LIC Lapsed Policy – Life insurance is extremely important, it protects you and your family from any unfortunate events. The life insurance policy provides financial assistance to your loved ones. You should purchase an appropriate life insurance policy. In addition to purchasing life insurance, it is recommended to pay a regular premium for the renewal of a policy.

What is a lapsed insurance policy?

You need to pay a premium of policy on time. If policy premium is not paid even after a grace period, the policy benefits will be seized and this type of policy is termed as a Lapsed policy. Laps policy is as good as no policy. The insurance company does not provide any risk coverage or monetary benefits against these types of policies.

If you want to continue the benefits of said policy, you need to go for the revival of laps policy. Revival means to rescue or to bring back in life.

The process of revival is easy but time-consuming. If you are holding LIC policy and your policy is lapsed here is complete information about How to Revive your Lapsed LIC policy online?

LIC Lapsed Policy – schemes for the revival

There are multiple schemes & options to do a revival of LIC Policy.

#1 Simple/ Ordinary Revival

Ordinary revival is also known as a simple revival. This type of revival is applicable if revival is initiated within six months of policy lapsation. It is the easiest form of revival. You just need to pay your unpaid premium along with the interest amount. Visit the LIC office with your laps policy and ask for revival. You will be given a quotation mentioning unpaid premium amount and interest. You need to pay the premium and interest amount. LIC may ask for a declaration of good health in case the policy amount is higher.

#2 Special revival scheme

A special revival scheme is launched by LIC from time to time. Under this scheme, LIC offers discounts/concessions in the late fees. The concession amount varies from 10% to 30%. Here commencement date of payment is shifted and the premium is revised as per policy holder’s age. The policyholder needs to provide Form No 680 or Declaration of Good Health and medical report for the revival.

#3 Loan cum revival scheme

The next method to do a revival of laps policy is loan cum revival. Under this scheme, a policyholder can make use of loans offered on policy for the revival of the policy. This type of scheme is available only once policy acquires a surrender value. In case the loan amount is not sufficient for the premium payment extra payment is required by the policyholder. In case loan amount is higher than the revival amount extra amount will be paid to the policyholder.

#4 Installment revival scheme

Installment based revival is a special type of revival scheme. If policyholder is not capable of paying revival amount in the single go, he/she can adopt an installment based revival scheme. Here policyholder needs to pay due premium amount in the installment. Installment based revival scheme is costly in nature.

#5 Revival on Medical Basis

Medical base revival is applicable when the policy cannot be renewed under a simple revival scheme. Here policyholder needs to submit medical records and other details as asked by LIC. The condition of a medical basis varies based on policy type and policy years.

Also Read – LIC Claim Online & Offline – Complete Guide

Things to consider before Revival of a lapsed policy

You need to consider the following things before the revival of a lapsed policy.

Duration – The revival of policy is allowed only if the policy has not exceeded a specific duration of time. This period is determined by LIC and dependent on the type of policy.

Medical Report – LIC may ask for medical reports in case revival is done on a medical basis. This is asked based on the age of the policyholder and insurance amount. If you have a medical history or other treatment conditions LIC may refuse to revive the policy.

Interest amount – The policyholder is required to pay interest amount. The interest amount is calculated from the date the premium amount is due. The percentage of interest is decided by LIC.

Additional penalty – The additional penalty is charged to the policyholder at the time of revival. This is based on the sum assured and time period after the policy lapses.

Concession – The LIC offers concession on premium amount time to time. It is offered under special revival schemes. The percentage is in the range of 10-30%. You need to consider concession before revival of lapsed policy.

How you can prevent the policy from getting lapsed?

- Pay your premium regularly on the due dates and within the grace period. You can set a reminder of the policy premium or go for the auto-debit or NCH option.

- Don’t wait for premium notice or due dates and grace period. Make a payment of your policy premium.

- Make use of the online facility of doing the premium payment. You can pay from the LIC website as well as LIC mobile app.

- In case of a change in address, you can intimate the insurance company immediately. You can get the option of change in address online under profile option at LIC site.

How to revive LIC Insurance Policy – Online Offline?

You can revive the LIC insurance policy anytime under the stipulated time. Follow the steps given below for the revival of laps policy.

Offline Method

The offline revival method is very easy. You need to visit the LIC office personally with detail of Laps policy. You need to ask for a policy revival quotation.

Once you get a policy revival quotation you need to make payment for the due amount along with interest for the revival of the policy.

Online Method

LIC also provides the facility of getting revival quotations online. You need to register on the LIC online service portal to use this method. The steps are given below.

- Visit LIC Online portal and click on customer portal. You will be taken to the new page where you need to click on the New User.

- On the new form provide details such as policy number, premium, birth date, mobile number, e-mail id and gender.

- Click on the submit button. You will be asked to select user id and password for your choice.

- Now you can login via newly created user id and password and use basic services. You need to enroll for all your policies by clicking on “Add Policy”.

- Once you have enrolled you need to login using username and password.

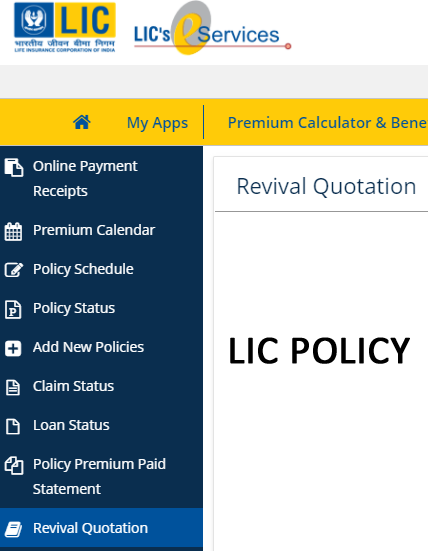

- Click on My Apps and go to Basic services.

- On the left side you will get option to get “Revival Quotation”.

On clicking Revival Quotation you will get quotation of policies which are laps. In case no policy is laps you will get message “No Policies are available for Revival”.

You will get a revival quotation only for the enrolled policies.

- Once you get quotation you need to make payment. You can make use of online payment services provided on the customer portal.

Your policy will be revived once payment is done.

How to get information about laps LIC Policies?

To know about laps policy, you need to know premium due. To know the premium due for particular policy, send the SMS ASKLIC <POLICY NO> PREM to 56767877 or ASKLIC <POLICY NO> PREMIUM to 9222492224.

To know the revival amount of particular policy, send the SMS ASKLIC <POLICY NO> REV to 56767877 or ASKLIC <POLICY NO> Revival to 9222492224.