Gratuity is a monetary reward paid by an employer at the end of employment. This benefit is applicable if you stay in employment for 5 years or more. It is a mandatory benefit as per the Payment Gratuity Act India 1972. This act applies to all establishments, where 10 or more employees are working in the preceding 12 months. If you are changing your job and want to calculate gratuity benefits here is a simple gratuity calculator, eligibility, and tax benefits.

Eligibility

- An individual is eligible for gratuity benefits if he/she has completed 5 years of continuous service in the organization.

- This benefit is not applicable if employment is terminated due to disability or due to death. In case of death, this benefit is payable to the nominee or legal heir.

- The maximum amount payable shall not exceed 10 Lakh.

- The time limit is 30 days of gratuity becoming payable.

Employer needs to pay gratuity amount –

- On Resignation

- On Retirement, Voluntary retirement, Superannuation

- On Termination or Layoff

- On Death

- On Disablement

The application can be made by –

- An individual eligible employee

- Nominee of the employee (In case of death)

- Legal Heir of the employee (If nomination is not made)

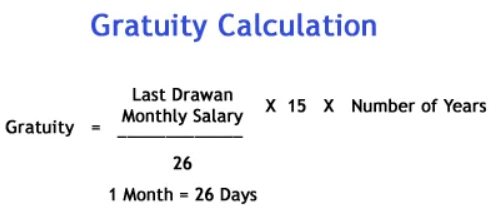

Gratuity Calculation –

The gratuity calculation of employees working with a company covered by the gratuity act is given below.

G = Y x S x 15/26

S = Last Drawn Monthly Salary (Basic + DA)

Y = Number of Years Completed in Service

15 = 15 days salary

26 = Number of working days in the month

Let’s say your last drawn monthly salary is 30,000 Rs and you have worked for the organization for 10 years. The amount payable would be

Gratuity Amount = 30,000 x 15 x 10 / 26 = 1.73 Lac

Download Gratuity Calculator

Note – The number of Years would be rounded off to the nearest year. The last 6 months or less are to be ignored, however, if it is more than 6 months it is to be counted as a full year.

You can download this Calculator from the following link.

Taxation

The gratuity amount is taxable if received when you change your job (on resignation) or on termination. This amount falls under the head of “salaries”.

If this amount is paid at retirement, death, or superannuation it is tax exempted.

Conclusion –

The gratuity calculator given above will help you in calculating the right gratuity amount. If you are planning to change your job just before 5 years, do consider your decision after calculating gratuity amount. You may lose this excellent benefit you are entitled to after completion of 5 years.