Income Tax Return – Before filing income tax return keep your form 16, bank account statement, TDS certificate, last year return copy, saving and investment proof handy. First thing you need to do is to register online on Income tax website.

Once you are registered you can file income tax return by using following steps.

7 Steps for filing Income Tax return online

Step 1: Open the Income Tax website. At the right-hand side, you will find download menu. Under this download menu, you will find a list of ITR form for AY 2015-16. Download ITR Excel form applicable to you. To know which form is applicable to you refer to following section.

ITR 1 SAHAJ – For Individuals having income from Salary, Interest + Income from one house

ITR 2 – For Individuals & HUFs not having Income from Business or Profession

ITR 2A – For Individuals & HUFs not having Income from Business or Profession and Capital Gains and who do not hold foreign assets

ITR 3 – For Individuals & HUF being partner in firms and not carrying out any business under any proprietorship

ITR 4 – For Individuals & HUF running business under proprietorship or profession

ITR 4S SUGAM – For Individuals/HUF having income from presumptive business

ITR 5 – For firms AOPs, BOIs and LLP

ITR 6 – For Companies

ITR 7 – For Companies/Trust/Political Party/college/institutions

If Form ITR 1 or ITR 4S is applicable to you can quickly file income tax return online without downloading from.

Step 2: Open Downloaded Excel based utility. The first thing you need to check is if macro is enabled or not. If macro is disabled kindly enable it. Fill up all applicable information. Green cells are for data entry and all fields with Red label are mandatory.

Step 3: Fill up information in form after verifying from Form 26AS. Once you are done with filling all information click on “Validate” tab.

Step 4: Find out total tax payable by clicking on “Calculate Tax” tab. If tax needs to be paid you can pay it online using NSDL site – https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

Step 5: Generate XML file and save it on your computer.

Step 6: Log on to Income Tax E-filing portal using your PAN number and password and go to e-file > Upload Return tab.

Step 7: Select AY 2015-16 and upload saved XML file using browse button. If you have digital signature certificate you digitally sign this return. On successful submission, acknowledgement will be displayed.

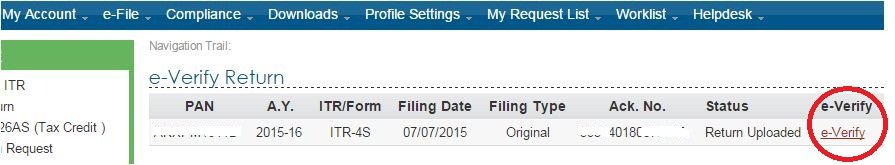

This year onwards you have an option to e-verify income tax return using Electronic Verification code (EVC) rather than sending acknowledgement by POST to CPC Bangalore.

EVC is 10 digit alphanumeric code. You can generate EVC code using any of following methods namely –

- Aadhar Card PAN card linking

- Through Net Banking

- To Register Email id and Mobile Number (Income should be below 5 Lakh)

- Bank ATM card

Once you submit EVC, the entire process of verification of your ITR is complete, There is no need to send a physical copy of ITR V.