When it comes to wealth, people often struggle & spend their entire lives to become wealthy. Some of them can change the wheel of fortune and become wealthy while others don’t. In this post, we will suggest a proven way to become wealthy.

Many people believe that “Being rich is being wealthy” This is not true; being Rich is about how much money you possess at a specific moment in time.

Being Wealthy is about . . .

- How much money do you keep?

- How hard it work for you?

- How much is left for future generations?

Being Wealthy is about exploding your Passive Income. (How long you can survive without ever having to go to work?).

- A million-dollar question arises as to why only a few people are wealthy.

- What do others have to do to become wealthy?

Let’s check out the views of the famous writer “Robert Kiyosaki “on this.

How to Become Wealthy? – Robert Kiyosaki Cashflow Quadrant

What The Wealthy Teach Their Kids About Money That The Poor And Middle Class Don’t.

We are a free country, not necessarily a fair country. We are all free to fail. We’re being taught to be “Good Employees.” Process flow from the beginning of our childhood is:-

Go to school –> Get good grades/results –> Get a good “JOB” –> Work hard –> Maintain good credit

So we can consume lots of stuff. “JOB” for most means “Just Over Broke.”

This is a way to become “Wealthy? – NO

It is not your boss’ / employer’s job to make you wealthy or secure. Their job is to give you a paycheck. . . for work you have done & nothing more. You have to decide what you want to do with this money to become wealthy. The first thing you must learn is how to drive this money.

The biggest problem today is money drives most of us and we obey money.

- Employers/Bosses

- Landlords

- Friends /Family

Probably it is because we are unable to drive money or maybe we are not smarter than our money?

If you want to be wealthy you have to be smarter than your money. You have to decide:-

Do you want to work for money? or do You want your money to work for you?

When money works for you, every rupee is your employee & you can decide how to take work from it. You have to manage the rupee so that every rupee works to bring you even more rupees while you’re asleep.

Yes, we are talking about the power of passive income. Passive income is income by Interest, dividends, real estate, rent, royalties, stock market, and annuities.

So it is not important that “What do you do?” but important is “What do you own?”

The key to becoming wealthy:-

- Make investments that will bring passive income.

- Know the difference between an ASSET and a LIABILITY, and only buy assets.

- A True Asset will bring positive cash flow every month.

- Live below your means, while constantly increasing your means. (Try to increase your active income)

- Make your PASSIVE INCOME cover your Lifestyle Expenses forever.

- Buy assets first, luxuries last.

- If today you are unable to buy something ask yourself “How can I afford it?” This stimulates your creativity.

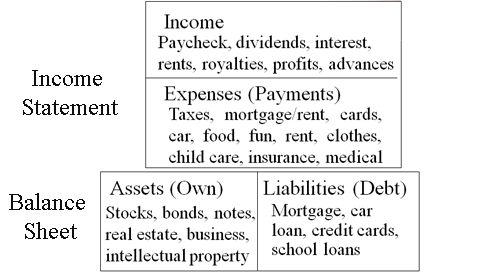

Sadly, most of us have been taught to read words and books, but not numbers and financial statements. Two key personal and business financial statements we all must be able to read.

- The Income Statement shows the amount of money coming in and going out.

- The Balance Sheet shows the balance of what you own and what you owe.

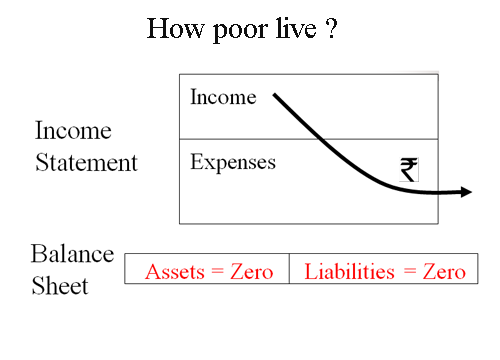

Let’s study the Income statements and balance sheets of the poor, middle-class, and wealthy people. Poor have small incomes and small expenses. Assets are zero and liabilities are zero.

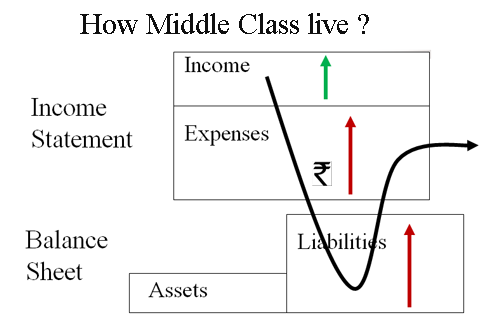

The middle class has a stable income but they buy expenses and liabilities by thinking that they are buying assets. Expenses and liabilities are more and assets are less.

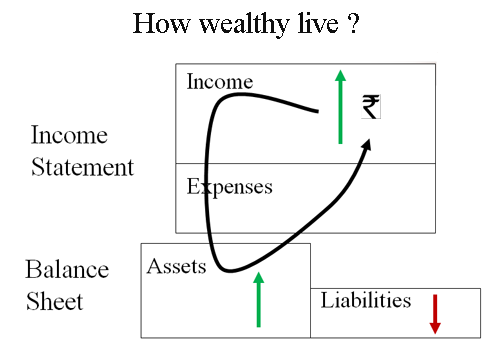

Now let’s take a look at how wealthy live. They usually take the income of the poor and middle class and buy assets that produce more income. Their assets produce passive income by which they again invest in assets to become wealthier. So to become wealthy you must invest in assets that are true assets and that will produce income for you.

