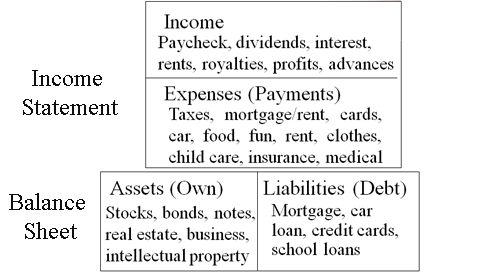

Types of Income – Income is money earned through employment, business, or investments. This income can be good income or bad income. For many of us, good income means a good salary or higher income and bad income means less salary or less income. So we divide income based on quantity and decide whether it is good or bad. What you may not know is the types of income and its division into good and bad income. So, let’s explore it.

3 Types of Income – Which One is Best?

There are three different types of income:

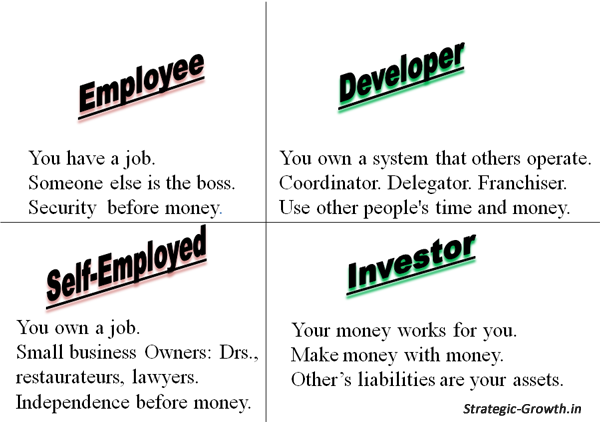

1) Earned income: Earned income is you working for money. It is the income that comes in the form of a paycheck (salary). It is also the type of income you ask for more of when you ask for a raise, bonus, overtime, commissions etc.

2) Portfolio income: Portfolio income is generally income from paper assets such as stocks, bonds, and mutual funds.

3) Passive income: Passive income is generally income from businesses or real estate. It can also be royalty income from patents (copyrights) or for use of your intellectual property such as songs, books, or other objects of intellectual value.

Out of these three types, passive incomes and portfolio incomes are good incomes while Earned income is average income.

Why Earned income is average income?

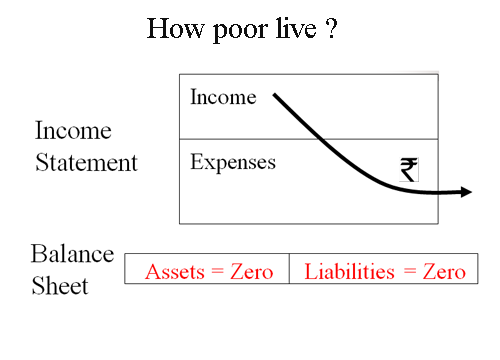

Earned income is worst due to the following reasons:-

1. It is the highest taxed income and it is the income with the fewest controls over how much you pay in taxes and when you pay your taxes.

2. You have to work for it and it takes up your valuable time.

3. There is very little leverage in earned income. The primary way most people increase their earned income is by working harder.

4. There is often no residual value for your work. In other words, you work, get paid, and then have to work again to be paid again.

5. You will always remain a slave.

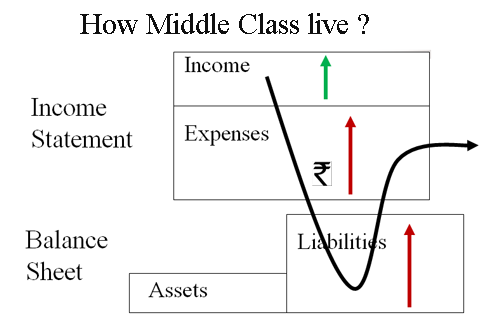

Most people today dream about high-paying jobs with lots of earned income. Teaching people to spend their lives working for earned income is like teaching someone to be a high-paid slave for a lifetime. Earned income is the income that you work the hardest for and you are allowed to keep the least of.

The trouble with working for earned income is that you have to keep working hard for it. Eventually, a person working for portfolio and passive income will pass the earning potential of earned income because you can work less, earn more, and pay less and less in taxes when you work for portfolio and passive income.

