Dolly Khanna is a popular stock market investor of Dalal Street. She is actually homemaker. Her husband Rajiv Khanna is a mind behind investment made by Dolly Khanna. Rajiv Khanna has an incredible ability to identify future multi-bagger stocks for investment. This Chennai based investor couple has started investing in the stock market with a capital of 1 Cr in 1996.

Dolly Khanna and Rajiv Khanna generally deal in Midcap and Small Cap stocks. As these stocks contain huge potential to become future multi-bagger. We have already discussed on success story and portfolio of Dolly Khanna. Today we will discuss on 10 Midcap Multibagger Stocks from Dolly Khanna Portfolio.

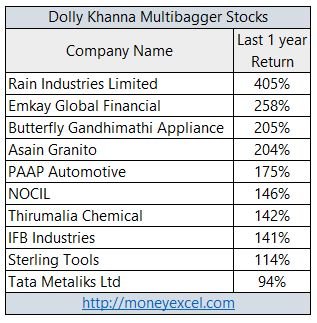

10 Midcap Multibagger Stocks from Dolly Khanna Portfolio

Top 10 Mid Cap Multibagger stocks from Dolly Khanna Portfolio are Rain Industries, Emkay Global, Butterfly Gandhimathi, Asian Granito, PPAP Automotive, Nocil, Thirumalai Chemicals, IFB Industries, Sterling Tools, and Tata Metaliks. Out of these Rain Industries has given 405% return to the investor. Emkay Global, Butterfly Gandhimathi and Asian Granito have given more than 200% return to the investors.

Please refer following table showing mid-cap multibagger stocks from Dolly Khanna Portfolio.

It is worth to know how Dolly Khanna and Rajiv Khanna identify future multibagger stocks for investment. Here is Investment Philosophy of this couple.

Investment Philosophy

Fundamental of Stock –

The method adopted by Rajiv Khanna for Identification of stock is simple. Do a fundamental analysis of the stock. If fundamentals are strong, a stock is more likely to become multibagger. It is also called as a thoughtful investment.

Small Cap Mid Cap Stocks –

Dolly Khanna and Rajiv Khanna invest only in Small Cap and Mid Cap stocks. As per them a chance of finding multibagger in Mid Cap and Small Cap stock is very high.

Consumer Stocks –

They invest in consumption based stocks only like a home appliance, cooker, cement, plastic, paper etc. All these companies deal with a middle-class product where the demand for the product is likely to be very high.

Facts & Figures –

Facts figures and public information is very important when you are taking an investment decision. Never Invest based on insider’s information or speculation. Invest based on public knowledge and information. Study market situation and pick stock accordingly.

Rajiv Khanna on Stock Market

As per Rajiv Khanna, stock market investing is like playing a game of tennis. In tennis, a game is played on different courts – hard court, clay court, and lawn. Similarly, in the stock market, you have to take a decision based on a market situation like technical, fundamentals, a momentum of the stock. In Tennis, you have to play a game as situation demands. Similarly in stock market investing you have to take a decision based on the market situation. Stock market investing is a complex puzzle full of challenges and investor need to play it carefully.

Do you think multibagger stocks of Dolly Khanna and Rajiv Khanna will give better return in future also?

Do you think investment style of Dolly Khanna & Rajiv Khanna is useful?