Mr.Rakesh Mishra Mumbai Mumbai-based MNC employee earns a good salary of Rs 60,000 and has only liability in terms of Home loan EMI. Yet every quarter his bank balance drops close to four digits, this is because every quarter amount close to 35000 Rs/- goes to school and tuition fees of his sons Shyam and Ram.

He keeps on praying that no unexpected expense turns up during this time. This could be the case with you A massive surge in education costs in the past five years has stretched the monthly budgets of middle-class families like anything.

According to an Assocham survey of 2,000 families across 15 cities, the annual school education expense on a child has risen from Rs 35,000 five years ago to Rs 94,000 now. It is observed that the cost of education usually rises twice as fast as normal inflation.

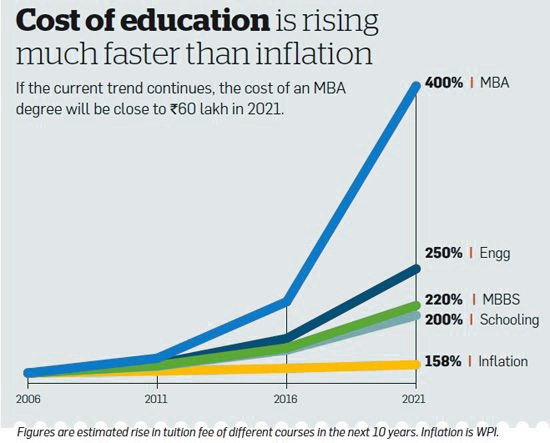

If you are worrying about this sharp rise in school education expenses, there’s a bigger time bomb ticking away. Higher education costs are growing at an even faster rate. The average fees of an Engineering course is roughly Rs 6 Lakh today, five years down the line it would be close to double meaning Rs 12 Lakh. In 10 years’ time, it’s likely to cost around Rs 20 Lakh.

The cost of the MBA course has grown even faster current cost is approximately 15 Lakh and is expected to be 40 Lakh after 5 years. MBA is likely to cost 60 Lakh in 2027.

This exponentially growing cost has no dead end. Many of you are planning for your retirement but looking to the future cost of education you must plan for your child’s education.

If the current trend continues then to make your child an Engineer or MBA like you is not child’s play.

You have to save & invest enough money for your child’s education.

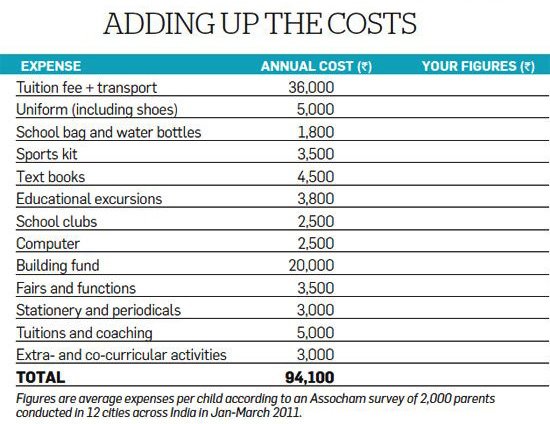

If you are thinking that you need to save only for fees then you are wrong your child’s school fee is not only an expense related to the child’s education. A lot of other expenses is involved in child education. There are books, stationery, uniforms, transportation, projects, picnics, annual school/college functions, sports, extra-curricular activities etc.

The estimated annual cost for one child is formulated in the below table. You can put your figures and see how much it costs in your pocket.

As we said saving for child education is not child’s play but if you think long term and invest Rs 5,000 a month in an option that delivers a 12% return every year, you would build a Rs 25 lakh corpus in 15 years.

If you can manage to increase this investment amount by Rs 1,000 every year and then your corpus will be almost doubled and you can build to Rs 50 lakh for child education.

It seems very simple, it is but parents should feel strongly that they need to save regularly for child education one of the crucial financial goals.

Remember your Investment amount, discipline & selection of the right asset class will decide whether your child goes to a premier institute like IIT, or IIM for higher studies or ends up doing a correspondence course in a small institute. This education will also decide the career path he plans for himself.

Essesnse of this article is not to increase your worry about the cost of child education but to make yourself aware of the situation so that appropriate steps can be taken.