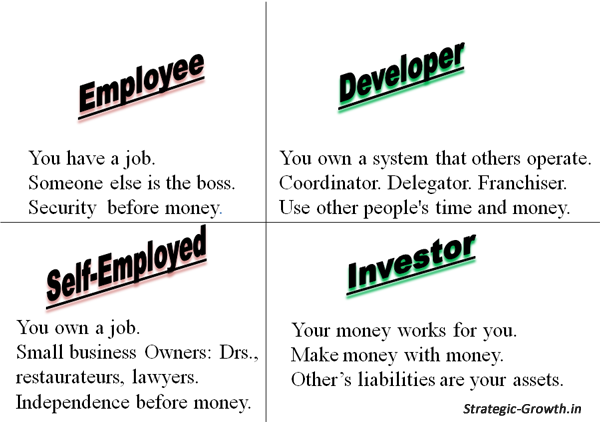

As per the Cash Flow Quadrant In the world, we have four types of people. Employees, Self-Employed, Developers, and Investor look at the following diagram.

Understanding the Cashflow Quadrant is essential for individuals seeking financial success. It provides clarity on the various paths to wealth and helps individuals identify where they currently stand and where they aspire to be.

The E Quadrant: Employee

Characteristics of the E Quadrant

The E Quadrant comprises individuals who work for others and earn a fixed salary or wage. Employees typically exchange their time and labor for monetary compensation, often with limited control over their income and schedule.

Advantages and Limitations of Being an Employee

While being an Employee offers stability and certain benefits such as health insurance and retirement plans, it also comes with limitations. Employees have less autonomy and are subject to layoffs, salary caps, and the whims of employers.

The S Quadrant: Self-Employed

Characteristics of the S Quadrant

The S Quadrant consists of self-employed individuals who own their businesses or work as freelancers or independent contractors. They have greater control over their work and income compared to employees but often shoulder more responsibilities.

Pros and Cons of Being Self-Employed

Self-employed individuals enjoy autonomy and the potential for higher income, but they also face challenges such as irregular income, long hours, and the need to handle all aspects of their business.

The B Quadrant: Business Owner

Characteristics of the B Quadrant

The B Quadrant is inhabited by business owners who create systems and leverage the efforts of others to generate income. They focus on building scalable businesses that can operate independently of their direct involvement.

Benefits and Challenges of Being a Business Owner

Business owners enjoy the potential for unlimited income and the ability to create wealth through asset accumulation. However, they must navigate risks, manage employees, and adapt to market changes to succeed.

The I Quadrant: Investor

Overview of the I Quadrant

The I Quadrant represents investors who make money by putting their capital to work in various asset classes such as stocks, real estate, and businesses. Investors seek to generate passive income and grow their wealth over time.

Strategies for Becoming a Successful Investor

Successful investors employ strategies such as diversification, risk management, and long-term planning to achieve their financial goals. They continuously educate themselves and make informed decisions based on market trends and opportunities.

Transitioning Between Quadrants

Moving from the E or S Quadrants to the B or I Quadrants

Transitioning between quadrants requires a shift in mindset and approach to income generation. It often involves acquiring new skills, building networks, and taking calculated risks to pursue entrepreneurial ventures or investment opportunities.

Steps to Transition Effectively

Effective transition requires careful planning and execution. Individuals should assess their strengths, interests, and financial goals, and then develop a strategic roadmap to move toward the B or I Quadrants.

Building Wealth Through the Cashflow Quadrant

To build wealth using the Cashflow Quadrant, individuals must focus on leveraging assets and creating passive income streams. This involves investing in income-producing assets such as stocks, bonds, rental properties, and businesses that generate recurring revenue.

Conclusion

In conclusion, becoming wealthy is attainable for those willing to learn, adapt, and take action. By understanding and leveraging the principles of the Cashflow Quadrant, individuals can create multiple income streams, build assets, and achieve financial freedom.

FAQs

Is it possible to become wealthy without taking risks?

-

- While risk-taking is often associated with wealth creation, there are ways to build wealth through conservative strategies such as disciplined saving and long-term investing.

Do I need a high income to become wealthy?

-

- High income can accelerate wealth accumulation, but it’s not the sole determinant. Consistent saving, smart investing, and prudent financial management are equally important factors.

How long does it take to become wealthy?

-

- The timeline for wealth accumulation varies depending on individual circumstances, goals, and strategies. However, achieving significant wealth typically requires time, patience, and diligent effort.

Can anyone become wealthy, or is it reserved for a select few?

-

- Wealth is attainable for anyone willing to educate themselves, take calculated risks, and stay disciplined in their financial habits. It’s not reserved for a select few but rather accessible to those who are committed to their goals.

What role does financial education play in wealth creation?

-

- Financial education is critical for making informed decisions about saving, investing, and managing money effectively. By improving financial literacy, individuals can navigate the complexities of wealth creation with confidence and competence.