It is very easy to pay Advance Tax Online. You just required Net Banking Facility to make an advance tax payment. Advance tax payment is required if your tax liability, after deducting prepaid taxes (TDS) is above Rs.10000. Short / Non-payment or deferment of payment of Advance Tax will result in the levy of interest.

What is Advance Tax?

Advance tax, also known as ‘pay-as-you-earn’ tax, is the income tax you pay in advance on your income throughout the financial year. Instead of paying taxes in one lump sum at the end of the year, advance tax requires taxpayers to pay it periodically, usually in quarterly installments.

It is mandatory to make e-payment of advance tax for all corporates and for the assesses whose accounts are required to be audited u/s 44 AB of the Income-tax Act. e-payment is convenient for taxpayers as it ensures correct credit.

Who needs to Pay Advance Tax?

Not sure if you fall under the advance tax net? Here’s a quick rundown:

- Individuals: If your total tax liability exceeds ₹10,000 in a financial year after considering TDS, you’re required to pay advance tax.

- Businesses: Companies, firms, and other entities with tax liabilities over ₹10,000 also need to pay advance tax.

If you are falling the category where you are liable to pay advance tax, follow the steps given below for e-payment of advance tax.

Now that we have a grasp of what advance tax entails, let’s delve into the steps to pay it online in India:

How to Pay Advance Tax Online? – Step by Step Process

Step 1: Calculate Your Estimated Income

The first step in paying advance tax is estimating your income for the financial year. Take into account all sources of income, including salaries, business profits, capital gains, and interest income.

Step 2: Calculate Your Tax Liability

Once you’ve estimated your income, calculate your tax liability using the applicable tax rates and deductions. Various online calculators and tools can assist you in this process.

Step 3: Determine Payment Due Dates

Advance tax payments are typically due in four installments throughout the financial year. Refer to the following schedule to determine the due dates:

- 15th June: 15% of estimated tax

- 15th September: 45% of estimated tax

- 15th December: 75% of estimated tax

- 15th March: 100% of estimated tax

Also Read – Download Income Tax Calculator FY 2023-24 (AY 2024-25)

Step 4: Making Payment on Income Tax Website

Advance Tax payment facility is available at Income Tax filing website. To make payment of advance tax online you need to visit Income tax website. On this website you will find tab called as e-Pay Tax in the left menu.

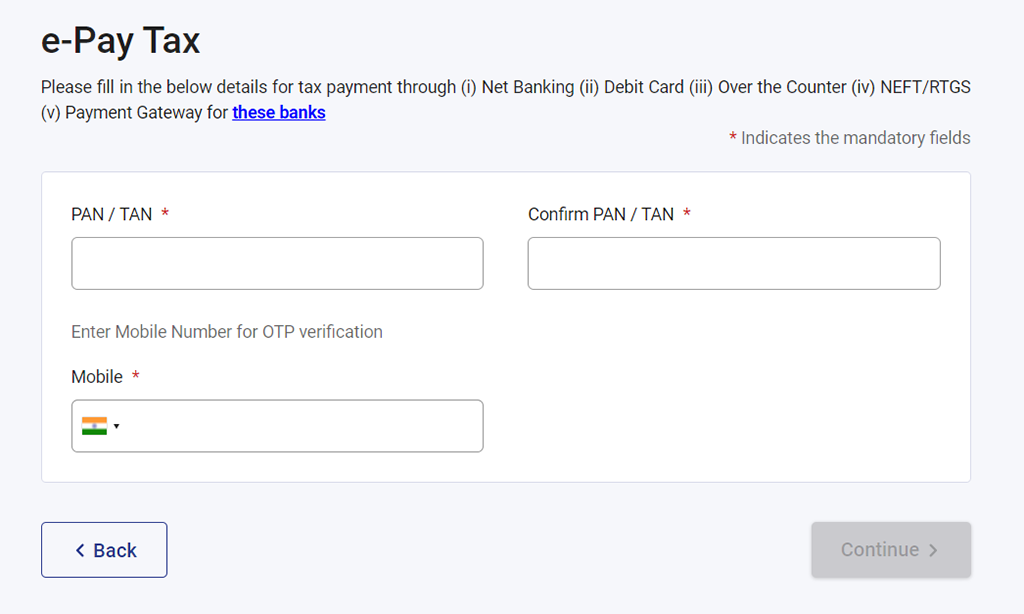

Now, login via entering PAN card. For Aadhaar authentication you need to enter your Mobile number. Once you enter the detail press continue button. OTP will be sent to your register mobile number. After entering OTP your profile would be successfully verified through mobile OTP.

