Download Form 16AForm 16A is an important document for ITR filing. Form 16A contains details about TDS deducted on the interest paid on fixed deposit, recurring deposit, and bank account. Form 16A is also known as TDS certificate. Form 16A is different than Form 16. Form 16 is applicable for only salary income. TDS deducted on salary income is defined in Form 16. On the other hand, TDS applicable on income other than salary income is defined in Form 16A.

It is necessary to check Form 16A before filing an income tax return. ICICI bank provides an online facility to download Form 16A online. This means you need not visit the branch for getting Form 16A. Here is a step by step method to download Form 16A and interest certificate from ICICI Bank website.

How to download Form 16A from ICICI website?

#1 Visit icicibank.com and login to your bank account using internet banking user ID and password.

#2 After login click on Payment & Transfer section and visit “Tax Centre” menu.

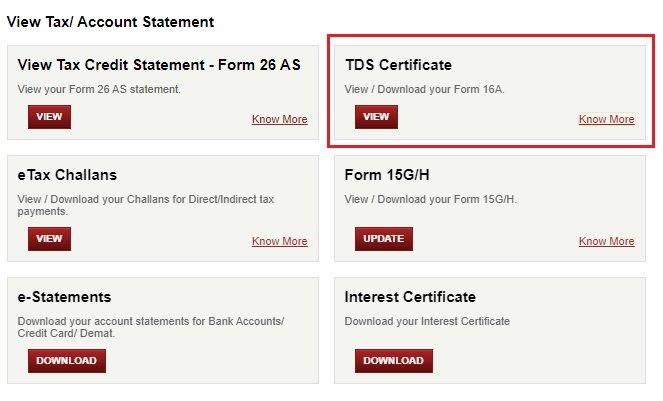

#3 You will be taken to a new page named as Tax Centre where you will find various options on the screen.

#4 The second option is TDS Certificate where you will find – View/Download your Form 16A. Click on the View button.

#5 On the next page you will be able to see drop down to select Assessment Year and Period. You need to select assessment year and period. You will be able to select and download the last 5 years TDS certificate. The period would be Q1, Q2, Q3, Q4 etc. If the tax is deducted in all the quarters then you have to select quarter one by one and repeat the steps.

Also Read – File Form 15G and Form 15H Online and Save TDS

#6 Now click on “Generate PDF”. You will be able to download the tax statement on your system. If tax is not deducted for the said period the message will be displayed – “There is no TDS data found for requested PAN for given Assessment year and Quarter.

How to download Interest certificate from ICICI website?

#1 Visit icicibank.com and login to your bank account using internet banking user ID and password.

#2 From the top navigation menu click on Payment & Transfer Tab and visit “Tax Centre” menu.

#3 On the new page you will be able to see various Tax and Account statements. Go to “Interest Certificate” section and click on the download button.

#4 You will be asked to select an account number. From drop-down select the account number.

There are two options for downloading an interest certificate. You can either select an Interest period or Interest period date option. If you want to download an interest certificate for a Financial year i.e April 1 to March 31, select the Interest period option. If you want to download an interest certificate for calendar year i.e from January 1 to December 31, please use the Interest period date option.

#5 After making appropriate selection click on the download option. Your interest certificate will be downloaded and saved in your desktop/laptop in the PDF format.

In addition to downloading TDS certificate and Interest certificate, you will be able to view your Form 26 AS, eTax Challans, Form 15G/15H at Tax Centre. You will also able to pay your direct and indirect taxes from Tax Centre.

Over to you

Whenever you are filing your Income tax returns with income tax department you have to declare income from other sources apart from salary. This include interest income earned from fixed deposit as well as saving bank interest. You will find this information in Form 16A and interest certificate.

I hope now you have got a complete idea about How to download Form 16A from ICICI bank website?

Please post your query in the comment section.