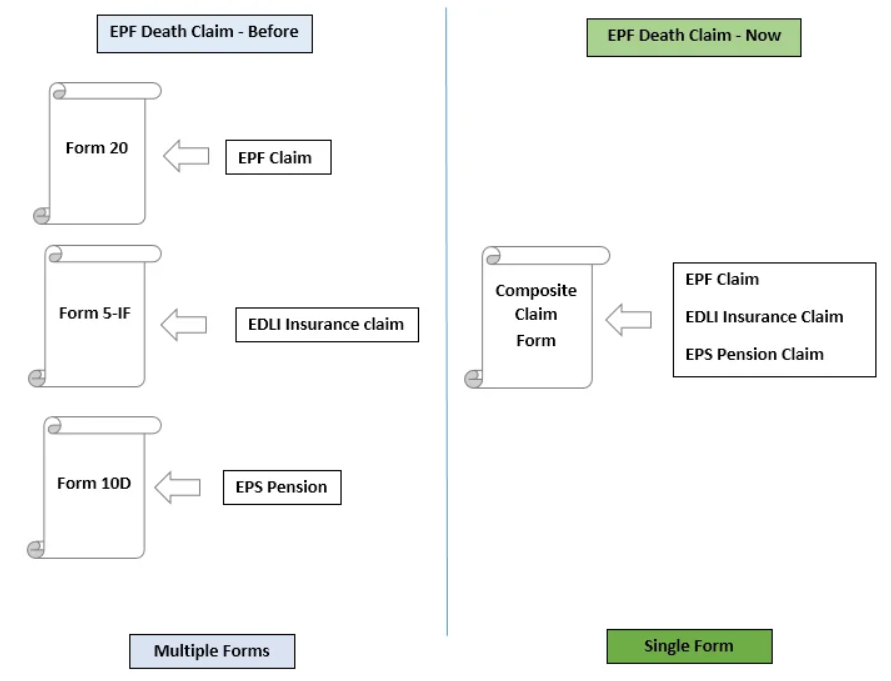

The Composite Claim Form – EPF withdrawal Death Cases is a crucial document for accessing the EPF funds of a deceased loved one. EPFO has launched a Composite Claim Form for EPF withdrawal in death cases. The new composite claim form for the death cases is a replacement of Form 20, Form 5-IF, and Form 10D.

A nominee or legal heir of the deceased member can withdraw EPF, insurance claim, and pension using this form. In this guide, I will help you understand the Claim Form and the process of filling and submitting the form.

Also Read – One Member One EPF Account – How to Transfer EPF Account?

Composite Claim Form – EPF withdrawal Death Cases

The Composite Claim Form is an essential document for those looking to withdraw EPF funds due to various reasons, including the death of the account holder. It combines multiple forms into one, simplifying the process for claimants.

Key Features

- Simplification – Merges multiple forms into a single document.

- Versatility – Can be used for withdrawals due to retirement, resignation, or death.

- Ease of Use – Designed to be user-friendly, reducing the paperwork burden.

