ULIP – Unit Linked Insurance Plan is a combination of investment cum insurance. Recently I got a marketing call for selling a unique product that provides life cover, investment, and tax benefit. The guy started with a sales pitch that product is like a fixed deposit and it comes with additional insurance benefit. It even gives you tax saving and you need to invest with a lock-in period of 5 years. It was a clear case of mis-selling ULIP. This incident inspired me to write about ULIP as a product.

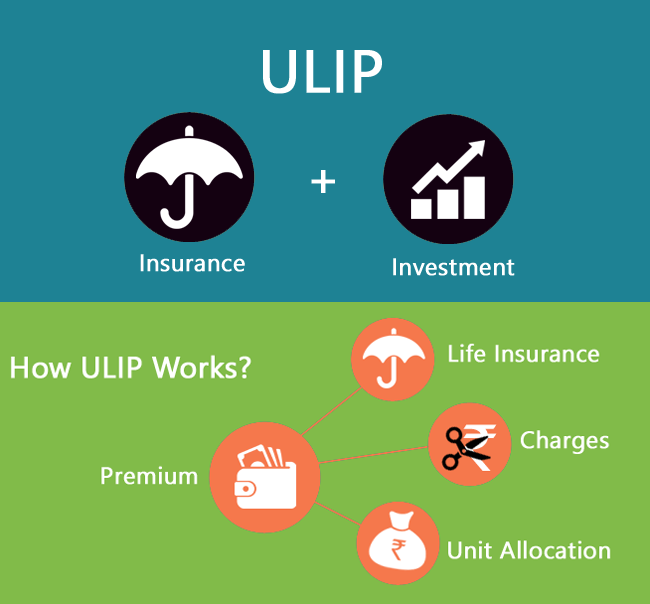

How ULIP works?

ULIP is an insurance cum investment product. You need to pay a premium to purchase unit linked insurance plan. The premium amount of ULIP is divided into two parts. Part of the premium is kept exclusively for buying life or health insurance while the remaining amount is used for making investments. The investment is made in equity or debt or both. The total invested corpus is divided into units and allocated to you as per the invested amount. The net asset value (NAV) of the allocated unit is decided and declared from time to time.

ULIP is managed by a fund manager. Fund managers invest the fund and responsible for tracking and making changes. (If required). You can switch your ULIP portfolio based on risk appetite.

Types of ULIPs

The Unit Linked Insurance Plans are classified based on three broad parameters.

- Investment Portfolio

- Financial Goal

- Death Benefits

(1) Investment Portfolio

Equity Funds – In equity funds, the premium amount is invested in equity funds. This type of fund is risky in nature.

Balance Funds – The fund that invests a premium amount in equity as well as debt to minimize risk is known as balance or hybrid funds.

Debt Funds – In debt funds, the premium amount is invested in debt instruments to reduce the risk. The return offered by this fund is less.

(2) Financial Goal

Retirement planning – The primary aim of this fund is to generate a corpus for retirement. This type of unit linked insurance plan is generally identified with suffix retirement.

Child Education – This type of unit linked insurance plan fund is made for child education. The product here is identified with the suffix of child education.

Wealth Generation – If your financial goal is to generate wealth you can use wealth generation type funds for investment.

(3) Death Benefits

Type I ULIP – This type of unit linked insurance plan pays higher of the assured sum value or fund value to the nominee in case of death of the policyholder.

Type II ULIP – This type of unit linked insurance plan pays the assured sum value plus the fund value to the nominee in case of the death of the policyholder.

Type of Fees and Charges

When you invest in ULIP you need to pay multiple fees and charges. This makes this product costly. The charges associated with this product are given below.

1 Premium Allocation Charges

The allocation charges deducted from premium in the initial years of the policy. It is charged at a higher rate. It includes initial and renewal expenses. It is kind of loading on the premium paid.

2 Mortality Charges

Mortality charges is charges to provide insurance coverage. This charge depends upon multiple factors such as age, sum assured etc. This charges are deducted on a monthly basis.

3 Fund Management Charges

The fee imposed by the insurance company for the management of various fund in the ULIP is known as fund management charges. It is like expense ratio charges of the mutual funds.

4 Partial Withdrawal Charges

ULIP comes with a lock-in period of 5 years. However, few ULIP offers the option of the partial withdrawal. You need to pay extra money for the partial withdrawal of money from ULIP.

5 Policy Administration Charges

The policy administration is also charged separately in the ULIP. It is levied at a fixed rate or as a percentage of your premium.

ULIP vs Mutual Funds

The primary difference between Mutual Fund and ULIP is of return. Mutual Funds generally provide higher returns. Apart from returns, mutual funds can be withdrawn at any time. However, ULIP comes with lock-in period of 5 years. The comparison table of ULIP vs Mutual Funds are given below.

| ULIP | Mutual Funds | |

| Type | Investment cum Insurance option | Pure Investment option |

| Withdrawal | Lock-in period of 5 years | Can be withdrawn anytime |

| Return | At long run returns are low | Returns are higher at long run |

| Switching | Switching between ULIP is permitted without any taxation. | Switching is permitted. However, it is considered as capital gain and tax is applicable. |

| Charges | Morality Charges, Premium Allocation charges, fund management and administrative charges | Exit load as applicable |

Things to consider before investing money in Unit Linked Insurance Plan

Looking at the product investors get excited as they see life insurance coverage and investment in a single product. However, you should note the following points before investing money in the ULIP.

- The fee structure of Unit Linked Insurance Plan is complicated. You need to pay multiple charges in order to purchase this product. The fee charges impacts returns of the unit linked insurance plan.

- Unit Linked Insurance Plan has lock-in period of 5 years. This means your money will be locked for 5 years after investment. If you are looking for liquidity you need to think twice.

- The ULIP investment funds are generally not diversified this means risk associated with this unit linked insurance plan is high.

- Compare all features and fees associated with unit linked insurance plan before investing your money.

- As you can’t exit from underperforming ULIP, the performance becomes important factor when you are investing in the ULIP product. You should compare past performance before making investment decision.

Over to you –

I hope now you have got a complete understanding of ULIP as a product. If you ask my views, I would recommend keeping investment and insurance separately. You should purchase good mutual funds and term plans instead of investing in Unit linked investment plan. The combination of mutual funds and term plan will give higher returns compared to a unit linked insurance plan.

Another reason of not recommending ULIP is higher fees and charges which will reduce the performance of the product. If you still decide to invest in unit linked insurance plan you should go for low-cost ULIP.