The Indian Initial Public Offering (IPO) market has seen wonderful growth in recent years.

Companies across different sectors, whether start-ups or traditional industries, have stepped ahead in the equity market to raise capital. Not just domestic companies, the IPO market in India has even attracted international firms to grab opportunities to increase their wealth.

Even the growing economy of India, which is the most talked about across the globe at present, has drastically impacted the market with the addition of improved financial literacy among the people.

In this article, we will read about the Top Upcoming IPOs in India, How to evaluate IPOs, How to Increase your chances of allotment in IPOs, One Place to Get all the IPO data and tax implications on IPO investing.

Rise in IPO Listings & Fundraising

With a 66% leap in IPO listings, India has witnessed a notable growth in the financial year 2024, jumping from 164 in FY23 to 272 in FY24. This astonishing increase shows the big queue of companies eager to go public.

The capital raised is increased by 24%, from ₹54,773 Cr. in FY23 to ₹67,995 Cr. in FY24, through these public offerings.

Many IPOs, such as Tata Technologies, Vibhor Steel Tubes, BLS E-Services, and Ideaforge Technologies, doubled investors’ money on the listing day.

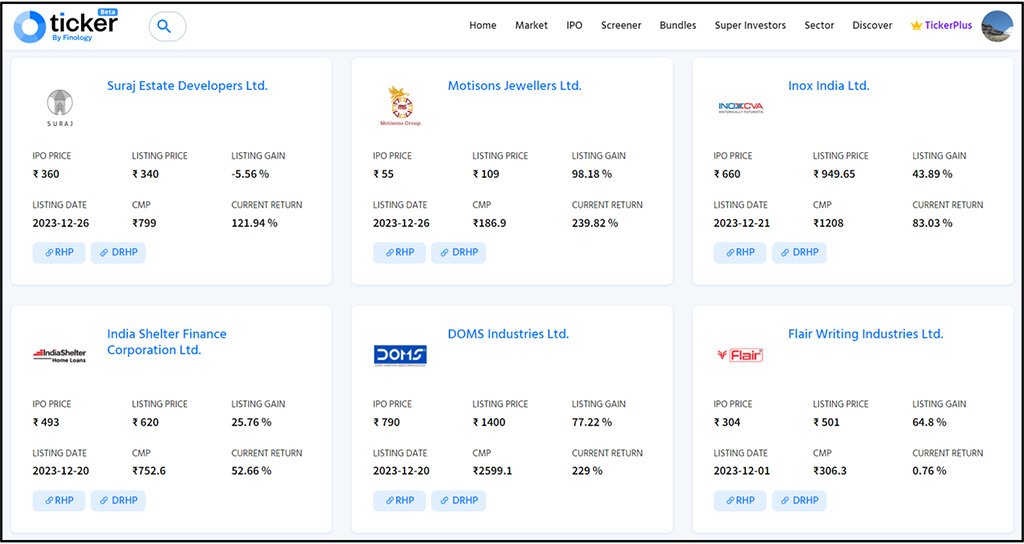

The companies which gave decent listings or negative listing day returns have also risen to double investor’s money in a short span of time.

Don’t believe it – check Listing Gains and Current Performance of IPOs for free on Finology Ticker.

The IPO market has been growing due to many factors. One such notable factor is the increasing active participation of investors in the stock market. Furthermore, the investors’ confidence, favourable market conditions, and India’s rising economy are also playing an important role.

By creating a vibrant market with a strong demand for new listings, the hike in retail participation has made IPOs more accessible.

Upcoming IPOs 2024 – The Future of India’s IPO Market

Notable names such as Bajaj Housing, VLCC Health Care Ltd., Waaree Energies Ltd., and One MobiKwik Systems are some big names planning their IPOs soon.

Here’s a list of the companies that will soon be entering the stock market.

- Hyundai – With an Initial Public Offer of around ₹25,000 Cr., it will be one of the largest in the Indian market, marking a significant milestone for the auto giant.

- OYO – For its much-anticipated IPO, this renowned hospitality tech company is targeting around raising ₹8,430 Cr.

- Swiggy – One of India’s leading food delivery companies, Swiggy, is seeking further expansion with a fundraising target of around ₹8,000 Cr. from the stock market.

- Waaree Energies Ltd. – This renowned renewable energy company is eyeing an IPO worth around ₹3,000 Cr. to grow its capital.

- Boat – This consumer electronics and audio products company will enter the market with a targeted IPO of approx ₹2,000 Cr.

- Penna Cement – This established cement producer is looking to go public with an IPO of around ₹1,550 Cr.

- MobiKwik – This digital payments company will soon join the wave of fintech companies going public with its estimated IPO of ₹700 Cr.

This data clearly shows that companies from diverse sectors, from technology to renewable energy, are seeking entry into the Indian equity market to attract more capital and flourish their emerging businesses even more.

Further, A to Z details about all these upcoming IPOs in India & upcoming ipo this week is available in Finology Ticker.

Evaluating IPOs

Evaluating an IPO, whether it is good or not, is a vital step in itself. Some concerns and risks from an investor’s point of view are common in IPO investments:

- Risk of overvaluation

- Lack of track record

- Allotment uncertainty

- Volatility

- Short-term fluctuations

- Insufficient information

Believe it or not, these above are like the fear of missing out (FOMO), often leading to mistaken investment decisions. So, the ultimate concern is whether buying an IPO is a smart move and whether you’ll avoid losing your money on the listing day.

Here are some evaluation factors to consider before an IPO investment:

- Sector and Company Analysis: The IPO prospectus, Draft Red Herring Prospectus (DRHP), provides the needed insights into the sector and the company’s operations. You can get valuable context about the company’s positioning by understanding the macroeconomic factors, industry trends, competitiveness, current state, growth potential, and supply chains.

