

In order to find the debt level, you should look at the debt equity ratio. Debt equity ratio of stock should be low. Some examples of low-debt or debt-free companies are Britannia Industries, Bajaj Corp, and Lupin.

Good Performance History

The third check to identify multibagger stock is the performance history of the stock. The company should be a consistent performer in terms of net profit margin and revenue. You can easily find out the performance history of the company from quarterly and yearly results.

One very good multibagger stock with consistent performance in profit margin is Eicher Motors where net profit is doubling every year.

Expansion or New Product development

The next check to identify multibagger stock is a business expansion or new products in the pipeline. This point is more or less related to future business growth.

One simple example of business expansion and new product launch is Reliance Industries. The company has invested a lot of money for the business expansion in a petroleum product. In addition to that new product launch Reliance Jio is likely to capture good telecom market.

EPS Growth Vs Valuation

The last check to find future multibagger stock is EPS Growth Vs valuation. The EPS of stock means the company’s profit divided by a number of shares. The EPS of the share should be at a reasonable level and the valuation of stock should not be very high. If a stock has already given a multifold return and the valuation of the stock is very high it is not multibagger stock. That is the reason future multibagger stocks are from small-cap and mid-cap sectors.

In addition to the above check, you can also look at factors such as dividend payment history of stock, business diversification, structural changes, management, and unique business model.

Also Read – 40 Multibagger Stocks of Jhunjhunwala, Kedia and Porinju Veliyath

Flow Chart to identify Multibagger Stock

In order to identify multibagger stock for the investment you can refer to the following flow chart.

Also Read – How to do Fundamental Analysis of Stock?

Over to You –

How do you identify multi bagger stock for investment?

Do you think the flowchart given above will help you in identifying multibagger stock?

Do share your views and identify multibagger stocks in the comment section.