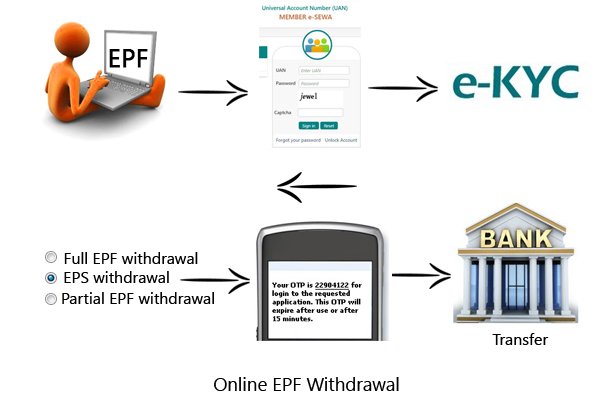

New Online EPF withdrawal facility is introduced by EPFO recently. This facility will surely help EPF subscribers for the faster claim settlement. A hassle of submitting forms for EPF claim settlement offline will be history now. As of now the process of claim settlement is offline, which requires submission of composite claim form. It generally takes 30 days or above for EPF claim settlement. This time will be reduced up to great extent by the introduction of this facility.

In the new facility, the entire process of EPF withdrawal claim submission is online, no intervention of employer or EPFO field officer is required. The claim of submitted application will be settled in your bank account directly.

You are not required to give any supporting document while preferring online PF Part Withdrawal case. Your online application will be taken as your self-declaration for the advance claim.

Let us take a look at the claim submission process and prerequisites for submission of Online EPF withdrawal.

Also Read – EPF withdrawal for medical treatment with self-declaration

Online EPF withdrawal Claim

Who can do Online EPF withdrawal?

- You should have activated Universal Account Number.

- Your mobile number used for UAN activation should be in working condition.

- Your Aadhaar details should be updated in EPFO database.

- Your bank account along with IFSC code should be seeded in EPFO database.

- The KYC detail of your UAN account should be current and completed.

- Your Permanent Account Number (PAN) should also be seeded in EPFO database for PF Final settlement claims in case your service is less than 5 years.

What type of EPF claims can be withdrawn online?

Three types of EPF claims can be withdrawn online. The details are given below.

- EPF Full and Final Settlement

- Employee Pension Scheme Withdrawal

- EPF Partial Withdrawal of EPF advance

Also Read – Composite Claim Form – EPF withdrawal Death Cases

How to apply for Online EPF withdrawal?

The steps involved in order to apply for online EPF withdrawal claim is given below.

- Login to unified portal member interface using UAN credentials.

- Check for your KYC status. You can see and modify your KYC detail by going to Manage >> KYC link.

- Click on Online services >> Claim (FORM-31,19 & 10C)

- The screen will display subscriber detail. In order to proceed further you need to verify your bank account by entering last four digit and clicking on verify button.

- On verification you will be able to see button “Proceed For Online Claim”. Click on that button.

- In the next screen you need to select the relevant claim from drop down option – I want to apply for

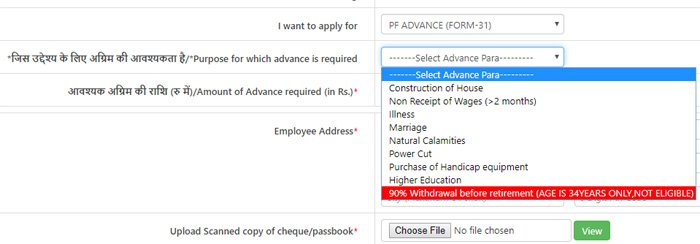

- You will be able to see Form 31 for PF Advance.

- You need to select the purpose for which advance/withdrawal is required.

- Enter the amount and your address. You need to upload scan copy of cheque or passbook. The image should be readable and should in JPEG/JPG format.

- You need to select consent by clicking on Aadhaar credential usage.

- Click on Get Aadhaar OTP.

- On submission of the request, OTP will be generated on your UIDAI register mobile.

- Authenticate the claim submission using OTP.

- On successful authentication, your claim will be submitted.

- You can check claim status by Clicking on TRACK CLAIM STATUS.

Also Read – New Single Composite Claim Form – EPF Withdrawal Simplified

The option for the online withdrawal is given based on your age and condition of your account.

If your age is near retirement age you will be able to withdraw 90% of EPF amount before retirement. If you have reached retirement age you will be able to withdraw full EPF amount. TDS is not applicable if EPF withdrawal is done on retirement. If you are not in employment for 2 months or above you can discontinue EPF account and apply for full EPF withdrawal. TDS is applicable on EPF withdrawal under this case.

By default you will be able to see PF Advance Form 31 only. The purpose for which PF advance given are –

- Construction of House

- Non receipt of wages above two months.

- Medical problem – illness

- Marraige

- Natural Calamaties

- Power Cut

- Purchase of Handicap Equipment

- Higher Education.

This new & simplified process of online EPF withdrawal will help EPF subscriber up to great extent.

This Aadhaar Based Online Claim Submission facility is available now. You can login to portal and submit your claim.