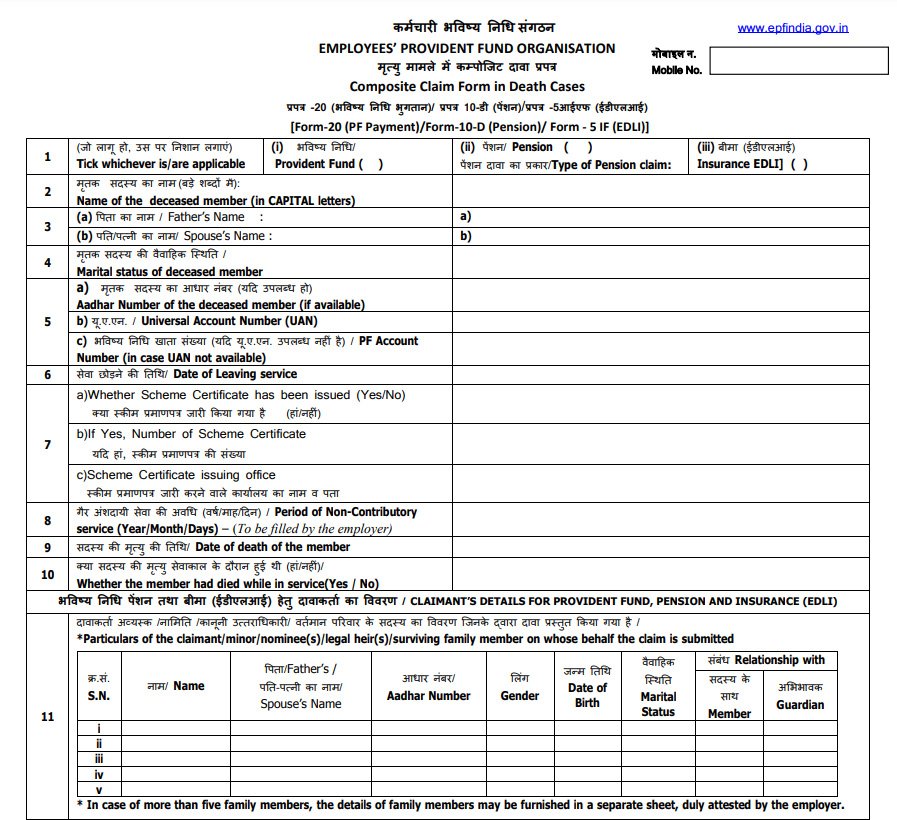

The screenshot of the Composite Claim Form applicable in the death case for EPF withdrawal is given below.

Step-by-Step Guide to Filling the Composite Claim Form

Filling the Composite Claim Form for EPF withdrawal in cases of death can be overwhelming, particularly in such a stressful period. Here is a detailed guide to assist you with the procedure.

Step 1: Gather Necessary Documents

Before you start filling out the form, make sure you have all the required documents. This includes –

- Death certificate of the EPF account holder

- Joint photograph of all the claimants

- Date of Birth certificate of children claiming pension

- Legal heir certificate or succession certificate

- Proof of identity and address of the claimant(s)

- Bank details of the claimant(s)

- For verification of bank accounts, a copy of the cancelled cheque or attested copy of first page of bank Pass Book.

Step 2: Fill Out the Claimant’s Details

This section requires the personal details of the claimant(s) –

- Name

- Relationship with the deceased

- Address

- Contact information

Step 3: Provide Details of the Deceased

You’ll need to fill in details about the deceased EPF account holder, including –

- Name

- EPF account number

- Date of death

Step 4: Bank Details

Provide the bank account details where the EPF funds should be transferred. This should be an account in the name of the claimant(s).

Step 5: Nominee/Legal Heir Details

If the deceased had nominated someone for their EPF account, provide the nominee’s details. If not, provide the details of the legal heir(s).

Step 6: Attestation and Submission

Once the form is filled out, it needs to be attested by the employer or a gazetted officer. After attestation, submit the form to the regional EPF office.

Download Composite Claim Form – EPF withdrawal Death Cases

Mistakes to Avoid

Filling out forms can be tricky. Here are some common mistakes to avoid:

- Incomplete Information – Double-check all fields to ensure they are filled correctly.

- Incorrect Bank Details – Verify the bank account details to avoid delays.

- Missing Documents – Ensure all necessary documents are attached.

- Unattested Form – Make sure the form is attested by the required authority.

Conclusion

You need to fill and submit the Composite Claim Form – EPF withdrawal Death Cases. By following the steps outlined in this guide, you can navigate the process with greater ease and ensure that the financial benefits reach the rightful beneficiaries. Remember, it’s always a good idea to seek help if you’re feeling overwhelmed—be it from a trusted family member, a financial advisor, or a legal professional.