Mutual Fund Tax and Equity Tax Rules are changed in Budget 2024. Now investors and traders both need to pay higher taxes on profit earned from the stock market. In Budget 2024, the rationalization of capital gain tax is announced. Changes in LTCG and STCG both are done for FY 2024-25.

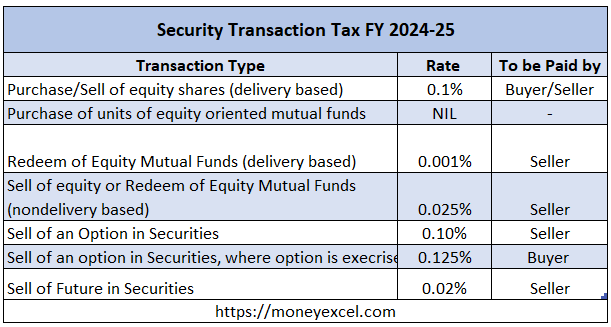

Now short-term gains (STCG) of financial assets attract a 20% tax rate. Long-term gains (LTCG) on all financial and non-financial assets to attract a tax rate of 12.5%. STT (Security Transaction Tax) is changed. The rate of STT on the sale of options in securities has increased from 0.0625% to 0.1%. The tax on futures transactions also increased from 0.0125% to 0.02% of the traded price.

The change in Mutual Fund Tax (LTCG, STCG) and Equity Tax (LTCG, STCG, STT) is complicated as per the type of the asset, listed, unlisted, and holding period. Let’s try to demystify and understand its impact on investors and traders.

Mutual Fund Tax – LTCG, STCG FY 2024-25

Types of Mutual Funds

After Budget 2024, there are 3 Types of Mutual Funds for Tax Purposes.

#1 Equity Mutual Funds

Equity Mutual Funds hold over 65% of Indian stocks in their portfolio. Furthermore, for a Fund Of Fund (FOF), the requirement is to allocate 90% of its assets to funds that also allocate 90% of its assets to domestic equity investments (such as Equity ETFs).

#2 Fixed Income – Debt Mutual Funds

Debt Mutual Fund hold over 65% of its portfolio in Bonds or Money Market instruments. Yet, in order to qualify for a Debt Mutual Fund, the Fund of Fund must invest at least 65% of its assets in funds that in turn invest at least 65% of their assets in debt and money market instruments.

#3 Other Mutual Funds

If any fund does not fall under the above two categories it is categorized as other mutual funds such as Overseas FOFs, Bonds, etc.

Holding Period

Along with the type of mutual funds, another important factor that decides tax on the mutual fund is the holding period.

#1 Equity Mutual Funds

The holding period of equity mutual funds decides the type of tax – short-term capital gain tax or long-term capital gain tax. If the mutual fund holding period is 12 months or less then the mutual fund gain is subject to short-term capital gain tax (STCG).

If the mutual fund holding period is more than 12 months the mutual fund gain is subject to long-term capital gain tax (LTCG).

To find out the holding period is very easy in case you have made a lump sum investment in the mutual funds. However, in case you have selected the SIP route, you need to understand that for mutual fund SIP, each SIP is treated as a separate investment to find out the holding period and applicable taxes. When you redeem a mutual fund it will be first in first out while determining the holding period and tax on the mutual fund.

#2 Fixed Income – Debt Mutual Funds

After Budget 2024, the holding period for debt mutual funds to be considered a long-term asset has been decreased from 36 months to 24 months. On debt mutual funds LTCG or STCG is not applicable they are taxed as per tax slab rates applicable to the investor.

#3 Other Mutual Funds

If you hold other mutual funds for less than two years or 24 months, it will be classified as Short Term Capital Gain (STCG); if held for more than two years or 24 months, it will be considered Long Term Capital Gain (LTCG).

Equity Tax – LTCG, STCG, STT – FY 2024-25

STCG – Short-Term Capital Gain tax is applicable on the profit of the listed equity if sold before 12 months. The earlier tax rate was 15% in the budget 2024 it is increased to 20%.

LTCG – Long-Term Capital Gain Tax is applicable on the profit of the listed equity if sold after 12 months. The tax rate would be 12.5%. Earlier that tax rate was 10%.

The LTCG exemption limit of 1 lakh on these assets has also increased to 1.25 lakh Rs. This increased exemption limit will apply for FY 2024-25 and subsequent years.

STT – Security Transaction Tax in the Futures & Options segment is modified. STT on the sale of an option in securities has been hiked from 0.0625% to 0.1% of the option premium.

STT on the sale of futures in securities from 0.0125% to 0.02% of the price at which such futures are traded.

FAQs

What is the date by which the new taxation provisions are applicable?

The new provisions for the taxation of capital gains come into force on 23 July 2024 and shall apply to any transfer made on or after 23 July 2024.

What simplifications have been made to the holding period?

Before, there used to be three timeframes to determine if an asset qualifies as a long-term capital asset. The holding period is now more straightforward. Listed securities have a holding period of one year, while all other assets require a holding period of two years.

What are the major changes in LTCG and STCG?

The rate for short-term capital gain paid on listed equity and equity-oriented mutual funds has been raised from 15 to 20%. Likewise, the long-term capital gain rate for these assets has seen a rise from 10 to 12.5%.

Is there any change in the exemption limit for long-term capital gains?

Yes, The threshold for LTCG exemption on these assets has been raised to 1.25 lakh Rs from 1 lakh. The enhanced exemption threshold will be in effect for the fiscal year 2024-25 and onwards.