- Type of Offer: Try preferring to invest in IPOs with a mix of Offer for Sale and Fresh Issue or a new Fresh Issue, as this indicates that the funds raised will directly benefit the company.

- Objectives of the Issue: The prospectus provides insights about funds allocation, including debt repayment, working capital needs, or expansion plans. As an investor, it will help you understand where your money will be utilised.

- Examine Potential Risks: Irrespective of company-specific or macroeconomic factors, carefully evaluate the risks highlighted in the prospectus. Understanding these challenges is essential for making your investment decision.

5. Evaluate Financials: Strong financials means a stable company. Analyse the company’s financials for key metrics such as sales growth, operating profits, after-tax profits, margins, profitability ratios (ROCE/ROE), debt-to-equity ratio, and cash flow.

6. Grey Market Premium (GMP): GMP indicates the potential listing price of a company’s stock. However, it should not be the sole basis for investment, as market shifts can happen at any time.

Investing in an IPO can be beneficial or risky. Understanding the IPO process, IPO types, pricing factors, and investment strategies is critical. Always thoroughly research and consider every point required for a successful IPO investment.

Not to forget, prioritising reading a company’s prospectus can greatly help you decide whether to invest in an IPO.

In Finology Ticker, you get detailed IPO analysis with all the financial data, RHP/DRHP analysis, valuation analysis, subscription data, Grey Market Premium Data and much more for free.

The cherry on the cake will be if you closely analyse the performances of recent IPOs.

Importance of Recent IPOs’ Performance Analysis

The IPO market frequently experiences overall market changes. Reviewing the performance of recent IPOs can help you forecast your investment’s future.

Well-performed IPOs indicate investors’ optimism and their willingness to take risks, and vice versa, weaker IPO performance may signal caution or scepticism.

Analysing IPOs within specific sectors can also reveal industry trends. For example, the recent hike in Pharmaceutical IPOs, such as Akums Drugs and Pharmaceuticals Limited and Emcure Pharmaceuticals Limited, shows the growing confidence of investors in the healthcare sector.

Also, with companies like Allied Blenders and Distillers, Vraj Iron and Steel, and Stanley Lifestyles, upcoming IPOs are creating buzz and attracting investors’ interest. Public sentiment can influence subscription rates and listing day performance, irrespective of being positive or negative.

For example, the Russia-Ukraine conflict pressured the Indian stock market, resulting in foreign investors continuously selling off shares because of rising global inflation and tightening central bank policy. Nifty and Sensex saw declines during this period. Even a few IPOs, such as LIC, were affected.

Tips for enhancing the chances of IPO allotment

If you got an IPO, congrats, you got a lottery!

If you didn’t get one, don’t be sad. Read the tips below that can significantly enhance your chances of getting an IPO allotment:

- Apply from multiple accounts: You can apply on behalf of your spouse, your parents, your siblings, or any other family members to increase the allotment chances. .

- Bid at Cut-Off Price: Select the cut-off price when bidding for an IPO. It ensures your application will be considered at the final price during the book-building process.

- Apply for Multiple Lots: The more the lots, the better the chances. If affordable, apply for multiple lots to boost your chances of allocation.

- Apply via HNI Quota: When the issue is highly oversubscribed, High Net Worth Individuals (HNIs) have a higher chance of getting shares allotted than retail investors. This is because HNIs typically invest large amounts of money, making them more desirable candidates for allocation

- Timing of Application: Allotment occurs in two stages, with minimum lot allocation and a lottery system for the remaining shares. However, applying on the second or third day of the IPO can give you a better idea of oversubscription levels.

Tax Implications on IPO Investing

Hoping to get high returns on your IPO investment is great, but remember there will be specific tax implications.

High returns often result in higher income or capital gains, subject to taxation. It depends on:

- Your income bracket

- The time for which you’ve held the shares

- And current tax regulations.

According to the Income Tax Act, the taxation of shares obtained through an IPO depends on the holding period.

- If you sell IPO shares within 12 months of allotment, any gain or loss will come under Short-Term Capital Gains (STCG). It will be taxed at 20% plus education and higher cess.

- If you sell after 12 months, it is considered Long-Term Capital Gains (LTCG). Gains up to ₹1.25 lakh per annum are exempt from tax (inclusive of equity-oriented mutual funds). Gains exceeding ₹1.25 lakh are taxed at 12.5% without indexation.

An Investor Never Loses Hope

Always be an encouraging investor, and don’t get false inspirations from the vast profits achieved within a few days or even hours of investment, as shown on the internet.

Huge profits can definitely be earned from the stock market, but ”all returns on investments are subjected to market risk as well as on investor’s patience level.”

So, we have come to the end of this detailed info-guide about the upcoming IPOs. However, there can never be an end to information.

In a quick flashback, we got a short overview of the IPO market in India, understood the significance of the increase in IPO listings, and got a list of all the upcoming IPOs of renowned companies. We even got insightful tips on how to boost our chances of getting an IPO allocation. We covered the tax implications when you, as an investor, step ahead to get an IPO allocation.

In addition, we have also checked the factors helpful in evaluating an IPO and thoroughly understood the importance of a prospectus in analysing the company’s IPO.

The future of the Indian stock market looks promising, driven by many upcoming IPOs. The confidence of investors in the growing market is reflected with more companies going public. Investors are seeking diverse opportunities to expand their stock portfolios. And with increased debuts of new investors coming into the market, the Indian IPO market could further attract investors from all across the globe.