In today’s time money management is essential for everyone. But if we talk about middle class people they always remain in pressure due to lack of money. They often joke that there is NO question of managing money as they don’t have money. But sometime this joke will lead them towards difficult situation. Remember money management is essential even for middle class people.

Many middle class people believe that money management is very difficult subject it requires ample amount of knowledge or consultation of financial planner. In order to help middle class people we are here with simple rule for management of money.

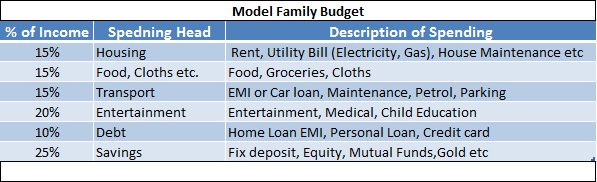

For effective money management you need to make your monthly budget based on your money spending habit. To get guideline please use model budget table given below.

Let’s consider someone has monthly income of 8000 Rs/- so as per above budget one has to save 25% of income 2000 Rs/- per month. This will lead to saving of 24000 Rs/- per year.

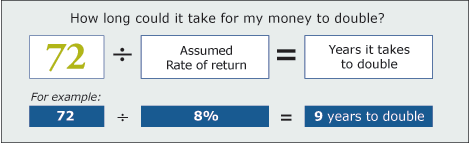

Now let us understand basic “Rule of 72” to estimate the growth of money. As per this law if your money earns 1% return than it will be double in 72 years, and if your money earns 72% return than it will be doubled in only 1 year.

If you deposit this money in fix deposit which gives 8% return than your money will be doubled i.e 48000 Rs/ in 9 years.

So as per above example FD doubles your money in 9 years but money invested in good mutual funds via SIP can give return up to 12%, hence your money could be doubled in 6 years & can grow to four times in 12 years.

So practice this basic rule of 72 for doing investment & see the magic. It is quite simple.

- At 24 % your money doubles in 3 years.

- At 12 % your money doubles in 6 years.

- On 6 % your money doubles in 12 years.

- On 3 % your money doubles in 24 years.

You can see that it makes a big difference how many times your money doubles. If you can make it double once or twice more by starting early, choosing the right investments, or keeping your money invested as long as possible before withdrawing it, Ultimately you could end up with significantly more money at retirement.