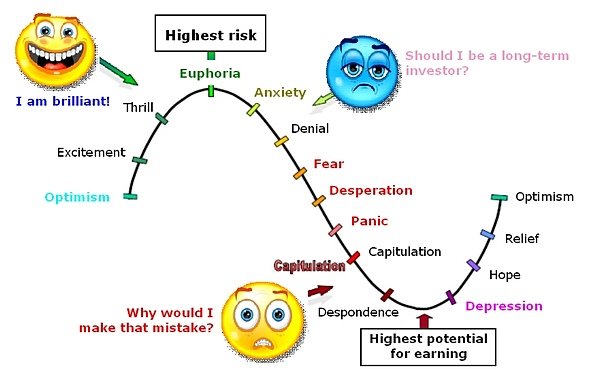

“Buy low, sell high.” It’s the golden rule of being a successful investor. You’ve heard this rule too many times, and you know it makes sense. Yet time and again, you find yourself doing the exact opposite. Most of us allow our emotions to play a big role the way we invest.

As we are unable to control our emotions we make mistakes, Emotions such as fear and greed. Fear of losing money holds back even those investors who have bright possibilities ahead of them. On the other hand, greed makes them make decisions that might make them lose more money they can make. Let’s discuss why these emotions come in between, and what we can do to stay away from such emotions.

Emotions Over Investments: Buy Low Sell High

Social burden

We are social animals and the social burden always is always present on our shoulders. A good house, a secure future for children, a comfortable lifestyle for spouse and parents, a smooth retired life, and the need for social status are the needs that make us greedy. The lack of any of the above may cause an inferiority complex or fear in us.

This inspires us to make the wrong decisions or wrong investments.

Confusion

The fear of losing everything and the greed of achieving everything create a conflict and confuse us at times of making investments. As we know Investment is all about putting the right amount of money into the right instruments at the right time. Let’s take a simple example.

What do we do in the case of the stock market?

“If the stock market goes up we don’t buy because of fear it may crash, if the market goes up again we wait & don’t buy because of fear the market may crash.

Instead of buying at low, we are waiting, and suddenly we find everybody is getting into the market like dot com companies, we lose control as we have emotion that we will be left behind and instead of buying at low we will end up buying at high. After some time, the market crashes, and instead of buying at low due to fear of losing we end up selling.”

So we do exactly the opposite which is foolishness caused by our emotions. Believe me, this emotion is the culprit for leaving us behind.

Burning Desires

Everyone wishes to have a luxurious car or a big bungalow as early as possible. These desires force us to invest in risky investments such as equities in the hope of getting higher returns quickly.

These shares may give returns that are higher than other instruments but if you make losses that are also terrible.

Following Other People

Many people think that following a successful investor like “warren buffett” will help. However, you need to keep in mind that every individual has different risk-taking capabilities, goals, and wants. Investment done by others may not be the right investment for you.

A successful investor may be able to cope up with loss but you may not, which may cause strong disappointment and fear. You may take advice from professionals but blindly following anybody is not a good idea.

FAQs

How do emotions influence investment decisions?

Feelings like anxiety and desire frequently lead investors to make illogical investment choices. Fear may cause investors to sell quickly when the market is falling, while greed can lead to hasty purchases when the market is rising.

What is the significance of “buy low, sell high” in investing?

The basic concept of “buy low, sell high” stresses the importance of buying assets at a low price and then selling them when their value increases. The goal is to optimize profits by taking advantage of market inefficiencies.

How can investors overcome emotional biases?

Recognizing emotional biases is the first step for investors to overcome them, followed by implementing strategies like setting investment goals, diversifying portfolios, and maintaining a long-term view. Consulting with financial experts can also offer valuable counsel.

Why is buying low important for investors?

Purchasing assets at a lower cost enables investors to attain discounted prices and possibly achieve greater returns in the future with improving market conditions. It also diminishes the chances of paying too much for assets and enhances the safety buffer in investment choices.

What are some practical tips for selling high?

When trying to sell at a high price, investors should concentrate on recognizing assets that are overpriced by using fundamental analysis and market trends. Establishing precise exit criteria and adhering to a planned selling approach can prevent investors from making emotional decisions and successfully secure profits.