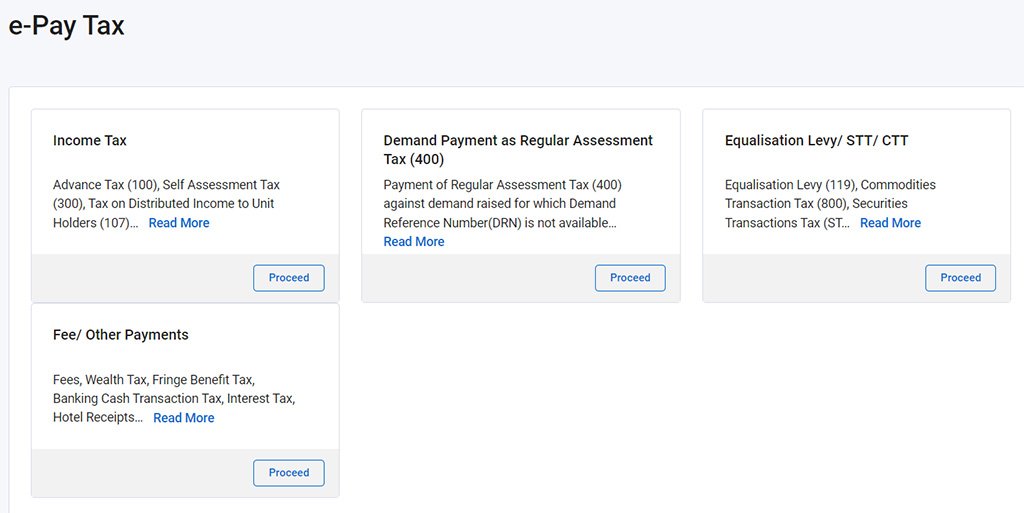

After pressing continue button your would be redirected to page containing facility of tax payment where you need make selection from following.

Income Tax

- Advance Tax (100)

- Self Assessment Tax (300)

- Tax on Distributed Income to Unit Holders (107)

- Surtax (102)

- Payment of Demand/Penalty/Interest etc.

- Secondary Adjustment Tax under Section 92CE of Income-tax Act, 1961(110)

- Accretion Tax under Section 115TD of Income-tax Act, 1961 (111)

Demand Payment as Regular Assessment Tax

Equalisation Levy/ STT/ CTT

- Wealth Tax

- Fringe Benefit Tax

- Banking Cash Transaction Tax

- Interest Tax

- Hotel Receipts Tax

- Gift Tax

- Estate Duty

Now, as you need to pay Advance Income tax, select income tax and make selection of assessment year and type of payment. Make sure to select “Advance Tax (100)’ under this head for advance tax payment.

Now enter tax amount, surcharge, cess, interest, penalty and other details. Now press continue button and you will taken to the page where you can make payment using (i) Net Banking (ii) Debit Card and (iii) Payment Gateway with specific banks.

On successful payment, you will receive Challan Receipt. This challan contains important information like BSR code, Challan number, Challan Date and Challan amount. You need to mention this detail while filing an income tax return. Please keep challan copy safe for future reference.

FAQs (Frequently Asked Questions)

1. Can I Pay Advance Tax Offline?

Yes, you can pay advance tax offline by visiting designated bank branches and filling out the necessary forms. However, paying online offers convenience and efficiency.

2. What Happens if I Miss an Advance Tax Installment?

Missing an advance tax installment may attract interest under Section 234B and 234C of the Income Tax Act. It’s advisable to pay any missed installments as soon as possible to avoid additional penalties.

3. Is Advance Tax Refundable?

Yes, if you’ve paid excess advance tax compared to your actual tax liability, you’re entitled to a refund. You can claim the refund while filing your income tax return.

Conclusion

Congratulations! You’ve now mastered the art of paying advance tax online in India. By following the steps outlined in this guide and staying informed about your tax obligations, you can navigate the taxation landscape with confidence. Remember, timely payment of advance tax not only helps you avoid penalties but also ensures smooth financial planning throughout the year. So, embrace the digital age, log in to the Income Tax Department’s portal, and stay ahead of the tax game! How to Pay Advance Tax Online in India?