We often visit the restaurant for taking food outside, however when the waiter comes up with a bill we get confused about applicable taxes. We end up paying this bill as we don’t know how much service tax is applicable on food bill. Recently government has revised the service tax and with effect from 1st June, 2015 service tax rate has been increased to 14%. Thus with recent changes taking food outside in AC restaurant has also become costly.

If you are confused about service tax applicable on restaurant services. Finance ministry has come up with clear-cut guideline mentioning how much service tax is applicable on restaurant services.

Service Tax Clarification –

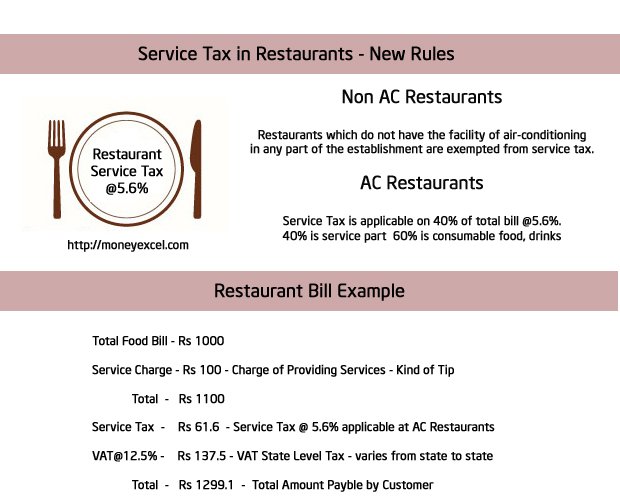

- No service tax is applicable at Non AC Restaurants. You can use dining facility at non Air-conditioned hotel and you need not to pay any service tax on food bill.

- For Air Conditioner restaurant, service tax is applicable on 40% of the total food bill. This means effective service tax would be 5.6% (14% of 40%) of the total amount charged.

- Prior to 1st June, 2015, when service tax rate was 12.36%, tax on restaurant service was 4.94% (12.36% of 40%).

Few additional clarifications regarding applicability of tax on restaurant services are given below.

Q – You are visiting a place where air conditioned as well as non-air conditioned restaurants are operational, but if the food is supplied from the common kitchen, will service tax is applicable in the non-air conditioned restaurant also?

A – Yes it is applicable. If you are visiting same restaurant having the facility of air-conditioning in any part of establishment service tax is applicable.

But if you are visiting complex having more than one restaurant (clearly isolated and separately named) but if food is supplied from the common kitchen, tax is applicable to restaurants having air-conditioning facility only.

Q – In a hotel, if restaurant services are provided in other areas e.g open area or swimming pool, service tax is applicable?

A – Yes restaurant services provided in other areas of the hotel are liable to service tax.

Q – Whether service tax is applicable on goods beverages sold on MRP basis?

A – No, if goods are sold on MRP basis service tax on such goods and beverages. Means if you are purchasing a water bottle or cold drinks on MRP basis you need not to pay service tax.

I hope all your doubts related to tax applicable on restaurant services are clear now. Next time when y0u visit restaurant keep all these points in mind. Remember service tax on AC restaurant bill is 5.6% and not 14%.

If information given in this post is helpful to you, don’t forget to subscribe our blog additionally you can also follow us on facebook.

Note – Service tax is now not more applicable. Service tax is converted to GST.