Corona Kavach and Corona Rakshak are two latest standalone health insurance plans available in the market. These are short term health insurance policies. Due to ongoing COVID 19 pandemic, IRDA suggested all non-life insurers to office corona specific health insurance policy. Corona Kavach and Corona Rakshak are two policies that provide exclusive coverage for coronavirus treatment cost.

The name of Corona Kavach and Corona Rakshak sounds similar, and you may get confused – Which Health Insurance you should buy? – Corona Kavach or Corona Rakshak. Here is a detailed post, that explains key features and benefits details of Corona Kavach and Corona Rakshak.

Corona Kavach – Key Features and Benefits

Corona Kavach is standard name given to health insurance policy by IRDA. For the identification insurance company name will be added after the name Corona Kavach. This policy is also known as COVID standard health insurance policy.

What is minimum and maximum entry age for this policy?

The minimum entry age is 18 years and maximum entry age is 65 years. If you opt for family floater policy the dependent child will be covered from day 1 to 25 years of age.

What is the policy term of Corona Kavach?

The policy term of Corona Kavach is three and half months, six and half months and nine and half months. This term is including waiting period.

What is minimum and maximum coverage offered under this plan?

The minimum sum assured under this policy is Rs.50000 and maximum sum assured is Rs.5 Lakh.

Also Read – Health Insurance Policies for Coronavirus (COVID-19) in India

Corona Kavach Coverage Benefits

This policy will have one base cover and one benefit based optional cover. It is single premium policy with short term coverage and no lifetime renewability. Basic and optional coverage details are given below.

Basic Cover

Basic cover includes hospitalization charges, home care treatment, pre-hospitalization and post-hospitalization medical expenses incurred on COVID-19 treatment.

#1 Hospitalization Charges

In case policy holder is diagnosed Corona positive by the government authorized diagnostic center and require to be admitted to hospital, the entire hospitalization expenses up to sum insured will be paid by the health insurance company. The hospitalization charges include –

Room rent, nursing expenses as provided by hospital or nursing home. It also covers fees paid to surgeon, medical practitioner, doctor, anesthetist and consultant. This policy also covers consultation via telemedicine.

Incase policy holder goes through treatment of COVID where oxygen, surgical appliance, ventilator other medical equipment is involved same is reimburse by this policy. The coverage also includes cost of drug, PPE kit, mask, gloves and other related expense.

The policy also covers ambulance charges up to Rs.2000. Expense on hospitalization for minimum period of 24 hours are admissible.

#2 Home Care Treatment

Home care treatment is also covered under this plan. If doctor advise you to take treatment at home, you will be eligible for this benefit. The cost of home treatment up to maximum 14 days is covered under this policy. The cost of diagnostic tests, medicines, nursing staff, cost of pulse oximeter, oxygen cylinder and nebulizer is covered under home care treatment.

#3 Pre-Hospitalization Expense

Pre-hospitalization expense incurred for the period of 15 days prior to date of hospitalization is covered under this plan. It also covers diagnostic cost towards COVID-19.

#4 Post-Hospitalization Expense

Post-hospitalization expense up to 30 days from the date of discharge from hospital or completion of home care treatment is covered under this policy.

Optional Cover

The policy holder can opt for optional hospital daily cash under this plan. The insurance company will pay 0.5% of sum insured per day for 24 hours of continues hospitalization. The benefit will be payable up to maximum 15 days during the policy period.

The premium for optional covers is payable extra. It needs to be paid separately along with policy premium.

Cashless option is available under this policy. Approval is required if treatment is taken at non-network hospital. This policy also covers ayush treatment.

What type of policy is available under Corona Kavach?

You can avail both individual and family floater under this plan. The family floater plan covers self, spouse, parents, dependent children between age 1 year to 25 years and parents in-laws. If child is above 18 years of age and financially independent, he/she shall not be covered under this plan.

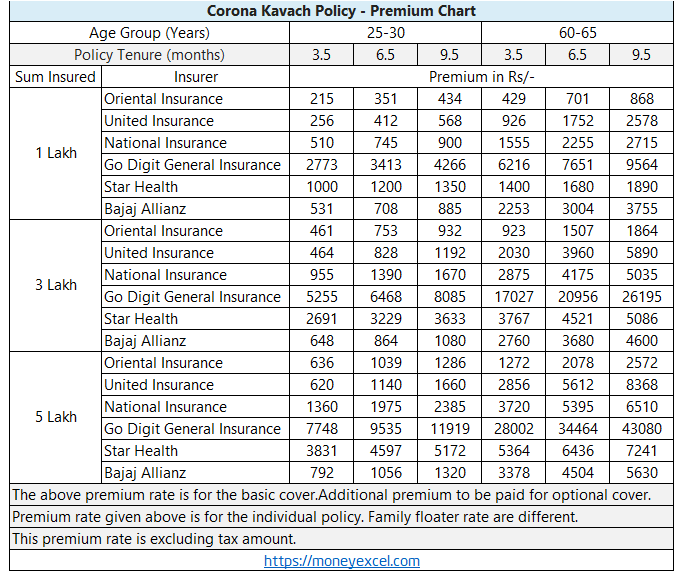

What is cost of Corona Kavach? – Premium Amount

The cost of this policy – premium amount to be paid for buying this policy varies from insurer to insurer. The premium comparison for two age groups for three different tenures is given below.

