New Income Tax Slab 2023-24 is announced by Union Finance Minister Nirmala Sitharaman. New Tax Regime is announced. New Tax Regime will be the default tax regime.

The income tax rebate limit is increased to 7 Lakh. With the new tax regime, those with incomes of Rs 7 lakh would no longer need to pay any income tax. Earlier this limit was Rs 5 lakh. A 5% direct tax would be applicable on a total income between Rs 3 lakh to 6 lakh. 10% direct tax would be applicable on total income between Rs 6 lakh to 9 lakh. 15% on Rs 9 lakh to Rs 12 lakh, 20% on Rs 12 lakh to 15 lakh, and 30% on Rs 15 lakh and above.

The government has reduced the highest surcharge rate from 37 percent to 25 percent in the new tax regime.

This means the basic exemption limit is hiked from Rs 2.5 lakh to 3 lahks. Rebate under section 87A has been hiked from Rs 5 lakh to Rs 7 lakh.

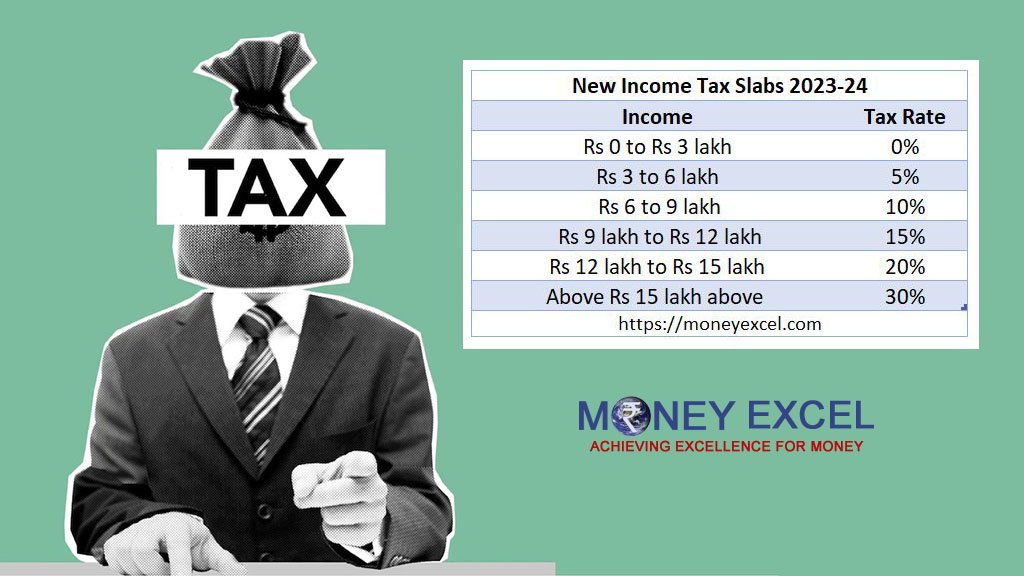

New Income Tax Slab 2023-24

a) Rs 0 to Rs 3 lakh – 0% tax

b) Rs 3 to 6 lakh – 5% tax

c) Rs 6 to 9 lakh – 10% tax

d) Rs 9 lakh to Rs 12 lakh – 15% tax

e) Rs 12 lakh to Rs 15 lakh – 20% tax

f) Above Rs 15 lakh above – 30% tax

A new Income Tax slab is beneficial as it leads to good savings on income tax.

Tax savings due to Income Tax Slab 2023

Earlier if your total income was Rs 7 lakh you were paying Rs 33800 as tax but now you need not pay any tax on Rs 7 lakh.

In case your income is 9 lakh earlier you were paying Rs 62400 as tax but now you need to pay Rs 46800 tax on income of 9 lakh so your total saving would be Rs 15600.

If your income is 10 lakh earlier you were paying Rs 78000 as tax but now you need to pay only Rs 62400 as tax so the total saving would be Rs 15600.

If your income is 12 lakh earlier you were paying Rs 119600 as tax but now you need to pay only Rs 93600 as tax so your total savings would be Rs 26000.

If your income is 15 lakh earlier you were paying Rs 195000 as tax but now you need to pay only Rs 158000 as tax so the total saving would be Rs 37000.

The new income tax regime becomes the default tax regime. However, the individuals will have the option to continue with the old income tax regime.