Where to Invest in the stock market? What is the process for conducting stock fundamental analysis? Do you have readymade tools or websites for fundamental analysis of stocks? Let’s try to get answers!

Well, Investing in the stock market can feel like navigating a maze, especially if you’re new to the game. Once you invest it is like a roller coaster ride. But here is a good news. There are tools and websites that can help you in evaluating stock performance quickly. You can get all data in the visual form which will help you in making informed investment decisions. So, let’s dive into the three powerful websites for fundamental analysis of stocks that every investor should have bookmarked.

Why Fundamental Analysis?

Before we get into the nitty-gritty of these websites, let’s quickly brush up on what is fundamental analysis? why we should perform fundamental analysis of the stock before investing?

Fundamental analysis is the process of evaluating a company’s financial health and performance by analyzing key metrics such as earnings, revenue, profit margins, future growth management, and more.

Fundamental analysis is focused on the foundational factors that impact a company’s performance, whether positively or negatively. Doing a fundamental analysis of the stock is extremely important. Unlike technical analysis, which focuses on price movements and market trends, fundamental analysis digs deep into a company’s financial health, competitive position, and future prospects. It is like doing a complete checkup on a business to see if it’s worth your hard-earned money.

Powerful Websites for Fundamental Analysis of Stocks

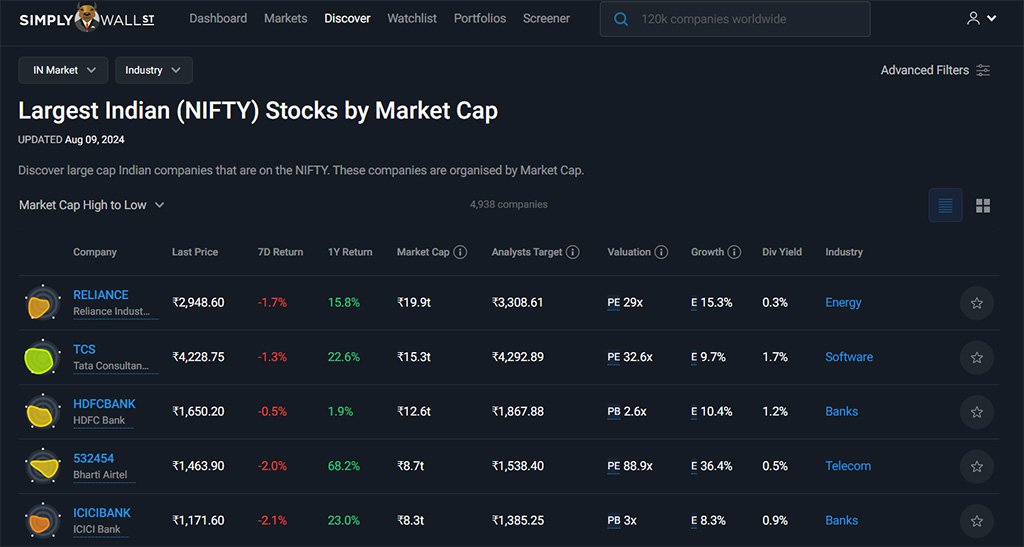

#1 Simply Wall St

Simply Wall St is one of the best tools for doing a fundamental stock analysis. Simply Wall St offers a comprehensive analysis of all publicly listed stocks around the globe right at your disposal. At Simply Wall St you can save valuable time by going through readymade reports to reduce investment risk.

Key Features of Simply Wall St

- Portfolio – You can build and manage multiple watchlists and portfolios effortlessly on this tool.

- Visual Analytics – Visual Analytics, user-friendly charts and graphs to present intricate financial information, allowing users to easily understand and assess stock and portfolio performance.

- Investment Research – Detailed analysis of specific stocks, providing important statistics, past trends, and visual forecasts to assist users in making informed choices when it comes to investing.

- Stock Screener – Stock Screener facility with readymade screens for stock filtering.

How to Use Simply Wall St?

The steps to use Simply Wall St are given below.

Visit the https://simplywall.st website. Create a free account or use Gmail, Facebook, or Apple ID to log in. On first-time login, you need to select market and industry. Now you will be able to see various menu items such as portfolio, watchlist, discover, screener, and market.

