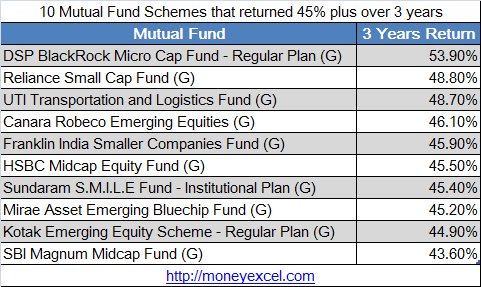

There are 10 mutual fund schemes that have given close to 50% annualized return in the last 3 years. If you could have invested any one of them you could have generated big corpus by now.

For Example – Three years back if you had started investing Rs 1,000 every month in DSP BlackRock Micro Cap Fund, you would have seen your investment (Rs 36,000) growing multi fold by now.DSP BlackRock Micro Cap Fund have given 53.9% annualized return over the past 3 years.

From above example, it can be clearly said that mutual fund is one of the best investment options for the wealth creation. However, it is very tough to identify a mutual fund that will help you in fulfilling your financial goals. You need to consider multiple factors while picking up a good mutual fund for the investment.

Steps to follow for the selection of Mutual Fund

Step 1 – Identify your investment objective, time horizon, and risk appetite.

Step 2 – Based on your risk appetite select the category of fund debt, equity or hybrid.

Step 3 – After identification of category identify right scheme based on following factors.

- Past performance of scheme

- Comparison with peer and benchmark

- Scheme Size

- Expense ratio

- Performance during poor market scenario

- Fund house reputation

- Mutual fund rank

Now let’s take a look at 10 Mutual Fund Schemes that returned 45% plus over 3 years is given below.

Top 10 Best Mutual Funds SIP to invest in India for long term

Mutual Fund Schemes that returned 45% plus over 3 years

DSP BlackRock Micro Cap Fund – Regular Plan (G)

AUM – Rs 2680 Cr

No of Stocks – 66

3 Year Return – 53.9%

Top Holding – SRF, KPR Mills, Navin Fluorine, Atul Ltd, Manappuram Finance

DSP BlackRock Micro Cap is open ended small cap equity fund that invests in the small companies with potential to become large in future.

Reliance Small Cap Fund (G)

AUM – Rs 2335 Cr

No of Stocks – 78

3 Year Return – 48.80%

Top Holding – Navin Fluorine,Intellect Design Arena, GIC Housing, Kalpataru Power

Reliance Small Cap scheme seeks to generate long-term capital appreciation by investing predominantly in equity and equity related instruments of small cap companies.

UTI Transportation and Logistics Fund (G)

AUM – Rs 772 Cr

No of Stocks – 40

3 Year Return – 48.70%

Top Holding – Tata Motors, Mahindra & Mahindra, Hero Motocorp, Bosch, Adani Ports

UTI Transportation and Logistics Fund is open ended fund invest in stock engaged in providing transportation services, design, manufacture, distribution or sale of transportation equipment and companies in the logistics sector.

Canara Robeco Emerging Equities (G)

AUM – Rs 1205 Cr

No of Stocks – 69

3 Year Return – 46.10%

Top Holding – Indusind Bank,Indian Oil Corp, Yes Bank, Devi’s Lab, The Ramco Cement

Canara Robeco Emerging Equities invest in diversified mid-cap stocks that have a potential to emerge as the bigger corporates with higher performance.

eKYC Aadhaar based authentication for mutual fund Investment

Franklin India Smaller Companies Fund (G)

AUM – Rs 3493 Cr

No of Stocks – 72

3 Year Return – 45.90%

Top Holding – Equitas Holding, Finolex cables, Yes Bank, eClerx Services

Franklin India Smaller Companies Fund aims to provide long-term capital appreciation by investing in small cap and mid cap companies.

What is your take on the mutual funds mention above?

Do share your queries and comments.

Subscribe to our blog and get latest updates in your inbox.