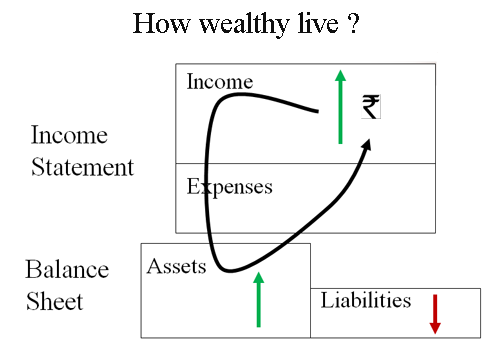

Why Passive income is good income?

- For Passive income, one has to work the least.

- Passive income is tax least.

- You can have better leverage over your income.

- You can serve more and more number of people and earn more and more (Sky is limit)

- You will be a master & can enjoy financial freedom.

A business owner has more control over taxes, the highest leverage potential, and the most legal tax advantages.

If you want to be rich you have to work for the right kind of income passive income (good income) but most of us join the rat race and work for Earned income (bad income).

70 % Money

This is what we call Earned income which you receive from a paycheck, “70 percent money.” The reason we called it 70 percent money is because no matter how much money you earned, the government always took at least 30 percent of it or more in one way or another by imposing income tax, professional tax, service tax, etc. As most people know, you are taxed when you earn, spend, save, and invest.

So, we wonder why people spend their lives in search of a higher-paying job or a pay raise. We can say, “When you get a raise, so does the government.” Spending your life working hard for 70 percent money was not the financially intelligent thing to do.

15 % Money

Many people today are working for 15 percent money, which is money from capital gains or appreciation of stocks and sometimes real estate.

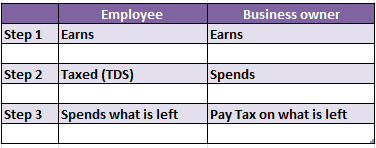

Tax law for employees:-

If you work for job security, you will earn less and less the more and more you work. That is too high a price to pay for a little bit of security. Today, the best way to earn more and work less is via owning your own business. It continues to be the best loophole in the world. One reason to start your own business is the difference in when you pay your taxes.

Employees and business owners both earn money but the income of the employee is taxed first (TDS) and then he spends what is left, while the business owner, gets a chance to spend earned money first before paying tax.

The tax laws are really bad for the employee.

Working for Good money can make you rich:-

You can work for good money by simply starting a small home-based business, buying a franchise, or joining a network marketing company, you are moving into more tax-advantaged income. You can be rich if you build, buy, or create assets that create positive cash flow.

Try exploring the potential of your free time and you can be rich.

Many of the very rich became rich in their spare time. So, if you have a job because you have financial responsibilities, keep your job but make better use of your spare time. When your friends go to play golf go fishing or watch sports on TV, you can start your part-time business.

Comparison of the Three Income Types

When determining which type of income is best for you, consider the following factors:

Risk Tolerance: How comfortable are you with the level of risk associated with each type of income?

Time Commitment: How much time are you willing to invest in generating and managing your income?

Financial Goals: What are your short-term and long-term financial goals, and which income type aligns best with them?

Skills and Expertise: What skills and expertise do you possess that can be leveraged to maximize your income potential?

Diversification: How important is diversification to your overall financial strategy?

Which income is the Best Income?

There’s no one-size-fits-all answer to this question. The best type of income for you depends on your individual circumstances, goals, and preferences. Some people may prefer the stability of earned income, while others may seek the potential for passive income or portfolio growth.

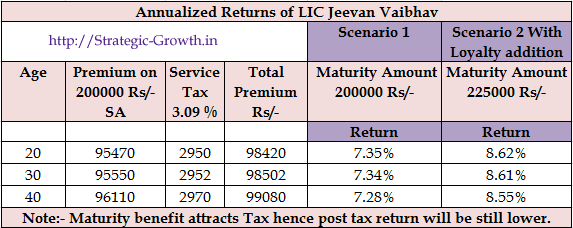

So, overall this policy also gives same type of return 6-7.5 % like most of endowment plan. If you think from return prospective it is not advisable to purchase this policy, Mutual funds or even FD for 10 year can give even more return compare to Jeevan Vaibhav plan.

So, overall this policy also gives same type of return 6-7.5 % like most of endowment plan. If you think from return prospective it is not advisable to purchase this policy, Mutual funds or even FD for 10 year can give even more return compare to Jeevan Vaibhav plan.