Portfolio

Under the portfolio tab, you will be able to create or see your portfolio. The portfolio can be created manually by clicking on the button “Create Portfolio” and adding stock names, quantities, and purchase prices. Continue adding stocks till your portfolio gets created. Once your portfolio is ready you will be able to see stock holding, portfolio Snowflake chart, stock analysis, and dividend tab with visuals and details.

Watchlist

In the watchlist tab, you can create your watchlist. You need to click on the Add Stock button and add the stock which you want to track. The best part of this watchlist is that based on data points it will tell you that added stock is undervalued or overvalued. It will also display the fair value of the stock.

Discover & Screener

The Discover tab is given to find out new investment ideas. You will get readymade screens such as Gem Stocks with Strong Fundamentals, Fast Growing Stocks, Dividend Powerhouse stocks, AI Stocks, Energy stocks, etc. On the Screener you will get the facility to screen the stock based on various filters. In case you find filters useful you can save the screener also.

Stock Report

From the search tab, you can search for any stock and get a stock report on the screen. The stock report shows a detailed fundamental analysis of the stock including Snowflake analysis. You will get Financial Health, Valuation, Future Growth, Past Performance, Dividend, Management, Ownership details and other information. The information given in the report is very useful to make investment decisions.

Price

The free Plan of this tool gives you the following facilities.

- Global Markets Access: Explore insights from worldwide financial markets.

- Company Reports: Receive detailed reports for up to 5 companies monthly.

- Portfolio and Holdings: Manage one portfolio with up to 5 holdings.

- Watchlist: Keep track of your favorite companies effortlessly.

The premium plan comes with a yearly price of $120. It gives you the following facilities.

- Global Markets Access: Insights from diverse financial markets worldwide.

- Company Reports: Receive 30 comprehensive reports each month.

- Portfolios, Holdings: Manage 3 portfolios with 30 holdings each.

- Watchlists: Simultaneously monitor 3 watchlists for market updates.

- Stock Screener: Leverage our robust tool for effective stock screening.

You can also purchase an unlimited plan with a yearly price of $240.

In short, Simply Wall St is a very good tool for doing fundamental analysis. It provides a user-friendly interface and effective tools for navigating the intricacies of the stock market. However, you will not get real-time data on the price of this tool it is delayed by 1 day for the Indian stock market.

Chartink Screener – Fundamental and Technical Scanner

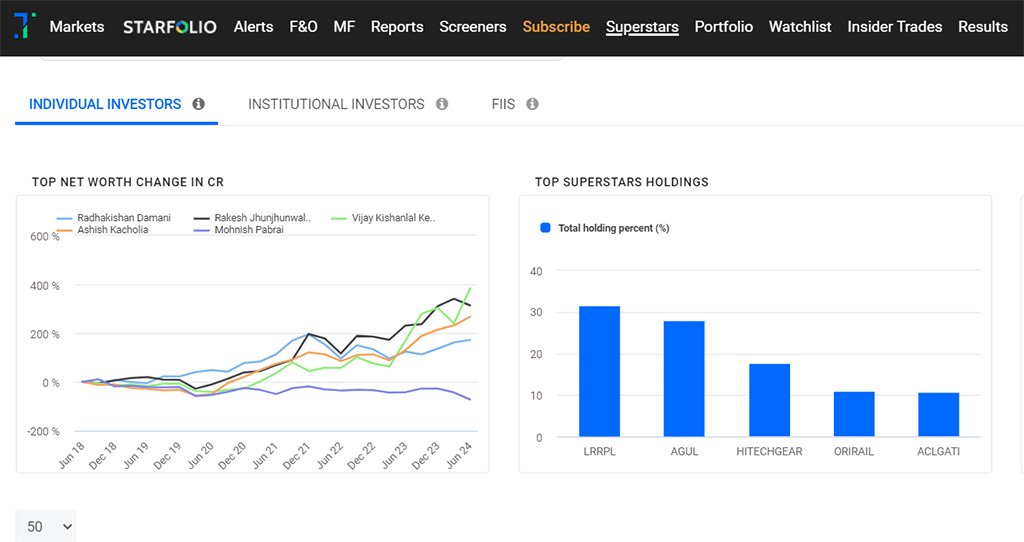

#2 Trendlyne

Trendlyne is a smart stock performance screening website. Trendlyne is useful for doing fundamental analysis as well as technical analysis of the stocks. Trendlyne offers distinctive features such as DVM, SWOT analysis, performance graph, comparative performance analysis, and others.

