Many of us take a home loan to buy the dream home. However, we hardly know the tax benefits associated with Home loan. In this post, I will throw light on Home loan tax benefits. I will also cover 10 less known facts which are not known to a majority of people.

Home Loan Tax Benefits

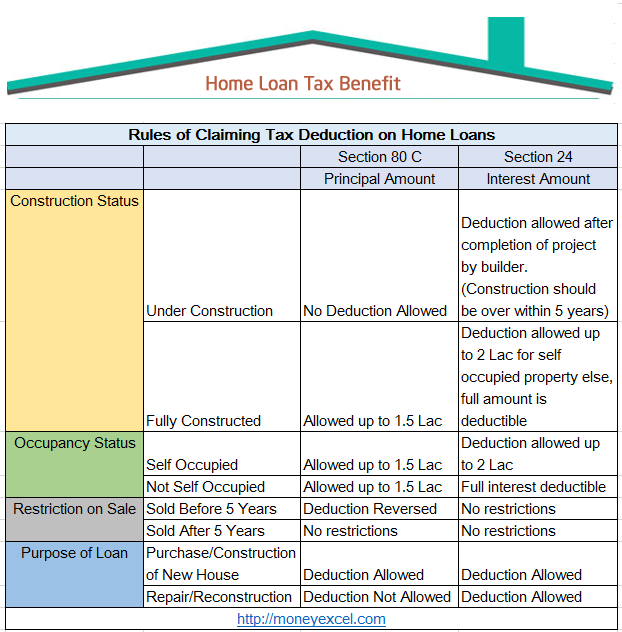

Home Loan EMI payment has two components (1) Principal (2) Interest (Section 24). You can avail tax benefit on both these components.

- Principal – You can claim tax deduction on the Home loan principal paid by you. The limit for this deduction is 1.5 Lac (Section 80C). You can get details about principal amount paid by you from your lender.

- Interest – You can also avail tax benefit on the interest component of the home loan. The total deduction allowed on interest component is up to 2 Lac. The condition of availing this tax benefit is owner should live in the house for which home loan is taken or house should be vacant.

Total Tax Benefit = 1.5 Lac Principal (80 C) + 2 Lac Interest (Section 24) = 3.5 Lac

Now let’s take a look at 10 less known facts about home loan tax benefit section 24.

10 Less Known facts about Home Loan Tax Benefits

First time home buyers can claim additional tax deduction of Rs 50,000 on Home Loan Interest

In budget 2016 new section 80EE is introduced for the first time home buyers. As per the new section 80EE, first time home buyers can claim an additional tax deduction of Rs 50,000 on home loan interest. This deduction is over and above tax deduction of 2 Lac under section 24 and 1.5 Lac under section 80C.

So, maximum tax benefit shall be 4 Lac per year. This new benefit is applicable under following conditions.

- You are first time home owner.

- No other house is owned by you.

- The value of the loan is less than 35 lacs and property value is less than 50 lacs.

- The loan should be sanction between 1st April 2016 and 31st March 2017.

This benefit shall be extended till the time repayment of home loan continues.

Deduction is allowed to the borrower and co-borrower

Home loan deduction on principal and interest is extended to the borrow and co-borrower both. This means if you have taken a home loan on your and your wife’s name you and your wife both can claim these tax deductions. So, effectively you and your wife both can enjoy tax benefit applicable on a home loan.

No benefit on principal payment during construction on property

As per income tax law, you can not avail any tax benefit on principal payment during the construction of the property. You are eligible for this benefit only after the project is completed and property possession is given to you.

Preconstruction period interest is also deductible in 5 equal proportion in 5 years.

You can claim home loan benefit only on the possession of the property. Any preconstruction payment towards principal cannot be claimed. However, you can claim preconstruction period interest payment once you received possession of the property. The tax deduction benefit on such interest is available equally over a period of 5 years starting from the year of possession.

Tax benefit on Home Protection Insurance premium payment

Many banks offer home protection insurance scheme. If you opt to take home protection scheme, an insurance premium paid towards this scheme can be claimed for tax deduction under section 80C. For home protection scheme sum assured and premium changes with the time.

Principal and repayment tax benefit shall be reversed if you to sell the property before 5 years.

You cannot sell the property before 5 years. If you sell the property before 5 years, all principal paid by you in last five years shall be reversed and added to your income. In addition to this, you may need to pay capital gain tax.

Loan from relative and friends is also eligible for tax benefits

You can take home loan from your friends and relatives and avail tax benefits. However, you will not get any tax benefit on the principal amount.

Let me explain, if you take home loan from your friend you can claim a tax deduction on interest paid to your friend (Under section 24). The following condition should be fulfilled in order to avail this tax benefits.

- You need to submit proof that you have paid interest to your friend. This may be in the form of a certificate.

- Your friend needs to show this interest income and he/she need to pay income tax on this income.

You can not avail tax benefit on principal payment under such case.

Benefit of section 80 C, section 24 and HRA

You can not avail the benefit of HRA if you are living in your own house and getting tax benefit towards section 80 c and section 24. However, if you are living in rented house despite owning your own house you can avail the benefit of section 80 C, section 24 and HRA also.

Buying multiple homes using home loan

You can purchase multiple home and avail tax benefits. The benefit under section 80 C for the principal payment shall be capped at 1.5 Lacs for all loans. The benefit under section 24 for the interest payment for the self-occupied property shall be 2 Lacs. For the house which is given on rent, there is no limit on interest payment claim.

Stamp Duty, Registration fee, Processing Fee and Tax Deduction

In addition to principal and interest component other expenses can also be claimed for the tax benefit. These expenses include stamp duty, registration fee expenses etc. All these expenses can be claimed as tax benefit under section 80C. Any processing fees for getting home loan sanction can also be claimed for tax benefit.

Over to you –

Hope I have clarified your doubts about home loan and tax benefits. If you have any other confusion related to home loan and tax benefit, feel free to post your query in the comment section.