From above comparison it is very clear that although features are same, premium rate varies a lot. Oriental insurance and United Insurance offers policy at lower premium rate. On the other hand, Go Digit and Star Health insurance policy are very costly.

What is waiting period for this policy?

The minimum wait period for this policy is 15 days from the date of policy issue. The company will not pay any benefit till this waiting period is over.

What are the exclusion for this policy?

- This policy does not include any expenses incurred for the diagnostic and evaluation incase policy holder does not found corona positive.

- No expense related to dietary supplements, vitamin, mineral and other substance unless prescribed by the medical practitioner.

- Any expense incurred on OPD and day care treatment are not covered.

- Diagnosis and treatment done outside INDIA is not covered.

- Incase testing is done at diagnostic center which are not authorized by the government of India

Corona Rakshak – Key Features and Benefits

Corona Rakshak is benefit based policy. This means the insurer will pay entire sum insured irrespective of hospital bill. The name of insurer is added after name Corona Rakshak for the identification of policy.

What is minimum and maximum entry age for Corona Rakshak?

The minimum entry age for Corona Rakshak is 18 years and maximum age is 65 years. Dependent children up to 25 years of age is covered under this plan.

What is the policy term of Corona Rakshak?

The policy term of Corona Rakshak and Corona Kavach is same. This means Corona Rakshak is offered with policy term of three and half months, six and half months and nine and half months.

What is minimum and maximum coverage offered under Corona Rakshak?

The minimum sum assured under Corona Rakshak is Rs.50000. The maximum sum assured under this policy is Rs.2.5 Lakh.

Corona Rakshak Coverage Benefits

Corona Rakshak is benefit based policy. Once policy holder is diagnosis COVID positive and require hospitalization for 72 hours or above the entire sum assured amount is payable to the policyholder. The diagnosis should be done at the government authorized center

What type of policy is available under Corona Rakshak?

Under Corona Rakshak only individual policy is available. No family floater option available.

What is cost of Corona Rakshak? – Premium Amount

The premium amount for Corona Rakshak policy is given below.

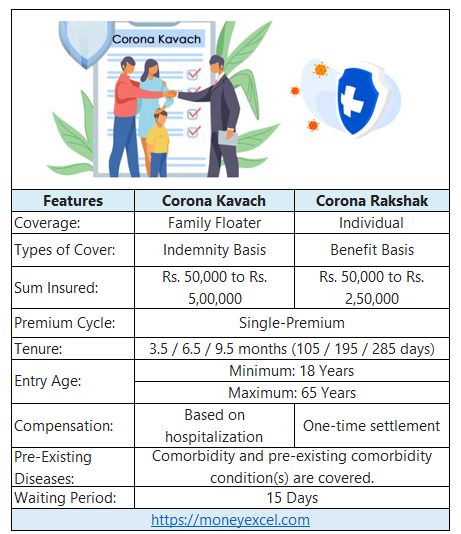

Difference Between Corona Kavach and Corona Rakshak

Which Health Insurance you should buy? – Corona Kavach or Corona Rakshak

After going through difference between Corona Kavach and Corona Rakshak, it is very clear that Corona Kavach is best. Looking at current situation it is advisable to buy this policy as an additional supplement to your health insurance policy. Few benefits of Corona Kavach compared to Corona Rakshak are given below.

- Corona Kavach is Family floater policy where coverage is available to entire family.

- Corona Kavach covers basic as well as optional cover. This policy cover entire hospitalization amount compared to lump sum benefit provided by Corona Rakshak.

- Corona Kavach is provided by almost every health insurance company. However, Rakshak is provided by limited insurance companies.

- Maximum sum assured of Corona Kavach is 5 Lakh. On the other hand, Corona Rakshak maximum sum assured is 2.5 Lakh.

- In the same premium you will get more benefits in the Corona Kavach policy.

If you have comprehensive health insurance policy, you may avoid buying these policy as COVID-19 is covered by all existing health insurance policies. It is made mandatory by IRDA.

In case you still decide to purchase corona kavach policy, you should do proper research with respect to premium as premium amount variation between various insurance company is very high.