Key Features of Trendlyne

- Portfolio – You can add your stocks view holding and manage accounts.

- Research Reports – Trendlyne offers readymade research reports as well as a forecaster dashboard.

- Stock Report – Trendlyne offers stock reports that include durability, valuation, and momentum details.

- Stock Screener – You will get a readymade stock screener as well as you can create your own stock screener in Trendlyne.

How to Use Trendlyne?

The steps to use Trendlyne are given below.

Visit the https://trendlyne.com/ website. Create a new account or use Gmail or Apple ID to log in. On logging on you will be able to see the dashboard view with menu items such as Reports, Screeners, Superstars, Portfolio, and many more.

Stock Research Reports

Under the reports section, you will be able to see various research reports & buy-sell calls. To search for any stock-specific report, you need to enter a stock name in the search tab. Now, you will be able to see the stock report, containing information such as durability score, valuation score, momentum score, and SWOT (Strengths, Weaknesses, Opportunities, Threats) for the stock.

Screeners

Under the Screeners section, you can create a new screener. Click on the Create New Screener button and follow the on-screen instructions to create your own screener. Under this section, you can also find the most popular expert stock screeners for usage. These fundamental and technical stock screeners are also sorted by various categories – highest returns, DVM, live results, volume, and more.

Superstars

Superstars is a unique section that contains Superstar Shareholder Portfolios – Ownership stakes held by prominent investors. In this section you can find out which companies the biggest superstar shareholders like Rakesh Jhunjhunwala, Dolly Khanna, Ramesh Damani, Goldman Sachs etc are investing in.

Portfolio

Under the portfolio section, you can create your own stock portfolio and track your investments. To do that, click on your portfolio and add stock, quantity, price, and transaction date. You can also import your portfolio by syncing from leading stock brokers.

Price

Trendlyne offers two different plans GURUQ and STARTQ. The price of GURUQ is ₹ 1890 per year. The price of STARTQ is ₹ 4950 per year.

#3 Tijori Finance

Tijori Finance is one of the best tools for Investment research and tracking. You can get unique insights about companies, news & markets in this tool. You can also get a performance tracking facility in this tool.

Key Features of Tijori Finance

- Research Tools – Tijori Finance offers an in-depth analysis of the fundamentals and technical data of the company. Additionally, it gives forensic analysis which is very useful while making investment decisions.

- Tracking Tools – Tijori Finance also offers tracking tools which include a company timeline, portfolio, watchlist, and alerts.

How to Use Tijori Finance?

The steps to use Tijori Finance are given below.

Visit the https://www.tijorifinance.com/ website. Sign up using your E-mail id or using the Zerodha Kite Account. On login, you will be able to see the dashboard view.

Timeline

Timeline is a personalized feed with updates about your companies. You can add your companies and get the latest information and financial news about these companies on your feed.

Portfolio

The stock portfolio section of Tijori Finance allows you to add investment data or pull your investment data by connecting to brokers. It is a premium feature and you need to pay money to avail this facility.

Company Research

The company research facility allows you to search and get data for any sector or stock. It gives the complete analysis of the stock in visual form. You can get financial, forensic, market share, revenue mix, peer comparison, cash flow analysis, shareholding, and many other details.

Price

Tijori Finance Free version offers limited information and features. For a premium account on Tijori Finance, you need to spend ₹ 330 per month or ₹ 3500 per year.

#4 Finology Ticker

As an investor, you must have surely come across insufficient or unreliable data while trying to analyse stocks.

Well, Finology Ticker was created as a solution to this problem.

It’s a stock screener for everyone that brings the best features of expensive stock screeners to you for free.

Ticker’s goal is to make investing simple for retail investors. It is a tool that can help you with all your stock research and analysis needs. It offers some really amazing features that can help you analyse stocks, track market trends, and make educated investment decisions—a total one-stop solution for both new and seasoned investors.

