Indian equities had outperformed major global indices in 2014. Outlook for 2015 is quite positive. Economic growth is expected to be 6.5%-7.0% during 2015 driven by good governance under the leadership of Mr. Modi.

Karvy expect Sensex to trade in the band of 27720 – 35640 during 2015. Prime sector which will be focus are Automobile, BFSI, Cement, Consumer Goods, Infrastructure, Metals, Software and Pharma.

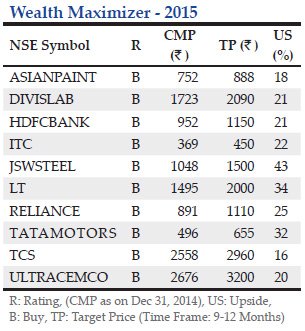

Top 10 Largecap Stock Picks by Karvy -2015

The 10 large cap companies mentioned here reflect superior businesses with consistent future cash flows, run competently and have potential for exponential stock price growth.

Asian Paints

Investment Argument – Market leadership with pricing power

Key Growth Driver – Double digit growth in domestic decorative paints. Volume in industrial and automotive segments is expected improve in 2015.Organic and inorganic growth plans to strengthen the leadership position. Softening RM prices to drive profitability.

DIVISLAB

Investment Argument – Consistency in growth & industry leading margins

Key Growth Driver – Revenue growth is expected to continue in Custom Synthesis. Higher Yields enables company to gain leadership status in Generics.

HDFC Bank

Investment Argument – Consistency in loan book growth, NIMs and lowest NPAs

Key Growth Driver – Loan book is expected to grow at a CAGR of 20%. Lowest NPAs reflect superior risk management. Capital raising plan will support balance sheet growth.

ITC

Investment Argument – Superior brands with pricing power

Key Growth Driver – Strengthen leadership position in cigarettes with double digit growth. Steady performance in other non-FMCG segments.

JSW Steels

Investment Argument – Well integrated efficient steel maker

Key Growth Driver – JSW steel is India’s largest private sector steel maker which will get benefit from economic growth in 2015.

L&T

Investment Argument – Proxy to ride the Indian economic growth

Key Growth Driver – Proven leadership reflected in robust order book build-up. Excellent execution capabilities making it the most preferred partner.

Reliance Industries

Investment Argument – Growth & Investment Engine

Key Growth Driver – Launch of Rel Jio 4G services could be a game changer in the Indian telecom market. Reliance is also doing expansion in retail to strengthen leadership position.

Tata Motors

Investment Argument – Leader in Automative segment

Key Growth Driver – Tata Motors is expected to witness strong traction with the launch of Jaguar XE range. Tata Motors has begun witnessing volume improvement in PV segment recently. Its newly launched Zest has received good response.

TCS

Investment Argument – Consistent growth with superior margins

Key Growth Driver – TCS has improved the margins steadily in the last many years.TCS has maintained the broad-based revenue growth in various geographies and verticals.

Ultratech

Investment Argument – Consolidating the leadership position with focus on improving efficiency

Key Growth Driver – Ultratech is India’s largest cement manufacturer to benefit from robust economic growth in 2015. Ultratech is expected to benefit from its network of cement, captive power, ready mix plants, material handling terminals is well positioned to benefit from better coordination & mobilization of materials within India and for export markets.

Read Full Report from here.