It is easy to generate rent receipts online. Multiple websites offer a facility to generate rent receipt online.

You must be aware that if you receive HRA above Rs. 3000/- per month, you must provide Rent receipt to the employer as evidence for claiming HRA. Even if your HRA is less than Rs. 3000/- you have to keep rent receipts with you in case Income Tax Officer asks for them at a later date.

Note – Receipt is required if you are living in a rented house.

One of the simplest options is to take physical copies of rent receipts from the landlord every month. However, practically it is very difficult and nobody does it. Mostly people prepare a receipt for the rental at the end of the year. If you are one of them here is a list of 5 different websites that can help you to generate rent receipts at the click of the button.

Also Read – Home loan HRA and your Taxes!

Rent Receipt Online – 5 Best Rent Receipt Generator

#1 Nobroker

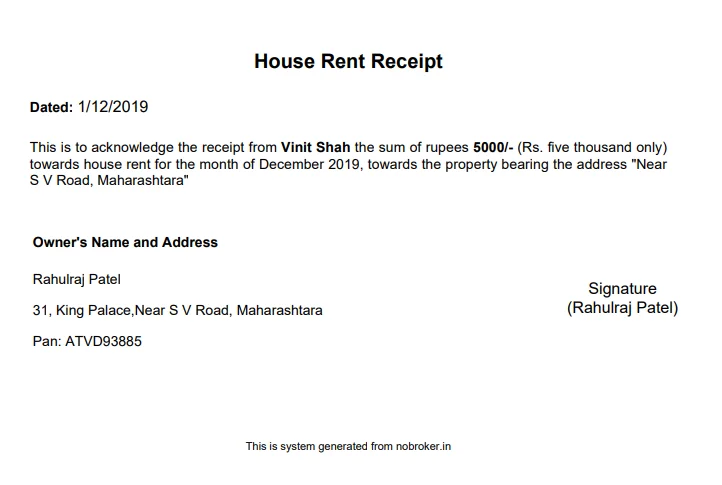

Nobroker is a real estate platform. Apart from buy/sell and rent services Nobroker also offers a facility to generate rent receipts online as well as generation of rental agreement online.

To generate rent receipts online you need to fill up a simple form with details such as tenant name, owner name, rent amount, owner PAN number, address and month for which receipt is required. The link is given below.

https://www.nobroker.in/online-rent-receipt-generator

Once you submit the details system will generate a house rent receipt online. This facility will also send SMS and email with a link to a tenant for downloading receipts. The sample is given below.

#2 ClearTax

ClearTax is a free income tax e-filing website. In addition to return filing, this website also provides facilities such as investing in tax saving funds, GST return filing & generation of free rent receipts.

To generate a rent certificate online you need to fill up the required details on the ClearTax site online. You are required to enter your name, name of landlord, rent amount, rent receipt month. The site will generate a rent receipt and display on the screen. You can take print of the receipt and take the signature of the Landlord. The link for ClearTax rent generation is given below. You are required to take the signature of the landlord on the receipt.

#3 Economic Times

Economic Times one of the biggest and popular news site also provide facility to generate rent voucher. You need to input basic details such as rent amount, address, your name, house owner name, PAN details and rent duration.

You can generate monthly, quarterly & half yearly receipt from this platform. You can print and download from this generator.

#4 Tax2win

Tax2win is an e-filing website. You can file your income tax return as well as get personal assistance from CA from this website. It is free, fast, convenient and easy.

You need to fill up the required details and print the receipt. After printing, you need to stamp and get it signed by the landlord.

#5 Housing

Housing.com is real estate platform that deals in buy sell and rent of properties. This website also provide facility for rent receipt generation.

The steps for generating rent receipt is very easy. Firstly, you need to provide the name of tenant and rent amount. In the next step you need to enter name of the landlord with address. You can also add PAN number if you want. Once you are done you can review the rent receipt and download the same. Once you are done you need to take signature of landlord on the receipt. The link of generating rent receipt via housing.com is given below.

https://housing.com/edge/rent-receipt-generator

FAQ about HRA and Rent Receipt

(1) Is it mandatory to keep/submit a rent receipt?

Yes, if you are living in a rented house and paying rent to the landlord. You must keep receipt of the rent payment. If you are salaried and receiving HRA above Rs.3000 per month from an employer it is mandatory to submit the receipt as evidence of claiming HRA.

(2) PAN of Landlord is required for claiming HRA?

PAN or Landlord is mandatory to mention in receipt in case annual rent is exceeding 1 Lakh. This means monthly rental is above Rs.8333 PAN Card is mandatory to mention. In case of landlord does not have PAN card declaration form is required.

(3) Is it mandatory to affix revenue stamp on rent receipt?

Revenue stamp is required to be affixed in case rent amount is above Rs.5000 and given in cash. For cheque or online transactions revenue stamp is not required.

(4) Only receipt or rent is enough for claiming HRA?

Yes, you only need to provide receipt for rent in order to claim HRA from employer.

(5) Is there any risk in submitting fake rent receipt to claim HRA?

It is very risky to submit fake rent receipt to claim HRA. You should never submit any fake documents for tax saving. In case fake document is traced by employer or IT department they will ask additional documents such as copy of leave and license agreement, electricity bills, water supply bill, PAN card of the landlord etc. The process is lengthy and may leads to penalty and other consequences.

Conclusion

Generating rent receipts online is a quick, efficient, and hassle-free way to maintain rental payment records. Whether you’re a salaried employee looking to claim HRA or a tenant needing a proof of payment, these rent receipt generators can save you time and effort. Pick any of the five platforms mentioned above and enjoy a seamless rent receipt generation experience.