A quant fund is a new concept in India. Quant Fund is a type of mutual fund that is managed using quantitative analysis and artificial intelligence.

As you are aware that mutual funds are managed by the fund managers. A fund manager invests money based on research analysis and investment strategies. This means investment decision in a mutual fund is influenced by human intelligence. Human minds are prone to mistakes. This gives birth to a new type fund called Quant Funds.

What is Quant Fund?

A quant fund is one type of mutual fund. The investment decision in this fund is not taken by a human being. The decision is taken by software programs that are based on predictive models, hidden patterns, statistical techniques, and quantitative analysis. The predictive model is known as the quant fund model. Quant fund models are based on back-tested data.

The followers of the quant fund say that the scope of human error in this fund is very less and almost negligible hence these type of fund is likely to perform better. However, as these funds work on historical data and artificial intelligence it cannot handle unprecedented events. This fund has a similar risk profile of the thematic fund.

Also Read – Thematic Funds, Sectoral Mutual Funds – Good for Investment?

How Quant Mutual Fund Works?

Quant Mutual Fund works on the predefined algorithms and historical data. The large diverse data & information are stored at the backend computational system of this fund. This fund makes use of the latest technologies such as data science and AI to process and analyze large data in generating meaningful information.

The quant system behind this fund selects the best available stock option that is likely to generate a good future return. The buy and sell decisions are given based on academically researched and complex decision-making systems. This fund restricts the choice of stocks based on the model. The quant model eliminates the involvement of human emotion and sentiment while buying and selling stocks.

The quant model to perform quantitative analysis using the computer-based model can be either outsourced or can be designed by the fund house internally.

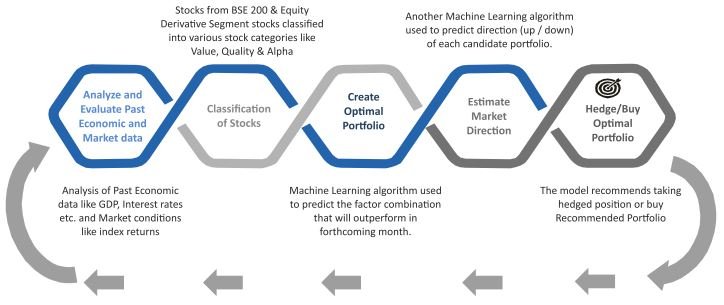

The method used by the quant fund for the selection of equity is given below.

- Analysis of Past Economic data like GDP, interest rate, market condition like index return.

- Classification of stocks.

- Usage of Machine Learning and AI algorithm to predict the factor combination that will outperform in the forthcoming month.

- Create Optimal Stock Portfolio.

- Estimate Market Direction.

- Hedge/Buy Optimal Portfolio.

- Repeat the above sequence.

The factors used for the prediction are Alpha, Value of stock based on ROCE, PE ratio, Quality of stock based on ROE, EPS and dividend earning ratio.

Famous Quant Mutual Funds in India

(1) Nippon India Quant Fund

Nippon India Quant Fund seeks to generate capital appreciation by investing in an active portfolio of stocks selected based on the quant model. 99.85% of the net allocation of this fund is equity and remaining in the cash component.

If we see the last five years of historical data, this fund is unable to perform and generated poor returns compared to the benchmark.

(2) DSP Quant Fund

DSP Quant fund is a new fund that was launched six months back. As per fund objective, the stocks are selected, weighed and rebalanced using stock screeners, factor-based scoring and an optimization formula that aims to enhance portfolio exposures to factors representing good investing principles such as growth, value, and quality within risk constraints.

As it is a new fund historical performance detail is not available. But, this fund has given good return since inception.

(3) Tata Quant Fund

Tata Quant Fund is recently launched. Objective of this fund is to generate medium to long term capital appreciation by investing in equity selected based on quant model. It is new fund and no historical data available as on 30th Jan, 2020.

Should you invest in Quant Mutual Funds?

At the first instance, the Quant Mutual fund seems to be a lucrative investment option. However, before deciding about investing in this fund you should look at the positive and negative side of this fund. Details are given below.

Benefits –

- This fund reduces/eliminates human error, bias, and emotions.

- Leverage the strength of Artificial Intelligence (AI) for investment strategy formulation.

- Consistency in strategy.

- Disciplined investment process claim to be offering high returns.

- Restricted choice of stock based on model and algorithm.

Drawbacks –

- The success is based on the quant model and analysis performed.

- As analysis is done based on historical data, this fund can not handle complex market conditions.

- The model should be constantly updated based on evolving market realities.

- There is no firm evidence that these funds can reliably outperform over time.

Looking at benefits and drawbacks you must have made up your mind about the quant fund. As per me, this fund is slightly new and risky. There is no established track record available for these types of funds. It is not yet become a matured investment product. An investor should stay away from quant funds as of now. If you are highly influenced by this fund you can allocate 5% of the equity portfolio in this fund. As this fund is available in multiple categories you should be absolutely sure about selection of category.