Key Features of Ticker

Ticker is like your very own team of researchers, but free. You can access all the data you need to make investments and manage your investment strategy with its many features. Here are some major ones:

Stock Screener – Users can filter and search over 5,000 listed companies with Ticker’s Stock Screener, and they can use more than 1,200 financial ratios as filters to do so. So, as an investor, you can easily find the stocks that fit your investment criteria, making the whole stock selection process easy and efficient.

Super Investors – Want to know the net worth of investors like Radhakishan Damani, Vijay Kedia, etc.? Ticker’s got your back!

It has a super investors section where you can look into the sock portfolios of stock market pros and get data of their holding values for free.

Initial Public Offers (IPO) – Ticker has all the data you need to stay updated on IPOs, including upcoming and newly listed IPOs, IPO-related news and in-depth IPO analysis. So, users never miss out on new investment opportunities.

Indices – Track the daily market movement and performance with Ticker. It provides real-time data to help investors make better investment decisions based on market trends and sentiments. More than 100 Indices of NSE and BSE are available with their top stocks for free.

Sector – As an investor, you must want to know which industry sectors are performing well. With Ticker, you can see how many listed companies are present in a sector and how each one is performing. With this feature, users can diversify their portfolio by investing in multiple sectors that are performing well.

Watchlist & Portfolio – With this feature, users can create personalised watchlists to monitor their favourite stocks and track their investment portfolios. It helps investors keep track of their investments’ performance and market changes.

Stock Analysis & Reports – Ticker provides detailed reports and analysis on various stocks, including historical performance, financial statements, Annual report, concalls, investor presentations, etc. This information is crucial for making data-driven investment decisions.

Now that you know some of Ticker’s many amazing features, let us move on to how you can use the platform.

How to Use Ticker

Ticker has so many different features it might get overwhelming to understand how to truly use them to your advantage.

Not to worry, here is a step-by-step guide on how to use Ticker’s key features:

Getting Started with Ticker

- Open ticker.finology.in

- Get what’s up with the market on the home page itself

- Scroll below to check the Corporate News, Economy News, Market News, etc.

- Search for any company or brand you like and analyse it with detailed financial statements and ratios.

Using the Stock Screener

- You can easily access the stock screener tool by clicking on the “Screener” button on the dashboard.

- Then, you can click on “Usage Guide” to understand how to set up screening criteria.

- If you are already familiar with the process, just choose the parameters such as sales or market cap to filter stocks.

- Click on “Run Screener”, and you will get a list of stocks that meet your desired criteria.

Creating a Watchlist

- Just click on your profile and click on “Watchlist.”

- Search any company and add the stock to your watchlist.

- Now, you can easily track the performance of your watchlisted stocks daily.

Company Analysis

- Search for any company name of choice in the search bar.

- You will be redirected to the company page.

- Now, you can explore all the financial information of the company and make educated investment decisions.

You can follow these steps and take the full advantage of Ticker’s many impressive features. It’s a search engine for all your investment needs.

Summary

If you are looking for an all-in-one tool that makes it easy for you to analyse stocks, then Finology Ticker should be your go-to tool.

It’s hard to believe one platform can do all of this, but Ticker can do even more. You don’t have to choose between free, unreliable tools and expensive premium tools when you can have the best with Ticker.

FAQs

What is fundamental analysis?

Fundamental analysis involves evaluating a company’s financial statements, management, industry position, and economic factors to determine its intrinsic value.

Why should I use multiple websites for analysis?

Different websites offer unique tools and perspectives, providing a more comprehensive view of the stock you’re analyzing.

Are these websites free to use?

Most features on these websites are free, but some advanced tools may require a subscription.

How often should I perform the fundamental analysis?

Regular analysis is crucial. Quarterly reviews are a good practice to stay updated with the latest financial data.

Can fundamental analysis predict stock prices?

While it can provide valuable insights into a company’s potential, it cannot predict future stock prices with certainty.

Conclusion

Investing in the stock market doesn’t have to feel like a gamble. By leveraging the power of fundamental analysis, you can make informed decisions that align with your financial goals. These tools provide essential resources to assist you in navigating the intricate world of investing.

By following the advice and utilizing the tools from these powerful websites, you’ll be well on your way to mastering fundamental analysis and achieving your financial goals. Remember, knowledge is power, especially in the world of investing!