Income Tax Return Rectification – Recently my friend has received tax demand from Income Tax Dept. He has filed an income tax return before the due date and return was processed by CPC. The intimation of processing ITR 143(1) was also generated and sent to his mailbox. However, intimation is containing tax demand. Before filing income tax return he has checked everything including Form 26AS tax credit. He was in a dilemma and thinking what is wrong and what to do next?

He asked for advice from me about this tax demand. As the return is processed and CPC has asked tax demand, he has two options.

- File a rectification after finding a mistake

- Agree with tax demand and pay due tax amount

After looking at tax demand and ITR copy, I realized it is a clear case of “Tax payment mismatch”. The TAN number mentioned in the TDS schedule was wrong in ITR and due to this, there was a case of Unmatched Tax Deducted at Source and tax demand. I told him to file Income Tax Return Rectification under section 154(1).

If you are facing a similar problem or you have done a mistake in filing an Income tax return, you can opt for Income Tax Return Rectification. A rectification request can be filed only for returns that are already processed by CPC Bangalore.

Also Read – ITR is not processed by the Income Tax Department – What to do?

What types of errors can be corrected by filing ITR Rectification?

A rectification request under section 154(1) is allowed only for correcting errors or obvious mistakes in Income tax returns.

The following errors can be corrected by filing a rectification.

- an error of fact

- a small clerical mistake

- mathematical error

- error due to oversight compulsory provisions of law

Few examples of these errors are –

- Tax credit mismatch

- Advance tax mismatch

- Mistake in mentioning gender

- Wrong TAN number entry

- Omission of TDS entry

You cannot use the rectification request option for changing the bank account or address details of the income tax return.

Revised Income Tax Return Vs Income Tax Return Rectification

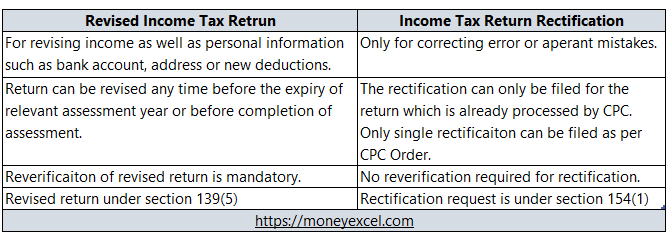

Please remember that revised income tax return and income tax return rectification is totally different.

Revised Income Tax Return

In revised income tax return you can change or revise your income and even modify your personal information in the appropriate fields. A revised income tax return can be filed by the taxpayer any time before the expiry of the relevant assessment year or before completion of the assessment. This is as per section 139(5).

E.g If income tax return is filed for FY 2017-18 (AY 2018-19) and if one wants to revise return with income detail or personal information he/she can do that up to 31st March, 2019 or before completion of assessment.

There is no restriction on number of times return can be revised. No penalty or fees applicable on revising return.

Income Tax Return Rectification

Income Tax Return Rectification can be filed under section 154(1) for correcting few obvious mistake. The mistake here does not include income declaration, personal information change etc. In rectification only error can be corrected and up to certain extent.

You cannot claim any new deductions or exemption under rectification. The rectification can only be filed for the return already processed by CPC. The rectification can be done online on Income Tax website.

How to file Income Tax Return Rectification Online?

Step by step process to file Income Tax Return Rectification Online is given below.

Step 1 – Login to Income Tax Website.

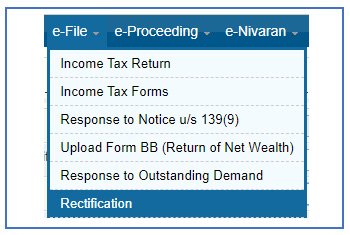

Step 2 – Go to ‘e-File’ and select Rectification from drop down menu.

Step 3 – Select Assessment Year for which rectification to be filed. Click on the submit button. You will be asked to select a request type. There are three different options. You can do return data correction (XML), you can reprocess the return or you can provide additional information for 234C.

Step 4 – If data correction is required select “Return data Correction (XML)” and press continue button.

Step 5 – System will display popup for the selection of Rectification Reason. Select the appropriate reason and press Ok button.

Step 6 – Select Schedules being changed such as TDS, TCS or IT. Regenerate XML file after correction of data in ITR. Select the XML file and press submit button.

Step 7 – On successful submission, a Reference number is generated and sent for processing to CPC, Bangalore. You will be able to see status of request under My Account > View e-Filed Returns/Forms. Select Rectification Status and click on Submit. You will be able to see Rectification Status Online.

Please note that the withdrawal of rectification request is permitted only within same day of e-filing of relevant rectification request.