A credit card is one of the most used financial instruments. Many of us are using credit cards. The credit card gives multiple benefits if a credit card is used wisely. If you are also using a credit card or planning to use one, you should be aware of hidden charges that are applicable to the credit cards. There are many hidden charges applicable to the credit card. I have discovered that hidden charges are up to extent that credit card company offers reward points and for the redemption of reward points you need to pay charges. Recently, I had a bad experience with credit card hidden charges. It was ICICI Coral Life Time Free credit card and I have canceled that card.

So, here is my experience with ICICI Coral Life Time Free Credit card Hidden charges.

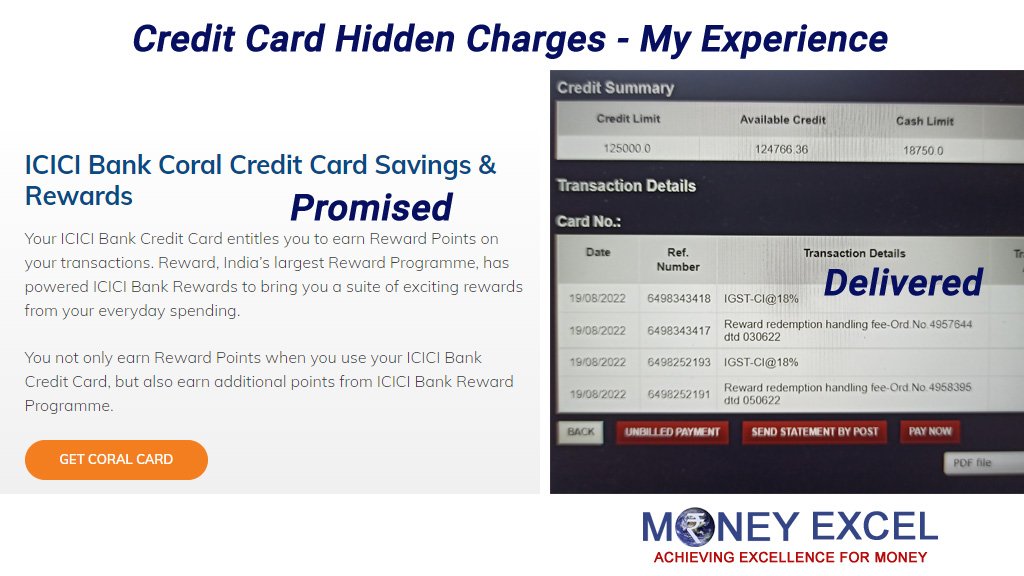

Credit Card Hidden Charges – My Experience

ICICI Coral Life Time Free Credit card is claimed to be a credit card with a lot of privileges.

ICICI bank says on their website that – “ICICI Bank Credit Card entitles you to earn Reward Points on your transactions. Rewards, India’s largest Reward Programme, has powered ICICI Bank Rewards to bring you a suite of exciting rewards for your everyday spending. You not only earn Reward Points when you use your ICICI Bank Credit Card, but also earn additional points from Reward Partner Brands for the same purchase.”

However, I discover that promotion and marketing are done for this card based on reward points. The reward system is hopeless. Not only that ICICI Bank charges extra money for redeeming points. In my case, it so happened that charges were equal to the amount of redemption. This means no benefit to the customer for the redemption of points.

Not only that, when it comes to redeeming point customer has to run from pillar to post or in other word struggle a lot. I had done a lot of struggle in redeeming my points. They have kept another website for redeeming points. You need to call customer care to get the password of that site. In short, you will end up losing a lot of time and energy.

Recently, when I redeem my points earned on ICICI coral lifetime free credit card, I feel cheated. I have redeemed the point and given an order for the water bottle. I received the water bottle via courier.

After 1 month I got my credit card bill, while checking the bill I found additional charges for the redemption of 99 INR + GST charges. Not only that for every time when redemption is done this charge is applicable.

While asking ICICI credit card customer care they said these charges are part of our terms and conditions and it is mentioned on the website. The word of the customer card executive was customer have mentioned in our terms that every time customer redeem their points we will charge 99 INR + GST for redemption.

Incidentally, I have done redemption two times so, I got charges of 2 redemptions in my bill. It is not about paying 99 INR + GST but it is about customer service and not only that prospective customers are approached with reward points and for reward point redemption only customer has to suffer and pay money.

Why?

I could find only three reasons for it.

#1 My casual approach to reading terms and conditions while opting for a credit card.

#2 Hidden charges can be applied on anything and everything on a credit card and One should be aware of that.

#3 Most of the customer care services offered by bank/credit card companies are outsourced and they don’t care for the customers.

Key learnings –

So learning is – Few credit card companies like ICICI impose Hidden charges on their customer to make extra money. So be aware of Hidden charges by the Credit card company. Make sure to read the terms and conditions and understand them before buying any financial product.