How to calculate capital gain for computing taxes? I have seen many people committing mistake while calculating capital gain tax. Many people believe that calculation of capital gain tax is complex. So, let’s try to simplify this calculation by understanding Capital Gain and Capital Gain Tax.

What is Capital Gain?

My friend recently sold property purchased by his father. This property was purchased at the cost of 25 lac in 2010. He sold this property in 50 lac recently. What will be profit 25 Lac simple right? If you are thinking it is 10 Lac you are wrong! Continue reading you are going to learn lot of things today.

Ideally capital gain is gain arising from sale or transfer of capital assets like property, shares, mutual funds, bonds etc. However when it comes to capital gains in taxes above definition of capital gain is not true.

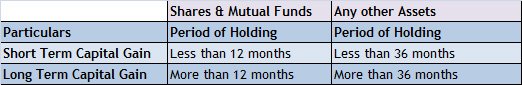

Capital gains is divided into two types (1) Short-term Capital Gain and (2) Long-term Capital Gain. This classification is based on holding period of assets.

Also Read – How to know your Gratuity Benefits – Calculator Download

How to Calculate Capital Gain Tax for Property?

Short Term Capital Gain Tax on Property

You can get calculate Gross Short Term Capital Gain by subtracting cost of purchase, expense on transfer/sell and cost of improvement from sale price.

Gross Short Term Capital Gain =

“Fair Market Value or Sale Price – Expense on Transfer – Cost of Purchase – Cost of Improvement”

- Sale Price is price on which you have sold your property.

- Expense on Transfer includes any cost incurred for selling this property i.e stamp duty, advertisement, legal expense etc.

- A Cost of Purchase is amount paid by owner at the time of acquiring property.

- A Cost of Improvement includes any cost incurred on improving or altering property since its acquisition.

You can get calculate Net Short-Term Capital Gain by subtracting Gross Short Term Capital Gain from Exemption.

Also Read – Cost of Child Education – Planning and Calculator

Net Short-Term Capital Gain =

“Gross Short Term Capital Gain – Exemption (If any) (54B/54D/54G/54GA)”

- 54B – Transfer should be of agricultural land. One should purchase New Agriculture land in 2 years from capital gain.

- 54D – Property acquired for Industrial purpose. One should purchase new Industrial property within 3 years from capital gain.

- 54G – Transfer should be of Machinery building or plant. Transfer should be due to shifting to any area other than an urban area.

- 54GA – Transfer should be of Machinery building or plant. Transfer should be due to shifting to any Special Economic Zone.

Once you obtain this value calculate tax on this value as per normal income tax slabs, that amount will be your short term capital gain tax on property.

Long Term Capital Gain Tax on Property

Long Term Capital Gain Tax rate is 20%.

You can get calculate Gross Long Term Capital Gain by subtracting index cost of purchase, expense on transfer/sell and index cost of improvement from sale price.

Gross Long Term Capital Gain =

“Fair Market Value or Sale Price – Expense on Transfer – Index Cost of Purchase – Index Cost of Improvement”

- Index cost of purchase is process by which the cost of purchase or acquisition is adjusted against inflationary rise in the value of asset. For this purpose Central Government notify cost inflation index (CII) every year.

Index cost of Purchase = Actual cost * CII for Year of Sale/ CII for Year of Purchase

Index cost of Improvement = Cost of Improvement * CII for Year of Sale/CII for Year of Improvement

Download Capital Gain Calculator

How to Calculate Capital Gain Tax for Shares & Mutual Funds?

Short Term Capital Gain Tax on Shares & Mutual Funds

Short Term Capital Gain Tax applicable on Transfer of shares and mutual funds is flat 15%, provided transaction is taking place at the recognize exchange and Security Transaction Tax (STT) is paid.

Short Term Capital Gain = Sale Price – Expense on Transfer – Cost of Purchase – Cost of Improvement

- Sale price is price at which you have sold the shares or mutual funds.

- Expense on Transfer in this case is brokerage charged by AMC or brokerage house.

- Cost of purchase is purchase price of shares or mutual funds.

Also Read – All you want to know about your Salary Slip

Long Term Capital Gain Tax on Shares and Mutual Funds

Long term capital gain tax on shares and mutual funds is reintroduced in 2018.

- As per new rule any person who sells shares after April 1, 2018, will pay a long-term capital gains tax at the rate of 10 percent on gains of more than Rs 1 lakh. For such shares, the cost of acquisition will be price as on Jan. 31, 2018.

- If a person who has held shares for more than one year sells them before March 31, 2018, there will be no long-term capital gains tax.

- No changes are made in short-term capital gain tax. Short-term capital gain would be taxed @15%.

Let’s try to figure out how this change will impact you.

Case 1 –

If you sell your equity or mutual fund investment before April,1,2018 you need not pay any LTCG as a new rule of LTCG will be applicable after April,1,2018.

Case 2 –

Suppose you sell shares after March,31,2018 you need to pay LTCG. LTCG is applicable beyond 1 Lakh. This means no tax is payable on profit amount up to 1 lakh per annum. Any amount beyond 1 Lakh will be taxed @10%. Suppose your long-term capital gain from equity and the stock market is 1.5 Lakh in a year. You need to pay tax on Rs.50000.