Now you can e-verify your ITR without login into e-filing account. This new facility is recently launched on the Income-tax website. The main objective behind this facility is to enable taxpayers to get quick access to e-verify ITR return.

Verifying an Income tax return is an extremely important step. It is the last step to complete the income tax return filing process. After filing an income tax return, you have to make sure that you have completed verification of ITR. The processing of ITR takes place only after verification. If you forget to verify ITR within the declared deadline by the Income tax department, your ITR is treated as invalid.

Many taxpayers assume that once the ITR XML file is submitted, ITR is filed and the process is over. However, it is not true. The taxpayer has to compulsorily carry out the ITR verification process.

The new feature launched on the Income Tax website allows e-verification without login to an e-filing account.

How to e-verify ITR without login to e-fling account?

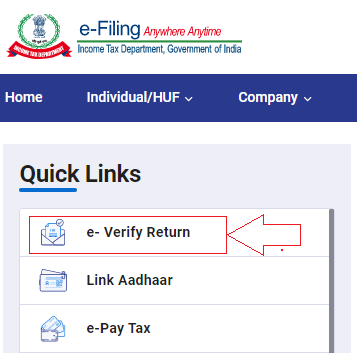

Step 1 – You need to visit the e-filing portal of the Incometax department. On the home page under the quick links section, you will find a feature called “e-Verify Return”

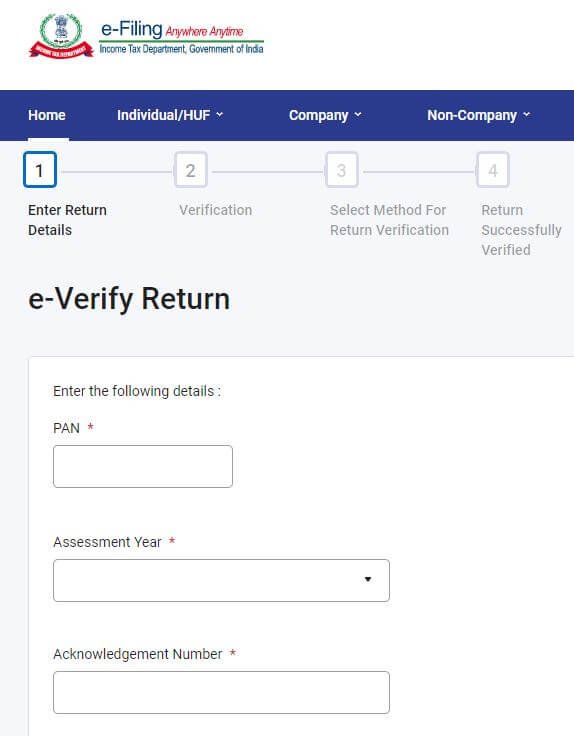

Step 2 – On clicking the “e-Verify Return” button, you will be taken to the e-verification ITR page. On this page, you need to provide your PAN number, select the assessment year, enter the acknowledgment number and mobile number.

Step 3 – After entering this detail, press the continue button. You will receive a six-digit OTP on the mobile number. After entering OTP, you need to press submit button.

After successful verification of OTP, ITR that you want to verify will be displayed on the screen.

In case you are verifying your ITR after 120 days of filing a return you need to select the reason for the delay from the drop-down menu. E-verification in this case would be a conditional request. After selecting the reason, you need to click on the continue to button.

Step 4 – In case you are verifying your ITR within 120 days for filing, you can directly select any of the following options and process for e-verification

- Generate Aadhaar OTP

- Existing Aadhaar OTP

- Existing EVC

- Generate EVC through Bank Account

- Generate EVC through Demat Account

- Generate EVC through Bank ATM option (offline method)

Basic Requirements for using new e-verify ITR facility

Basic requirements of using a new facility to e-verify ITR are given below.

- You have to file ITR on the Income-tax portal before using this facility.

- You should have the acknowledgment number of ITR which you want to e-verify.

- This facility of e-verification is available only for the return filed for Assessment Year 2019-20 onwards. This means you cannot use this facility for old returns.

- The new facility of e-verify can be used only for returns where a digital signature certificate (DCS) is not mandatory.

- The e-verification is to be done with individual capacity. Returns filed by an authorized signatory or representative assessee cannot be e-verified using this facility.

Please note that the old facility of doing e-verification via login to the income tax portal is still available. This is an additional facility given to the taxpayer to quickly e-verify income tax returns.